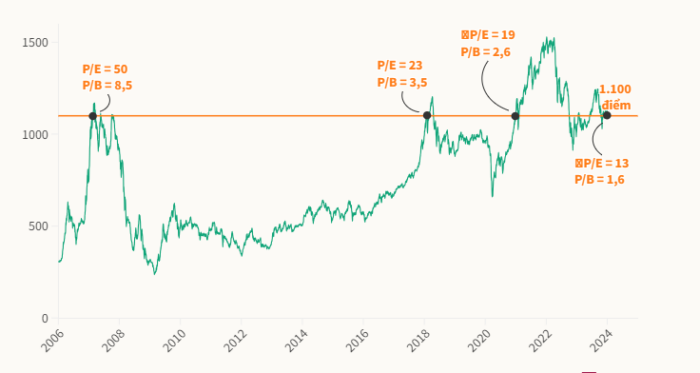

VN-Index 1100 points is a milestone of Vietnamese stocks. From 2007 to 2024, the stock market witnessed the prosperity and peak of VN-Index, then returned to the 1,100 point mark, but the current valuation in 2024 is considered "much more attractive than before".

1. VN-Index 1100 points from 2006 to 2023

At the end of 2023, the VN-Index recorded a level of nearly 1,130 points, which means a growth of more than 12% compared to the previous year. However, after a strong correction, the index has fluctuated around the 1,100 point range from November to the present. This is the price level that the VN-Index has reached in three different periods, the most recent being January 2021, followed by January 2018 and the oldest being January 2007 - 17 years ago.

However, according to experts, it is incorrect to infer about the stock market based on this data to conclude that the market has not brought any profit to investors after nearly two decades. The nature of the 1,100 threshold of the VN-Index this time is different", the 1,100 point level in 2007 represented the peak of the market "bubble" when the P/E ratio (market price compared to profit per share) reached 50 times and the P/B ratio (market price compared to book value) was 8.5 times. In contrast, the current 1,100 point area in 2024 is the "trough" for the new growth cycle, with the P/E and P/B ratios at only 13 and 1.6, respectively.

Valuations are now much cheaper than they were in 2007, and the upside for the market over the next five years is very positive. In fact, the first 1,100 point mark was recorded in 2007, when the stock market was excited by the wave of IPOs of many state-owned enterprises. Rapid economic growth, accession to the World Trade Organization (WTO), and loose monetary policy were the factors that stimulated the market's development.

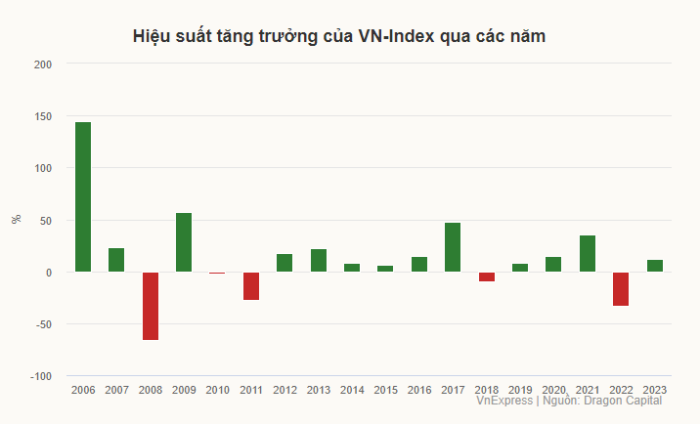

From the 300-point mark in early 2006, the VN-Index took just over a year to increase fourfold. During this period, many trading sessions saw more than half of the stocks on the HoSE increase in price to the limit, many codes were priced at hundreds of thousands of VND - a price equal to the basic salary at that time. The stock "fever" spread, causing many people to invest with the belief that "just buy and you will make a profit".

