Many large organizations such as foreign funds Dragon Capital, Pyn Elite Fund or some securities companies also have conflicting views on the prospects of the Vietnamese stock market in the coming time.

The stock market last week once again witnessed the VN-Index's unsuccessful attempt to conquer the 1,300-point threshold. This is not the first time the index has failed to reach this milestone. In the second quarter, the VN-Index has repeatedly come close, even closing above 1,300 points in mid-June, but then quickly lost its momentum.

There are many reasons why the market lacks the momentum to overcome the resistance level around 1,300 points, such as the differentiation between industry groups and stocks, especially in the large-cap group. Obviously, after a period of simultaneous growth in the first quarter of the year thanks to the record low interest rate environment and profit growth from last year's low base, the situation has become more difficult since the beginning of the second quarter.

Exchange rate pressure makes it difficult for interest rates to decrease further, or even increase slightly, which is a factor affecting cash flow into the market. In addition, the real estate market is still gloomy, causing difficulties for "land stocks" on the stock market. The banking group is also partly affected by pressure from bad debt and declining asset quality.

On the contrary, bright spots come from the technology, telecommunications, retail, etc. groups with their own attractive stories. However, the overheating in the previous period has also put many stocks in this group under pressure to adjust. The short-term challenge is difficult to avoid, although the long-term growth prospect is still highly appreciated thanks to the "trend" of AI (for the technology group), Data Center (for the telecommunications group) or the recovery of consumer purchasing power (for the retail group) ...

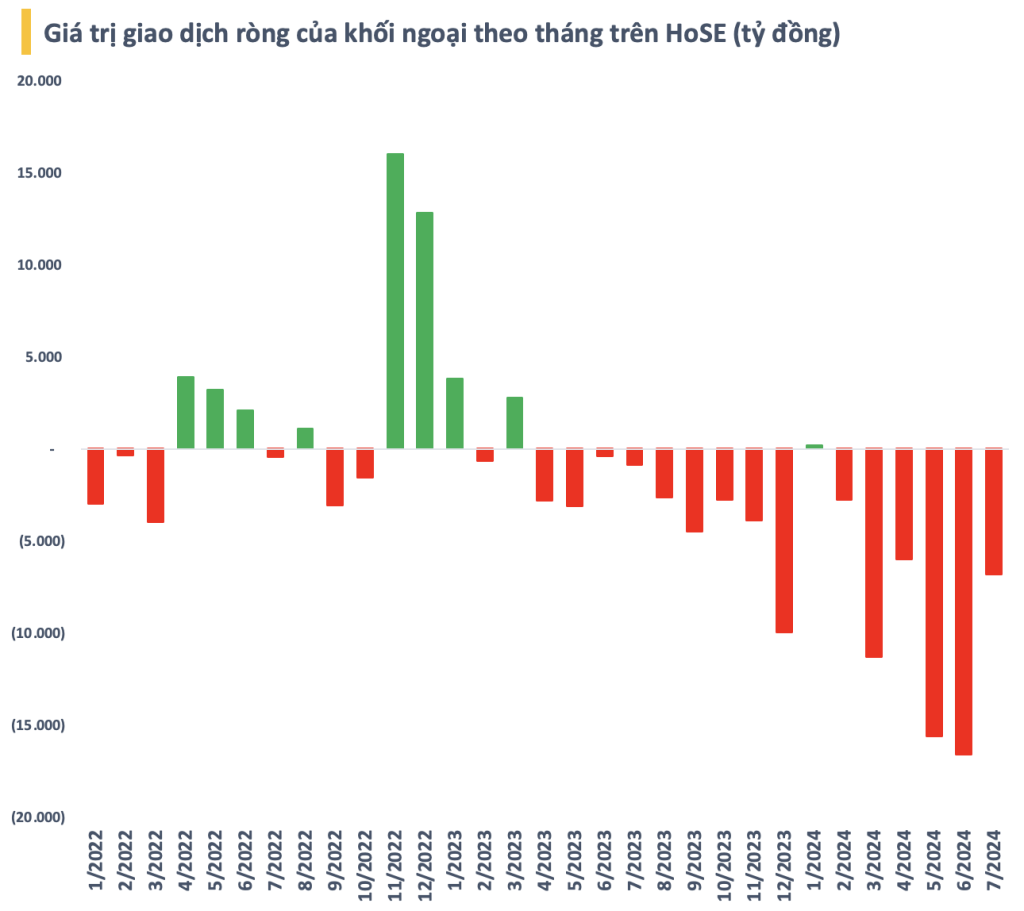

In addition to the differentiation factor, net selling pressure from foreign investors also negatively impacted investor sentiment and restrained the market's upward momentum. In June, foreign investors net sold a record of nearly VND16,600 billion on HoSE. This trend has shown no signs of stopping as foreign investors continued to sell more than VND6,800 billion since the beginning of July. The cumulative net selling value since the beginning of the year has reached nearly VND59,000 billion (USD2.3 billion).

