Liquidity this afternoon was significantly better than the morning session, especially in the VN30 basket, helping many blue-chip stocks recover positively. The impact of this group on the score was clear in the last 30 minutes, even bringing the index back close to the morning peak. However, the breadth showed that red was still dominant.

Liquidity this afternoon was significantly better than the morning session, especially in the VN30 basket, helping many blue-chip stocks recover positively. The impact of this group on the score was clear in the last 30 minutes, even bringing the index back close to the morning peak. However, the breadth showed that red was still dominant.

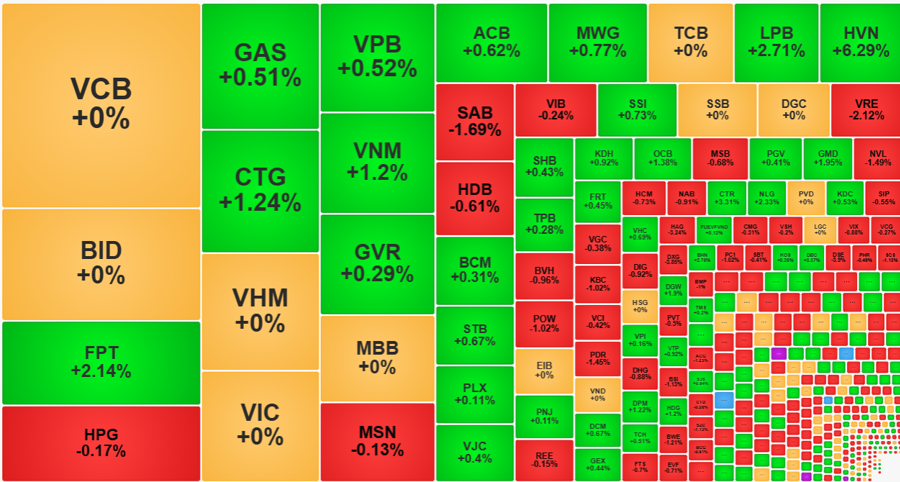

VN30-Index closed the session up 0.42%, significantly stronger than the increase of 0.25% of VN-Index. The Midcap group index also increased only 0.32%, Smallcap increased 0.23%. The breadth changed significantly in the blue-chip basket with 15 stocks increasing/8 stocks decreasing (the morning session ended with only 6 stocks increasing/21 stocks decreasing).

The liquidity of the VN30 basket in the afternoon also increased by 38% compared to the morning session, reaching about 3,593 billion VND. Better buying power helped many stocks recover. Statistics show that 23/30 stocks in this group increased in price compared to the morning session, only 6 stocks decreased in price. However, the pillars of the VN-Index are not strong, while the pillars of the VN30-Index are significantly better.

FPT is still the strongest stock of VN-Index when closing up 2.14% compared to the reference, bringing 1.05 points to the index. However, this afternoon FPT increased weakly, only increasing by about 0.43%. VIC, VHM are also two pillars that improved, but the amplitude is small. Meanwhile, BCM jumped 1.27% compared to the morning price and successfully reversed. ACB, GVR, SSI, STB, TPB are other stocks that were clearly strong in the afternoon, but mainly affected VN30-Index, helping this index close higher than the highest peak of the morning session, while VN-Index is still nearly 2 points lower than the peak.

Overall, the group of blue-chip stocks is still keeping the pace quite effectively for the VN-Index, but the consensus is still poor, causing this index to lose significant inertia. For example, today VCB, BID, VHM, VIC could not increase. In the group of 10 leading capitalization stocks, there are only 3 strong stocks: FPT increased by 2.14%, CTG increased by 1.24%, VNM increased by 1.2%. Even banking stocks cannot be represented by CTG or LPB, because only 11/27 stocks in this group were green at the end of the session and only 4 stocks increased by more than 1%, the rest were weak.

Liquidity in the blue-chip group also focused on a few individual codes. The 5 most traded stocks were FPT, MWG, VRE, HPG, VPB, accounting for approximately 44% of the total matched value of the VN30 basket.

The market this afternoon saw another decline, forcing the VN-Index to break through the reference level. It was not until after 2 o'clock that it began to recover and the real increase was only in the last 15 minutes. Many stocks also recovered following the index, the breadth reflected this quite closely: At 2 o'clock, there were only 127 stocks increasing/286 stocks decreasing on HoSE, but closing was 182 stocks increasing/231 stocks decreasing. However, this increase still could not reverse the correlation of the market breadth, showing that the strength had significantly differentiated. Of the 231 red stocks, there were still 77 stocks decreasing by more than 1%. Strong selling pressure appeared at VRE, decreasing 2,12% with liquidity of 407.9 billion VND; DXG decreased 3,85% with 233 billion; HAG decreased 3,24% with 178.3 billion; POW decreased by 1,02% with 165.5 billion; NVL decreased by 1,49% with 115.6 billion... PC1, ITA, PDR, NKG, KBC... were all under strong pressure with liquidity quite high compared to average.

The phenomenon of power differentiation is clearly shown in small and medium-sized stocks. Although representative indices such as Midcap and Smallcap are still increasing, the index breadth is leaning towards the decrease. This is the effect of short-term transactions that differ depending on the stocks. Investors act based on their existing portfolios, not the index. The stocks that are sold a lot and discounted a lot still have prices falling, regardless of the green index.

Foreign investors unexpectedly increased their selling this afternoon. Specifically, this group sold an additional 1,170.8 billion VND worth of stocks on the HoSE, up 1.5 times compared to the morning session. The buying level was about 959.8 billion VND, equivalent to a net selling of 211 billion. In the morning session, this group sold 160.2 billion VND. FPT was unexpectedly sold again strongly with -270.7 billion after yesterday's slight net buying session. VRE was also sold up to 156 billion VND. In addition, there were HPG -92.3 billion, VHM -65.8 billion, VPB -58.9 billion, LPB -45.2 billion, HDB -42.6 billion, DXG -42.6 billion. On the buying side, there were NLG +98.3 billion, SSI +64.3 billion, BID +56.6 billion, HVN +39.8 billion, GMD +35.3 billion, VCB +32.3 billion.

VN-Index has increased for 5 consecutive sessions and closed at 1283.04 points. Thus, the index has returned to the old peak, challenging this resistance level for the third time. However, this week liquidity has weakened significantly, the average matched order level only reached 14,070 billion VND/session, down 37% compared to the average of last week.

Source: VnEconomy