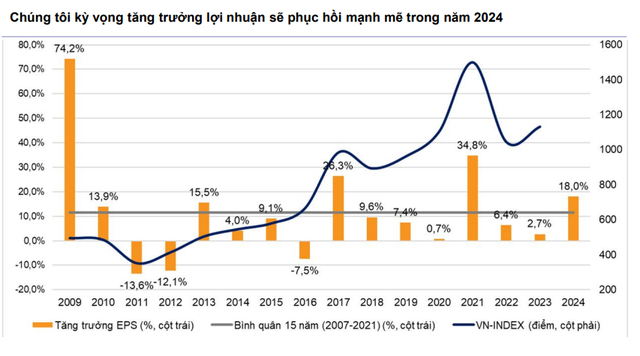

VNDirect maintains its forecast that 2024 profits of companies listed on HOSE will grow by 18% over the same period in a positive scenario.

In a newly updated outlook report, VNDirect Securities assessed that the gap between the VN-Index's earnings per share (E/P) and deposit interest rates is high compared to historical levels.

Specifically, VNDirect said that the gap between E/P and 12-month deposit interest rates is currently quite large compared to the past, showing that the stock market still maintains its attractiveness compared to the savings deposit channel. E/P of VN-Index is about 7% (as of June 28, 2024) while the 12-month deposit interest rate is nearly 4.9%/year.

“Although deposit interest rates have gradually increased, the profit growth rate of listed enterprises in the coming quarters will help the gap between the E/P of VN-Index and deposit interest rates remain high. This helps the stock market maintain its attractiveness compared to the savings channel in the second half of 2024.“, the report stated.

VNDirect maintains its forecast that 2024 profits of companies listed on HOSE will grow by 18% over the same period in a positive scenario.

In addition, the analysis team expects the market's EPS growth to rebound strongly this year from the low base of 2023 thanks to a stronger recovery in manufacturing and trade activities (Vietnam's PMI in June reached 54.7, higher than expected). Furthermore, the real estate market continues to recover in the second half of 2024 and the higher credit growth target in 2024 supporting the banking sector's business results will be the driving force for the market's EPS growth.

In the second half of 2024, VNDirect maintains its forecast that the main index could reach 1,350 points by the end of the year on the base scenario.

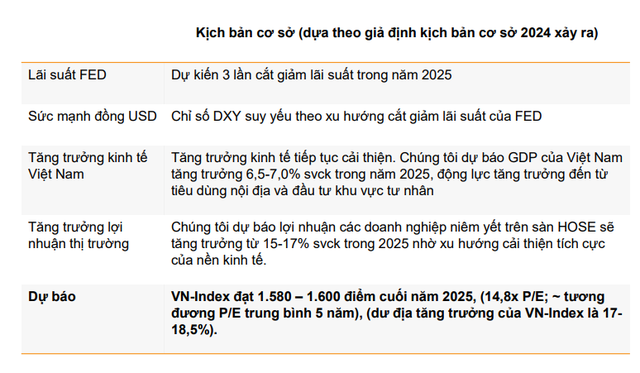

Looking further ahead, in case Vietnam's economic growth continues to improve, VNDirect forecasts that Vietnam's GDP in 2025 will grow by 6.5-7.01% YoY, driven by domestic consumption and private sector investment. Profits in 2025 of listed companies on the HOSE will grow by 15-171% YoY thanks to the positive improvement trend of the economy.

Forecasting the key index score in 2025, the analyst group is optimistic that VN-Index will reach 1,580 - 1,600 points by the end of 2025 corresponding to target P/E of 14.8x ~5-year average P/E.

Source: CafeF