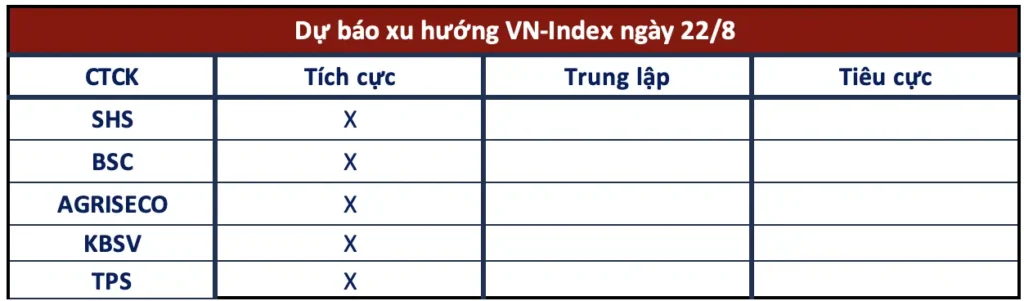

Commenting on the market in the next trading session, most securities companies believe that the market can continue to increase to return to the 1,300 point mark.

The market continued to open Gap Up in the morning session and then fluctuated in a narrow range when there was selling pressure. In the afternoon session, the buying force continuously increased and absorbed all the selling pressure, helping the VN-Index close the session on August 21 at 1,273 points, up 11 points compared to the reference.

Commenting on the market in the next trading session, most securities companies believe that the market can continue to increase to return to the 1,300 point mark, but also need to be careful of profit-taking pressure appearing at high prices.

Market up 1,300 points

VN-Index is maintaining in the price range of 1,280 points -1,300 points, the nearest support zone is around 1,280 points, stronger support is 1,255 points -1,260 points. SHS expects VN-Index to continue to move towards a very strong resistance zone around 1,300 points, possibly expanding to the 1,320 point zone corresponding to the highest price zone in June 2022.

The market is on the way to recover to old resistance levels. In the coming sessions, the index may continue to advance to the 1,290 - 1,300 zone, however, investors should be careful of profit-taking pressure at high prices.

Consider buying stocks

On the technical chart, the market continues to increase in price as new buying demand absorbs most of the short-term selling pressure of stocks. The Bollinger Bands indicator expands and prices tend to stick to the upper band. Agriseco Research believes that the market will move up to the 1,290 point area in the coming sessions as it has momentum to increase in the "V" shaped recovery.

In the scenario where the excited cash flow continues to support the pillar stocks and expand the uptrend, the index will confirm that it has surpassed the near resistance zone. Although there may be a risk of technical profit-taking after the uptrend sessions, the VN-Index will have many opportunities to conquer the resistance level around 1,300. Investors are recommended to buy back their trading positions when the VN-Index or the target stocks adjust to the near support zones.

VN-Index maintained its impressive growth momentum and surpassed the 1,280-point threshold – heading towards higher price ranges. The growth in liquidity and the index will ensure that the current growth momentum of VN-Index will maintain its strength in the upcoming sessions.

Medium and long-term investors can take advantage of corrections (if any) to buy stocks. Current supports are at 1,220 and 1,240 points. TPS expects bright scenarios for VN-Index if there are no strong fluctuations in the last two sessions of the week.

Source: CafeF