The market quickly “collapsed” in 2008 with a decrease of nearly 70%. By March 2009, the VN-Index had fallen deep to the 230-point area. But that was also the starting point for a very strong price increase cycle nearly a decade later. During that period, the improvement rate was up to tens of percent. The number of years the market increased was much greater than the number of years it declined.

Even during the times when VN-Index regained the 1,100-point mark in early 2018 and early 2021, the current market valuation is still cheaper than the previous two periods. According to SGI Capital's calculations, the current P/E is 13 times and P/B is about 1.6 times - both at the cheapest levels in history.

Today, we are witnessing a milestone in the Vietnamese stock market with the VN-Index reaching 1,100 points. This brings back memories of a similar period 17 years ago, in 2007, when the stock market witnessed the prosperity and peak of the VN-Index. Let us look back and compare the market's performance during these two periods.

2. VN-Index 1100 points in 2024 is more attractive and potential

The year 2007 marked a strong revival of the Vietnamese stock market after a difficult period. For the first time, the VN-Index reached 1,100 points, creating a positive atmosphere and optimism. Many investors successfully traded, and the market became the center of attention. However, the prosperity did not last long, and 2008 marked a series of negative events with the global financial crisis. The Vietnamese stock market was not immune to the impact of this crisis. The VN-Index collapsed, investors suffered huge losses, and the economy was under great pressure.

Through many challenges and learning from the costly lessons of the past, the Vietnamese stock market has made significant progress. In 2024, the VN-Index will stabilize at 1,100 points, with a positive market sentiment. Bloomberg's projections for the economies of countries in 2024 indicate that growth will not generally recover strongly, but inflation and interest rate expectations in the US and Europe will be lower than in 2023, creating favorable conditions for the stock market.

For the world's largest economy, the US, most major organizations such as Bank of America, Morgan Stanley, Goldman Sachs, etc. forecast stable growth in 2024 with GDP growth from 1-2% and inflation around 3%. Vietnam's economic projections from the World Bank (WB) and the International Monetary Fund (IMF) are quite cautious, with GDP growth from 5-5.8%, inflation around 3%. In a more positive scenario, the Vietnamese Government and other organizations such as HSBC, ADB, Fitch Solutions forecast GDP growth from 6-6.5%, inflation above 3% and within the Government's control.

From there, looking at the profit prospects of listed companies, the rate of decline in EPS (earnings per share) gradually decreases. Specifically, in the fourth quarter of 2022, corporate profits decreased by more than 30% compared to the same period, while in the third quarter of 2023, they only decreased by about 2%. In the fourth quarter of 2023, corporate profits will grow positively again. In 2024, EPS may increase around 30%. In which, each industry will have different growth, some industries may grow very strongly (such as raw materials increased by nearly 550% due to this year's low base).

In addition to the difference in valuation, this analysis group also believes that VNindex 1100 point milestone will now become a "support level" of the long-term uptrend, instead of being a challenging number for the market many times over the past 17 years. SGI Capital made the above assessment based on the Government's determination to bring Vietnam into the group of emerging markets in the next two years, liquidity will increase along with the VN-Index and the general corporate profit growth in 2024 is about 15-20%.

With attractive valuations and low interest rates, many securities companies believe that this is the right time to accumulate assets through stocks. The market will receive a lot of supporting information in the coming time when the KRX system (a new information technology system for HoSE, allowing same-day trading) is put into operation, creating a foundation for many new products to be deployed, thereby shortening the path to upgrading Vietnam to an emerging market. Therefore, this analysis group believes that reasonable market valuation is an opportunity to accumulate stocks with a long-term vision.

With a general profit growth of 15-20% in 2024, the VN-Index of 1100 points, which has been tested many times over the past 17 years, will become a support level with historically cheap valuations of the long-term uptrend.

