Caution has dominated the market in recent sessions, with liquidity falling sharply. The decline has shown signs of slowing down, but a reversal signal has not been confirmed. This week, the domestic macroeconomic situation and the business results of enterprises will finally be revealed, which is expected to be a catalyst for the market.

Domestic stocks have just experienced a week of strong fluctuations, VN-Index ended the week down 1.8% to 1,242 points. The market received information that the total margin debt balance at the end of the second quarter of 2024 reached a new peak, selling pressure increased. It was not until the last session of the week, when selling pressure gradually decreased, demand recovered, that VN-Index recorded a recovery.

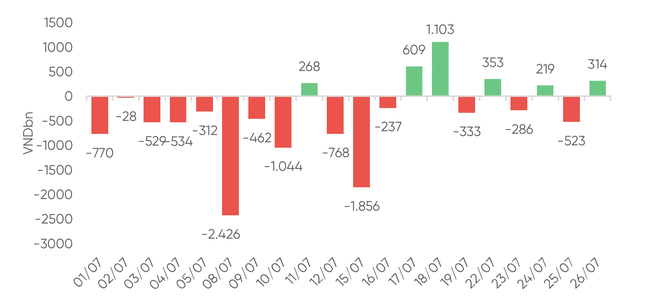

Liquidity dropped sharply, the total matched volume for the week on HoSE decreased by 18.2%. Notably, foreign investors net bought more than 420 billion VND on HoSE, focusing on KDC, SBT, VNM and MSN.

This week, some industries witnessed many stocks falling, such as securities, with SSI, VCI, VIX, BSI, CTS, MBS... falling sharply.

The banking sector also traded inactively, with LPB, MBB, ACB, CTG... adjusting. Most insurance stocks had a week of red trading, with BVH, MIG, BMI all falling in price.

Meanwhile, telecommunications, petroleum, food and beverage stocks... had positive transactions.

Expert Nguyen Huy Phuong - Dragon Viet Securities (VDSC) - said that the liquidity still maintained at a low level shows that the temporary supply has not put pressure on the market. Cash flow has not improved, although the market had a good increase at the end of the week.

Accordingly, the market is likely to continue to be supported and explore supply. It is expected that the resistance zone of 1,245 - 1,250 points will put supply pressure on the market in the coming time. Investors still need to be cautious with the unstable state of the market and keep the portfolio proportion at a safe level.

VNDirect Securities experts commented that, technically, the VN-Index showed signs of forming a short-term bottom and recovering after falling to the lowest level of 1,218 points in the last trading week. Notably, selling pressure has weakened significantly, while demand pressure showed signs of slight improvement in the last trading sessions of the week.

Moving into the next trading week, the market trend may be confirmed when important information is about to be announced. Domestically, investors are waiting for monthly macroeconomic data and second quarter business results reports of listed companies.

In the international context, investors' attention is focused on the US Federal Reserve (Fed) providing updates at its meeting at the end of July on the roadmap for interest rate cuts and

In the base scenario, in the coming trading week, VNDirect expects the main index to build a foundation and accumulate again in the 1,230-1,260 point range. Market valuations have returned to a more attractive level, medium and long-term investors can start building their investment portfolios for the next 6-12 months, focusing on some sectors with improved business prospects such as banking, consumer - retail and import-export. Meanwhile, short-term traders need to wait for the market to confirm the short-term trend and improve cash flow before increasing their stock holdings.

In the short term, the analysis team of Saigon - Hanoi Securities (SHS) believes that the VN-Index is tending to retest the price zone around 1,255 points, the highest price zone in 2023.

In a positive case, the index needs to surpass the resistance zone around 1,255 points to improve the short and medium-term trend. The positive point is that the market is strongly differentiated, many stocks have good price increases, aiming to surpass the old peak when having positive business results in 2/2024, such as some stocks in the industrial park real estate group, gas distribution, plastics, oil and gas transportation, gasoline... Some technology stocks tend to recover to the old peak.

Regarding the medium-term trend, SHS has a less positive assessment when VN-Index cannot maintain the price trend line that has lasted from November 2023 to present, as well as the equilibrium price range of 1,245 - 1,255 points.

Source: CafeF