In fact, strong net selling pressure from foreign investors is not only happening in Vietnam but also in most Asian markets. In a recent report, Dragon Capital said that the dissolution of the iShares Frontier ETF, with total assets of about 120 million USD in Vietnam, also contributed to this pressure.

Based on the relatively high valuations of some sectors and the anticipated growth, Dragon Capital maintains a cautious view of the market in general and prioritizes the selection of stocks with safe valuations. In particular, in the context of domestic investors' cash flow absorbing and balancing the selling pressure of foreign investors, the market may continue to be volatile and volatile.

On the other hand, this foreign fund also pointed out some factors that have a positive impact on the stock market in the coming time, such as the Fed is approaching the time to cut interest rates, the second quarter business results reporting season is expected to be positive, with estimated profit growth from 14-17% compared to the same period and the draft circular amending the pre-transaction margin regulations is expected to be announced by the Ministry of Finance in July.

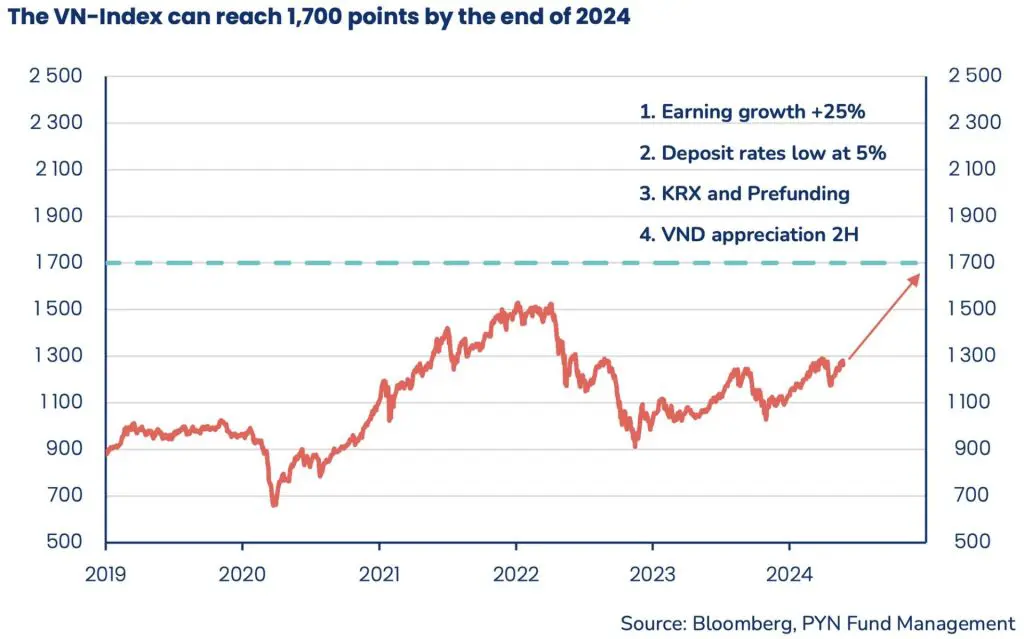

More optimistically, another large foreign fund in the market, Pyn Elite Fund, predicts that the VN-Index could reach 1,700 points by the end of 2024. In addition to strong earnings growth, this foreign fund also points out other factors that could boost domestic investor sentiment, even leading to a strong momentum at the stock market level.

First, expectations of upcoming US interest rate cuts will ease pressure on the VND, which is negatively impacting the Vietnamese stock market.

In addition, the new KRX trading system is expected to be deployed this year and the bottleneck of foreign institutional investors' pre-trading deposits may be resolved as soon as the third quarter, which will have a positive impact on the market. In addition, Pyn Elite Fund also expects interest rates in Vietnam to remain at a very moderate level, thereby promoting economic growth.

Meanwhile, KBSV Securities has a more cautious view when reducing the expected score of the VN-Index at the end of the year to 1,320 points (from 1,360 points in the latest report). KBSV lowered the average EPS growth forecast of listed companies on the HSX to 14% (from 19% in the latest report) after the first quarter data was not as optimistic as expected.

This reduction in forecast also reflects a more cautious view on two large-capitalization sectors such as banking and real estate in the face of rising interest rates and the slow recovery of the real estate market. However, this securities company also emphasized that this 14% increase is still considered a high increase, supporting the trend of the stock market in general.

In addition, the upward trend of interest rates due to exchange rate pressure is also a factor affecting the market. The analysis team forecasts that the mobilization interest rate will continue to increase by 0.7% - 1% in the second half of 2024, putting pressure on the stock market.

Exchange rate pressure is forecast to remain tense in the third quarter, before cooling down in the fourth quarter thanks to the Fed's interest rate cut as well as increased foreign currency from remittances and exports entering their peak season.

Source: CafeF