A recent investment strategy report by VNDirect Securities assessed that better market-wide profit prospects could have a positive impact on the VN-Index. In 2015, 2017 and 2021, profit growth recovered from the bottom, leading to a positive price increase in the domestic stock market. The analysis team forecasts that the profits of listed companies on HOSE will grow by 18% in 2024 (positive scenario).

According to VNDirect, banking and real estate are the two main contributors, accounting for 66.11% of the profit growth of companies listed on HOSE in 2024.

Sectors that are affected by commodity price fluctuations, such as construction materials, agriculture and exports, are expected to see positive profit growth thanks to the recovery in global trade. In addition, profit growth in the electricity and aviation sectors will improve in 2024 thanks to a better economic outlook.

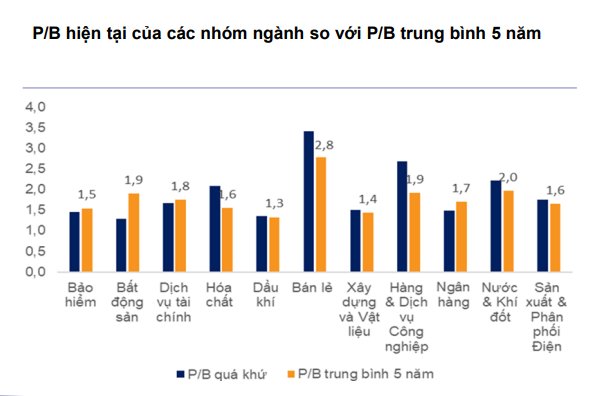

Notably, VNDirect said Both P/E and P/B valuations of the banking sector are below the 5-year average.. In case the economic outlook turns more positive in the future, the banking sector could be valued higher.

On the other hand, the insurance and financial services sectors also have P/E and P/B valuations below their 5-year average, while the Real Estate sector has a P/B valuation well below its 5-year average.

On the contrary, analysts predict that consumer retail and oil and gas are two industries with negative profit growth in 2024, investors need to be cautious before making investment decisions related to these two industries.

Net profit growth of the entire banking industry in 2024 will reach about 23.8%

Regarding the banking sector alone, VNDirect expects deposit interest rates to increase slightly from the recent low by about 0.5% to 0.75% by the end of 2024. Therefore, the cost of funds (COF) will be more clearly affected in Q4/24 because COF across the industry often lags the interest rate trend by three to six months.

The recovery in credit growth from Q3/2024 will enable banks to pass on the increase in funding costs to customers. Overall, the industry’s average NIM is expected to remain stable this year at around 4%.

VNDirect believes that a faster economic recovery starting from Q2/2024 will help retail banks achieve better NIM than Q1 (VPB, VIB, ACB and TPB).

Accordingly, the analysis team forecasts that the net profit growth of the entire banking industry in 2024 will reach about 23.8% over the same period (Q1/2024 recorded 18.1%). VPB, LPB and CTG are likely to be the banks with the highest growth rates in the industry.

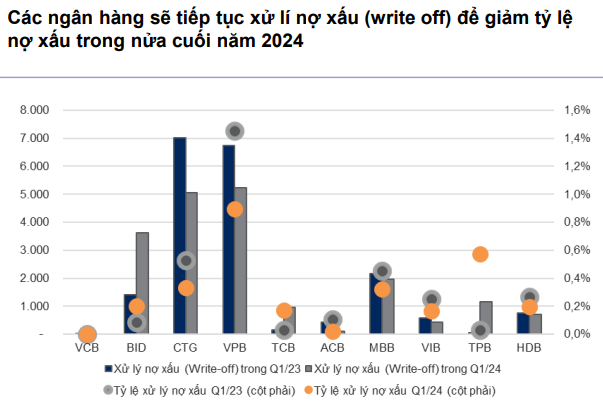

In addition, the banking sector's asset quality will improve in the second half of this year thanks to: 1) low lending rates, 2) economic recovery improving earnings, 3) debt collection activities (through liquidation and asset auctions) being enhanced as the real estate market gradually recovers, 4) Circular 02 being extended until the end of 2024, and 5) banks will continue to handle bad debts (write off).

Source: CafeF