Administration Risks in stock investment is an important part of long-term success in the markets. By developing a long-term investment plan, diversifying your portfolio, and controlling your emotions when making trading decisions, investors can minimize unwanted volatility and maximize profits. Calmly observing the market and using automation tools also help improve risk management.

1. What are the risks in stock investment?

Risks in investing in stocks refers to the possibility of loss in investment value, resulting in losses for the investor. There are many causes of this risk:

Risks from socio-economic situation: Economic stability facilitates business growth and increases the money supply in the stock market. Conversely, an unstable economy causes investors' expectations to decline, which can lead to panic or fear-based sell-offs, reducing market value.

>>> See more articles: Learn about stock order types: ato, atc, lo, mp

Market risk: This is the type of risk that most stocks in the market are strongly affected by. It can originate from factors such as rising interest rates, fluctuations in gold prices, commodity prices, or political and geopolitical factors. Although it is possible to diversify your portfolio, market risk can still cause large losses, so setting a stop-loss threshold is very important.

Business risks: It can come from many factors such as business growth, financial situation, or issues related to the company's management. Any internal factor can cause the stock price to fall and pose risks to investors.

Unsystematic risk: This is a controllable risk that includes factors such as wrong stock selection, bad timing, wrong investment strategy or incorrect analysis. This risk affects each specific stock and can be mitigated through careful research and portfolio allocation.

2. What is risk management in stock investment?

>>> See more articles: OPPORTUNITIES AND RISKS IN EX-DIVIDENTIAL TRADING DAY

Risk management in stock investment is the process of analyzing, identifying, and minimizing the risks that may arise when participating in the stock market. Risks that may arise from investment portfolios and trading accounts include sharp reversals in trends, price swings, political events, market crashes, bankruptcies, currency risks, earnings reports, government reports, inflation, and monetary policy.

Stock purchase capital management Risk management is the process of identifying, analyzing, measuring and evaluating risks to find ways to control and minimize the consequences of risks to business operations, in order to optimize the use of resources. In finance, risk management refers to analyzing and identifying potential risks, then applying measures to reduce uncertainty when making investment decisions. It can be understood as limiting losses in a specific investment or in an investment portfolio.

Investors need to have their own risk management process in stock investment to identify, adjust and manage all potential risks that their account may face, ensuring that losses are minimized to the maximum extent.

This concept is very popular and involves statistical and probability aspects, which are often not well understood by professional investors. Therefore, for ease of understanding, we can focus on some simple risk management techniques that investors can apply. This includes risk management methods at different stages: before opening a position, during holding a position, and after closing a position.

2.1 Before opening a position

Before open buy/sell position, investors need to consider the following important issues:

- Always calculate a stop loss: Even if you buy a good company, risk management is still important. Calculating a stop loss helps to clearly assess the level of loss that can be incurred if the forecast is incorrect. This helps investors to control risks effectively.

- Risk reward ratio: This is stock index Measures potential profit against the maximum acceptable loss. The maximum loss is usually determined from the purchase price to the stop-loss threshold. Meanwhile, profit is usually estimated from target prices or other forecasting methods.

>>> See more articles: Understanding uptrend and downtrend for high performance investment

For example, if the ratio is 1:7, the investor can get 7 coins of profit for every coin of risk. However, if the purchase price is higher and the ratio drops to 1:1, the purchase position becomes unattractive because the purchase price is too high. Normally, the ratio should be at least 1:3 to ensure a balanced risk/reward ratio. If the ratio is too high, the risk will increase, at which point the investor should reconsider the decision to open the position. Instead, they can wait for a better purchase point or look for other investment opportunities.

2.2 During the investment process

To maximize profits:

- Profit taking levels are often determined based on a variety of factors such as price patterns, strong resistance levels, or market fundamentals. However, the reliability of these methods often varies, with fundamentals changing and creating stronger price growth than expected. In uptrends, profit taking may seem unnecessary, especially when the trend is continuing. When a resistance level is broken, this is often a significant signal of the strength of the uptrend.

- However, it is important to note that raising the take-profit threshold must be based on specific and reasonable analysis. If the investor does not have a specific plan when the price exceeds the profit target, then the decision to take profits and wait for a new opportunity is the best choice. In addition, raising the profit target should also go hand in hand with increasing the stop loss to protect existing profits.