After a tightening period of nearly 2 years, there is considerable room for monetary easing globally as inflation in many countries has fallen below the ceiling interest rate. Goldman Sachs forecasts that inflation in the US and developed economies will return to the 2% - 2.5% range by the end of 2024 and there will be no rebound effect. Stock markets often perform well during periods of inflation in the 2% - 3% range. Therefore, in the trend of falling interest rates and economic recovery, major organizations around the world recommend allocating money to investment channels instead of holding cash in 2024.

December’s macro data on manufacturing and employment showed signs of stabilization and recovery in the global economy, including industrial production and retail consumption in China. This recovery will continue to spread to manufacturing countries such as Vietnam. In 2024, we can expect synchronized interest rate cuts across the globe to support growth and thus boost stock markets.

Valuations in many emerging markets are now relatively cheap relative to the past and the US. Meanwhile, the US dollar has ended its bull run as the Fed prepares to cut interest rates, which could see money flow back to emerging markets. The recent surge in cryptocurrencies is an early sign of this trend.

The key risks for 2024 are the possibility that the economic locomotives of the US and China will not recover but gradually slide into recession. US unemployment exceeding 4.2% will be an important recession warning mark to pay attention to. In addition, the risk of inflation outbreak due to escalating geopolitical tensions can also change the positive scenarios for 2024.

2024 is opening up a positive outlook for the market Vietnam Securities, especially with the stability of the VN-Index at 1,100 points. This is not just a number, but the result of sustainable development and solid foundations of the market. One of the main factors that helps create a positive outlook is the diversity and quality of listed companies.

The Vietnamese stock market is currently witnessing the emergence of many businesses with sustainable development strategies and stable growth capabilities. This not only benefits investors, but also promotes healthy competition among businesses. Innovation in management and investment in infrastructure are also major drivers helping the market maintain its appeal.

Improving the legal system and market rules not only helps create a positive business environment, but also increases investor confidence. Transparency in securities management and trading is becoming an important advantage, attracting more and more foreign investment.

Faced with attractive valuations, savvy investors can see the upside potential and invest in stocks with solid fundamentals. A flexible strategy and patience in maintaining investments are the keys to maximizing the opportunities that the market is bringing. 2024 promises to be a year when the VN-Index of 1,100 points will be surpassed, and this will be a journey full of discovery and success for stock investors with a broad vision and extensive knowledge.

3. Stock investment strategy for the future

Looking back at the past and present, investors can draw valuable lessons. Investment strategies need to be flexible, based on thorough research and a solid understanding of the market. The appeal of VN-Index 1100 points Not only an opportunity but also a challenge for wise investors.

With significant progress and valuable lessons, the Vietnamese stock market is opening up attractive prospects for investors with the right strategy and vision. Let's look forward to new opportunities and challenges in the coming time.

2024 is a promising time for stock investors in Vietnam, and to exploit these opportunities, investment strategies need to be built with consideration and flexibility. An important strategy is to diversify the investment portfolio, ensuring risk dispersion and the ability to take advantage of opportunities from many different sources of income. This is especially important with the diversity and development of many companies with great potential in the market.

In addition, prioritizing investment in companies with growth potential and strong infrastructure is key to achieving stable returns. This means paying attention to management innovation and investing in businesses that enhance competitiveness.

The legal system and market rules are becoming increasingly transparent and trustworthy, opening up opportunities for the sustainable development of the Vietnamese stock market. Risk control through the use of tools such as stop-loss is an important part of the investment strategy to protect investments from sudden fluctuations in the market.

Seizing opportunities from technology trends and innovation is a smart strategy, with artificial intelligence, blockchain, and renewable energy continuing to dominate. Onstocks Securities And the first businesses to get on board with these trends can reap huge profits.

Ultimately, maintaining a long-term vision, not letting yourself be distracted by short-term fluctuations, and regularly updating and adjusting your strategy according to market fluctuations are the keys to success in trading. stock investment in 2024In short, a smart investment strategy is a combination of diversity, creativity, and a deep understanding of the market, helping investors take advantage of opportunities and face challenges effectively.

Source: Onstocks