Diversifying the investment portfolio by sector to catch the cash flow is a strategy that investors can apply. Stock selection needs to be carefully considered when the differentiation is becoming more and more obvious.

The stock market in the week of June 17-21 recorded sideways movements around the 1,270-1,290 point area of the VN-Index. The market only moved within a narrow range with a trading value about 10% lower than the previous week. Compared to the previous week, the VN-Index increased by 2.11 points (+0.16%) to 1,282.02 points. The negative point came from foreign capital flows when foreign investors continued to net sell nearly 5,000 billion VND throughout the past 5 trading sessions.

Commenting on the market next week, experts said that investors should focus on opportunities in industries and businesses that expect good business results, along with economic recovery. However, stock selection needs to be carefully considered as the differentiation becomes increasingly clear.

The market needs to accumulate more, the correction is a buying opportunity.

According to Mr. Bui Van Huy - Director of DSC Securities, Ho Chi Minh City branch, VN-Index had a slight increase this week, however, the performance was relatively cautious and divergent with low liquidity and foreign investors continuing to net sell. The market still lacks supportive information, the domestic and international context is still not really clear.

Mr. Huy believes that the market still needs to accumulate for another 1-2 weeks before waiting for new supporting information from economic data in the second quarter and the new business results season. The strong support of the market is 1,240-1,250 points and the market still has a scenario of testing this support zone in case of weak demand. Adjustments to this zone are buying opportunities. In the positive case, if VN-Index surpasses the area around 1,290 points, it can return to the uptrend sooner than expected. At the same time, the expert does not see the possibility of the negative market falling beyond the 1,240-1,250 point zone.

Regarding the relentless net selling of foreign investors, Mr. Huy said that the selling momentum will continue to be strong in the upcoming sessions due to the difference in interest rates and capital allocation in the global scope. The net selling pressure of foreign investors is worrying but is actually something the market needs to accept due to the low interest rate environment.

Giving advice to investors, Mr. Huy said the appropriate strategy is to hold a certain proportion, wait for a deeper correction or wait for the market to have a clear scenario before taking action. Industry groups that recover according to the economic cycle will still be prioritized.

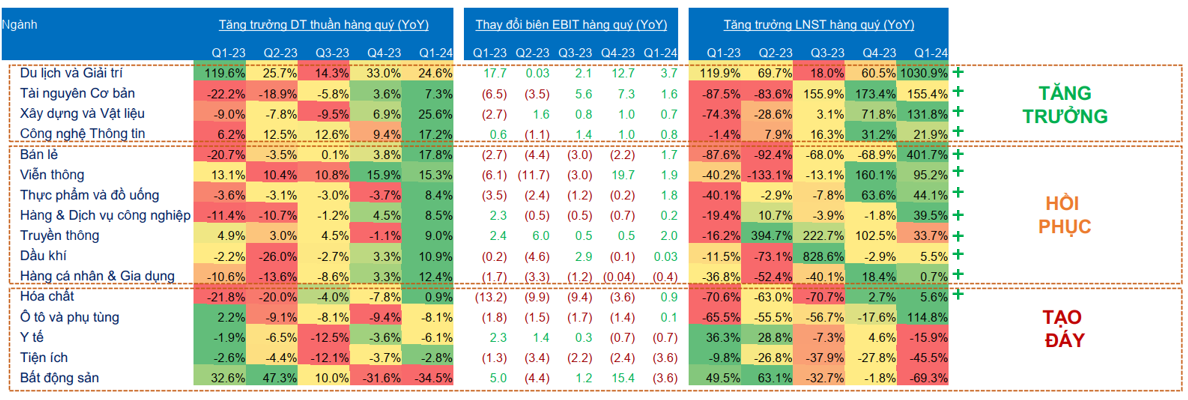

Regarding the picture of the second quarter business results, according to experts, there will be similar developments to the picture of the first quarter of the year in the direction of continuing to record profit growth in line with the economic recovery. Prominent industry groups include Information Technology, Basic Resources, Construction Materials, Tourism and Entertainment, Retail, Telecommunications, Food and Beverage, etc. because the data shows that the economic recovery continues to be positive.

Meanwhile, for real estate businesses or banks, Mr. Huy assessed that there will still be many difficulties when the real estate market situation is still quite gloomy and they have to wait for the boost from new policies.

Market focuses on Q2 business results, investors can diversify portfolio by industry

Mr. Nguyen Anh Khoa, Head of Department - Agriseco Securities Research assessed that this is the re-accumulation phase of the general market after the sharp decline on June 14. Although the industry wave is still continuously rotating to maintain cash flow in the market, selling pressure is showing signs of increasing every time the VN-Index approaches the resistance zone of 1,295-1,300 points. The market has not had the motivation to break out strongly because it is in an information valley when the shareholder meeting season has passed and attention is focused on the business results of the second quarter. However, with the increasing liquidity of the market supported by domestic capital flows, Mr. Khoa said that the market's upward trend is still preserved, but it will take more time to re-test demand when the index is getting closer to the resistance zone of 1,300 points.

According to Mr. Khoa, despite the net selling of foreign investors, the VN-Index is still relatively positive with support mainly coming from domestic capital flows. In addition, major central banks in the world are getting closer to the monetary policy easing cycle, which will help reduce exchange rate pressure in the coming time. In addition, the second quarter business results announcement season is approaching, with positive profit growth prospects across the market, investors can prioritize focusing on the profit prospects of industry groups, thereby screening potential stocks with room for growth and attractive valuations to find quality investment opportunities.

Regarding the story of market upgrading, experts from Agriseco said that the expectation of the upgrading story will become clearer in the period from the end of the third quarter to the beginning of the fourth quarter of this year when the bottlenecks of the Vietnamese market gradually show signs of being removed. Therefore, in the short term, the results of the periodic market classification will probably not affect investor sentiment.

The expert believes that diversifying the investment portfolio by industry to catch the cash flow is a strategy that investors can apply. Stock selection needs to be carefully considered when the differentiation is becoming more and more obvious. Industry groups with positive profit growth stories compared to the same period such as Retail, Steel, Export, Construction, Information Technology - Telecommunications and Oil and Gas are forecasted to be able to attract cash flow in the coming time. In addition, stocks with cheap valuations are also an attractive choice for investors, including the banking group when the industry P/B level returns to 1.5x - a relatively low valuation compared to the general market (1.8) and compared to the average of the last 5 years of this industry group (1.8x).

Source: CafeF