Cut loss:

- This is a core principle of risk management. While investing can yield large returns, failing to cut losses in time can in some cases wipe out all of the profits that have been made. Cutting losses ensures that capital remains available for reinvestment at a later date.

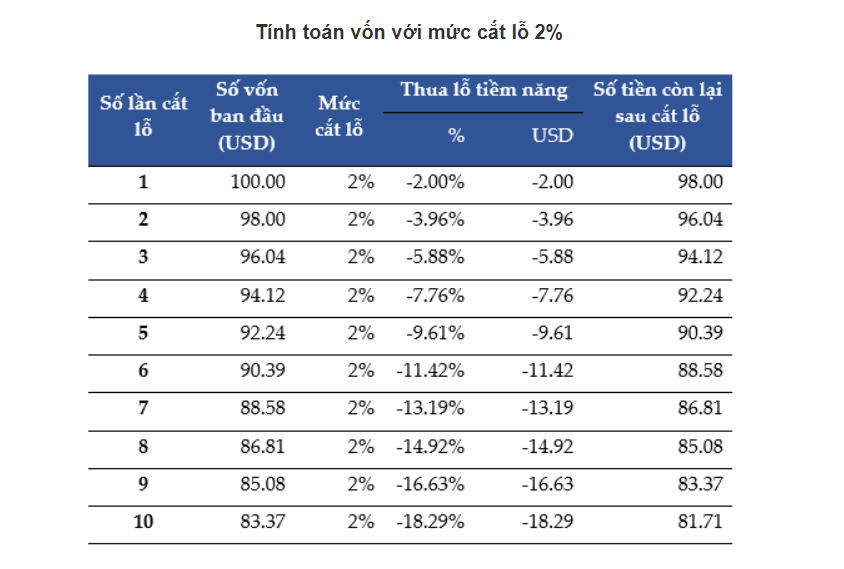

- For example, if a strategy is set up with a stop loss level of 2% below the purchase price and the price reaches the stop loss level 10 times in a row, the total loss will be 18,29%. With this loss level, the investor only needs to grow the portfolio by 22.3% to recover the initial capital (100/81.71-1). It is worth noting that if the initial investment strategy is carefully constructed, it is very rare to lose 10 times in a row. If such a continuous loss really happens, it may be due to (1) the investment strategy is incorrect, the investor needs to readjust the strategy; or (2) luck is not on the investor's side, that is, financial investment is not suitable for the investor.

Raise stop loss:

- Raising the stop loss is a method of managing potential risks in the investment process. Often, we will encounter situations where the asset price increases as predicted and approaches the profit target. However, before reaching the target, the market may reverse and require adjusting the stop loss, resulting in a small loss in the investment portfolio. From a technical perspective, this is normal and only shows compliance with the original investment rules.

- However, from a risk management perspective, this method can lose unnecessary profit potential or create unwanted risks. Therefore, to prevent this situation, investors need to apply a “stop loss” mechanism.

- The mechanism works as follows: when the price moves in the predicted direction (up), the stop loss level is adjusted up (raised) accordingly. This helps to ensure that in case of a price reversal, the investment can still generate profit or at least avoid losses.

2.3 After investment

Re-evaluating investments plays an important role in checking the effectiveness of risk management strategies in stock investment and identifying areas for improvement. This not only helps investors adjust and improve their strategies but also creates opportunities to optimize future profits.

Staying away from the market after a big win or a big loss may seem like an unbelievable decision, but it is actually necessary. When a big win occurs, the euphoria can make investors overconfident and lead to more risky investment decisions in the future. Conversely, when a big loss occurs, the timid mentality can push them to overinvest, hoping to recover their capital. However, this often leads to taking big risks and often results in more losses. In both situations, being ruled by emotions is something to avoid.

Therefore, one of the effective ways suggested is to stay away from the market for a certain period of time to regain mental stability before rediscovering trading opportunities. This helps investors maintain calmness and objectivity, thereby ensuring that investment decisions are made based on reason and analysis rather than being influenced by emotions.

3. Risk management methods in stock investment

Determine the exit point is the process of deciding at what price an investor will close his position. Before buying any stock, this is extremely important to protect the investment capital and minimize losses. If the account records a loss of -10%, there may still be a chance to recover, but a loss exceeding 15% will make it much more difficult to recover the initial capital. This approach depends on the risk appetite of each investor, however, some suggestions from successful investors are to set the exit price when the price corrects from the recent peak at 8-10%. This helps investors keep profits and preserve investment capital.

