What is Dow Theory? in the popular technical analysis indicators today. Professional stock investors who analyze technical information will have a good understanding of the theory.

What is Dow Theory?

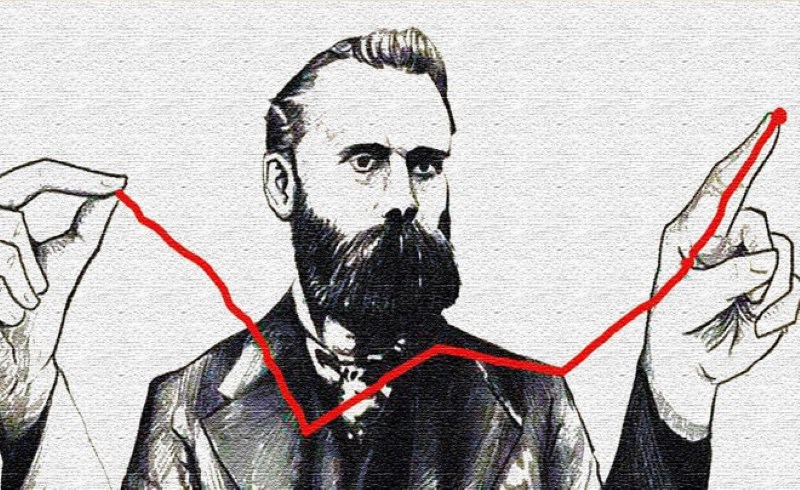

What is Dow Theory, this theory was developed by Charles Dow in the late 19th century, is a set of basic principles that help investors understand how the stock market works. As one of the first foundations of technical analysis, this theory helps identify market trends, thereby supporting effective trading decisions.

Although it was created more than 100 years ago, Dow Theory still retains its core values and is widely applied in many aspects of modern financial markets. Familiar concepts such as uptrend, downtrend, support and resistance all originate from this theory.

This article will analyze in detail the history of formation, six basic principles of Dow theory and its limitations, to help readers better understand the importance of this theory in technical analysis and investment.

History of formation and development of Dow Theory

Charles Dow was the founder and first editor of The Wall Street JournalHe developed this theory from his observations of market price action and the role of industries in the economy.

Dow did not write a book but presented his principles through a series of editorials in The Wall Street Journal from 1900 to 1902. After his death, financial analysts such as William Hamilton, George Schaefer and Robert Rhea continued to research, perfect and popularize this theory through in-depth articles and books such as The Stock Market Barometer of Hamilton and Dow Theory by Rhea.

Today, Dow Theory is not only the foundation of technical analysis but also considered a useful tool in predicting trends and determining trading timing.

6 basic principles of Dow Theory in economics

1. The market reflects all investment factors

According to Dow Theory, market prices already reflect all available information, including economic, political, and psychological factors.

Stock prices are the sum of all the expectations, worries and forecasts of all investors in the market, especially Dow theory in forex. Although unexpected events may occur, they usually have only a short-term impact, and the main trend will continue to maintain until there is a clear sign of a reversal.

2. The market has three trends

Dow Theory divides market trends into three categories:

- Primary Trend:

This is the largest and most important movement, lasting a year or more. The main trend can be either up or down. - Secondary Trend:

This trend usually goes against the main trend, lasting from several weeks to several months, and is often considered a correction phase. - Minor Trend:

These trends only last for a few days or weeks, are mainly market noise and are of little use for making long-term investment decisions.

3. Trends have three phases

Every trend in the market consists of three stages:

- Accumulation phase:

After a sharp decline, large investors start buying at low prices, leading to the formation of a support level. - Growth phase:

Stock prices increased rapidly due to the participation of many retail investors and institutions. - Distribution phase:

Large investors sell stocks at high prices, leading to the formation of resistance levels and a downtrend.

4. The indicators must confirm each other

According to Dow theory of stocks, a trend is only confirmed when all major market indicators agree.

For example, if the VN-Index is increasing but other indices such as VN30, HNX30 are decreasing, the upward trend is not considered certain. This helps investors avoid making decisions based on inconsistent information.

5. Trading volume must be consistent with market price trends

An uptrend or downtrend is only truly confirmed when trading volume increases accordingly.

- In an uptrend, trading volume increases as prices rise and decreases as prices correct.

- In a downtrend, volume increases as prices fall and decreases as prices recover.

Trading volume is an important indicator that reflects the level of investor interest in market trends.

6. The trend will continue until a reversal sign appears.

The main trend of the market will remain until there is a clear sign of reversal. Short-term corrections or minor trends do not affect the main trend.

This helps investors avoid being swayed by short-term fluctuations and stick to a long-term investment strategy.

Advantages of Dow Theory

Dow Theory is an important tool that helps investors identify market trends effectively, thereby taking advantage of potential opportunities based on price action. long term investment in stocks. This method also helps investors make careful decisions, avoiding going against the current market trend. In particular, investors often use theory to evaluate dow theory in crypto, the theory emphasizes that closing price acts as an important indicator reflecting the overall sentiment of the market.

According to this theory, stock prices can fluctuate continuously during any trading session. However, as the market closes, most investors tend to adjust their behavior to match the prevailing trend. Therefore, the closing price is often a clear indication of how investors reacted after a trading day. This information provides valuable insights into the direction of the overall market. Based on this important data, investors can develop trading strategies accordingly. Dow Theory Science of Stock Investing, helping them make more rational and optimal decisions.

High applicability: The principles of Dow theory are still relevant in modern market analysis, helping investors understand trends and make more accurate decisions.

Focus on long-term trends: Dow Theory emphasizes identifying and following the main trend, reducing the risk from short-term fluctuations.

The Foundation for Technical Analysis: Many of today's technical tools and indicators, such as support, resistance levels and price patterns, are based on the principles of Dow theory.

Limitations of Dow Theory

Every theory has its limitations, and Dow Theory is no exception. Here are some points to keep in mind when studying and applying this theory:

Not always accurate: The market context is always changing over time, so the principles are built to help investors have the most realistic view. However, the correct or incorrect analysis depends a lot on the ability to judge, the sensitivity, and the flexibility of each individual. This leads to different investment performance between investors.

Limitations in short-term speculation: Dow Theory is often ineffective when applied to short periods. Investors who focus on short-term “waves” will have difficulty predicting market movements over a period of just a few weeks, because the theory is biased towards long-term trends.

Not predicting the trend with absolute accuracy: In many cases, an index like VNINDEX may decline, but there are still stocks that go against the trend. This is often due to individual factors such as the internal story of the company or the positive impact of macro conditions such as export growth or commodity price fluctuations. These factors can make it confusing for new investors to apply Dow Theory.

Forecast with delay: Although theories can help investors identify market trends, forecasting often comes with a certain lag. If investors rely solely on theories without observing and analyzing actual signals, they risk missing opportunities at important price zones, such as reversals or rallies.

Conclude

Dow Theory is considered one of the most important foundations of technical analysis, helping investors better understand market trends and make reasonable trading decisions. Although it has existed for more than a century, the principles of this theory still retain their core values and continue to have a profound influence on the approach to financial markets. However, to successfully apply Dow Theory, investors need to clearly understand both its advantages and limitations, and combine it with modern analytical tools and methods to optimize investment efficiency. Learning and applying Dow Theory flexibly is the key to achieving success in the volatile financial market. Hopefully, through this article, HVA Group, investors have understood what Dow theory is in the field of finance and investment.