>>> See more articles: What is sideway indicator and trading opportunities in the market

Lock in profits Targeting is when an investor sets a target price or rate of return that they are willing to accept. When the price reaches that target, the investor can decide to sell all or part of the position to realize a profit. This helps avoid greed when the market is rising and establishes a willingness to sell. Setting a target also helps prevent the temptation to hold the price high and not sell, a common mistake when the market is falling.

Use financial leverage wisely can help optimize opportunities and increase profits, but also comes with high risks. When there are unstable signals from the socio-economic environment, investors need to be careful, because this is when stocks can decrease in price, reducing net asset value according to the leverage ratio. Advice from OnStocks Securities is to only use financial leverage When you have experience and when the market shows clear signs of growth, avoid risks when there are signs of instability from the macro economy.

Monitor investments carefully is an important factor in risk management when investing in the stock market. Paul Singer, known as the “King Vulture” in the financial market, emphasized that “Risk needs to be managed continuously and ensured at all times, which is the only way to truly control risk.” The stock market changes every day based on the domestic and foreign economic situation, so it is necessary to follow the news regularly to be able to adjust the investment portfolio in time, thereby minimizing risks and optimizing profits.

Diversify your portfolio is an important strategy in risk management in stock investment. This requires investors to allocate investment capital to many different stocks, industries, regions and markets, in order to minimize the risk from a specific stock or industry. Diversification helps to balance the return and risk ratio of the entire investment portfolio, while increasing the chance of catching high-performing stocks and minimizing the negative impact of fluctuations in a small part of the market.

Research the market is an important method to help manage risks in stock investment. This requires investors to have a clear understanding of the trends, rhythm, health and factors affecting the market, as well as the stocks they are interested in. By carefully studying the market, investors can assess the potential and risks of investment opportunities, thereby making smart and effective buying and selling decisions, while avoiding mistakes due to lack of information or emotions.

Find a reputable brokerage firm is also one of the risk management measures in stock investment. This ensures that investors have support, advice and protection of their interests from a reliable partner, helping them avoid risks that may arise from fraud or scams from the brokerage company. Finding a reputable brokerage company also helps save transaction costs and improve the investment efficiency of investors.

Long term stock investment is considered one of the effective risk management methods. This requires investors to choose stocks with a solid business foundation, growth potential and stable profitability over a long period of time. Long-term stock investment strategies help minimize the impact of short-term fluctuations in the market, thereby taking advantage of compound interest and increasing the value of stocks over time. In addition, long-term stock investment also helps investors save time, effort and transaction costs, while avoiding common mistakes due to emotional influences or impatience.

Comply with stock investment rules is an important part of a long-term investment strategy. This includes thoroughly researching, analyzing, and evaluating stocks before investing, as well as adhering to basic principles such as buying low and selling high, not being swept away by the crowd, not being influenced by emotions, not speculating excessively, and not using borrowed funds to invest. Adhering to the rules of stock investment helps avoid common mistakes, while improving investment skills and experience. This also helps investors build a clear investment strategy and plan, thereby controlling risks and maximizing profits.

4. Conclusion on risk management in stock investment

Risk management in stock investment is an important step to ensure capital protection and profit optimization. This raises a series of questions and requires investors to apply appropriate strategies to achieve their investment goals.

First and foremost, determining your risk appetite is key. Every investor has a different risk tolerance, and understanding this will help them choose the right stocks and investment strategies. For beginners, choosing low-risk stocks and focusing on capital preservation may be a good choice. On the other hand, investors with a higher risk appetite may accept stocks with higher potential returns, but with greater risk.

The second point is to determine the exit point and acceptable loss level before opening a position. This helps investors not to lose control when the market moves not as expected and ensures that they do not lose too much capital in a position. This point also helps them to maintain a stable mentality and not get caught up in the emotions of the market.

Finally, it is important to apply risk management in stock investing such as diversifying your portfolio, following basic rules and using leverage appropriately. Diversification helps to minimize the risk specific to each stock or industry, while following basic rules helps to avoid common mistakes. Using leverage appropriately can increase profits but also comes with increased risk, so caution is needed when applying leverage.

In short, risk management is an integral part of any investment strategy. By understanding your risk appetite, determining your exit points and acceptable loss levels, and applying basic risk management principles, investors can optimize their investment performance and achieve their financial goals.

Source: Onstocks