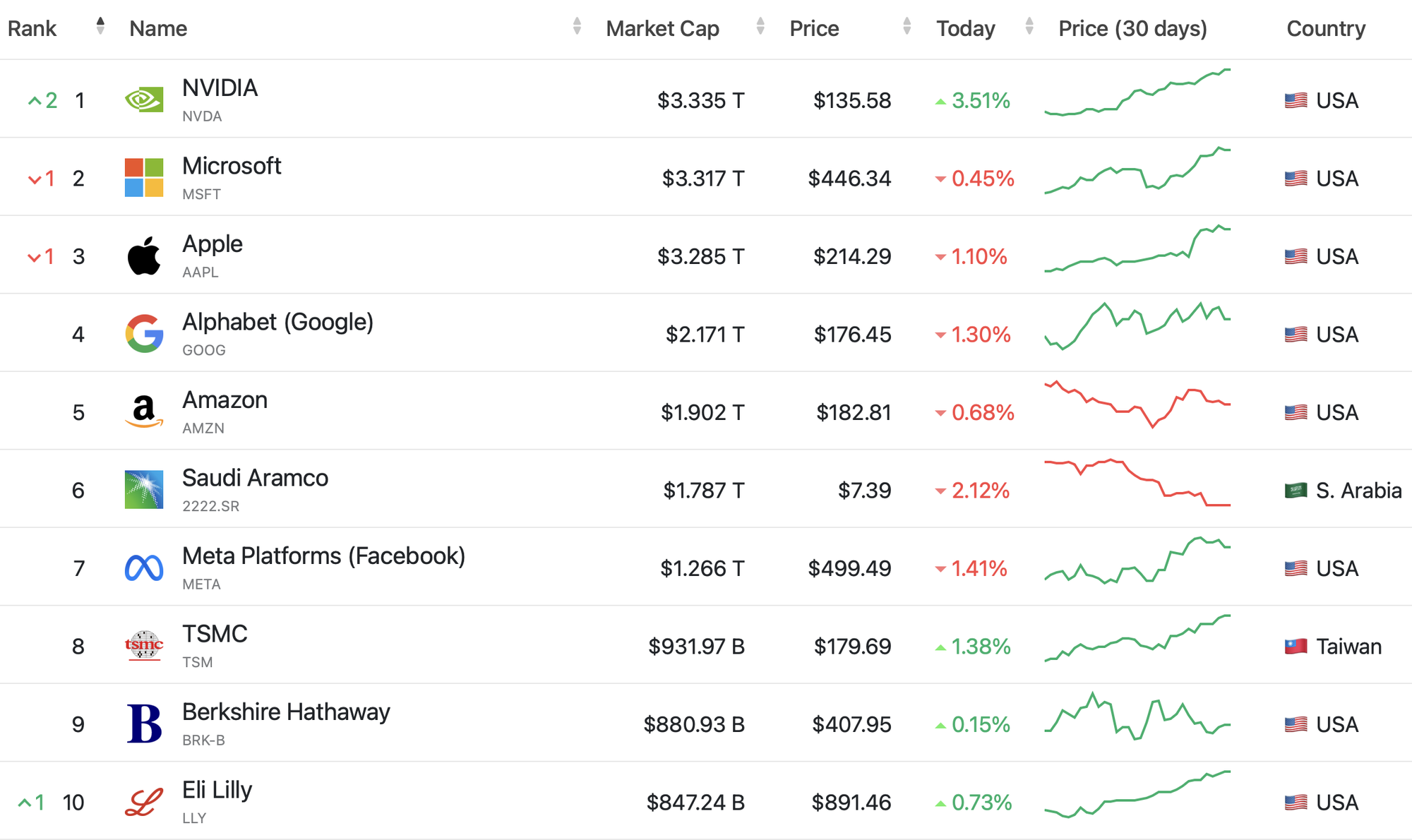

NVIDIA shares made a spectacular breakthrough when they increased by 3.2% to 135.18 USD/share, thereby increasing the market capitalization to 3,332 billion USD, surpassing 2 other "bigtech" Microsoft and Apple to reach the number 1 position in the world. This is the first time in more than a decade that this position does not belong to the Windows operating system manufacturer or the owner of "apple".

Mr. Do Cao Bao, member of the Founding Council of FPT Corporation, assessed that the miracle and strangeness of NVIDIA is thanks to the explosion of artificial intelligence AI, turning NVIDIA from a semiconductor chip company into an AI platform software company, including software tools and AI libraries, an AI ecosystem that is almost unrivaled.

According to Mr. Bao, when it comes to Apple, everyone knows about iPhones, iPads, Apple Watches and MacBook computers, it is present around us, even we are using it every day. With Microsoft, everyone knows about Windows, Word, Excel, PowerPoint, Exchange, Outlook, LinkedIn software, most computer users use these software.

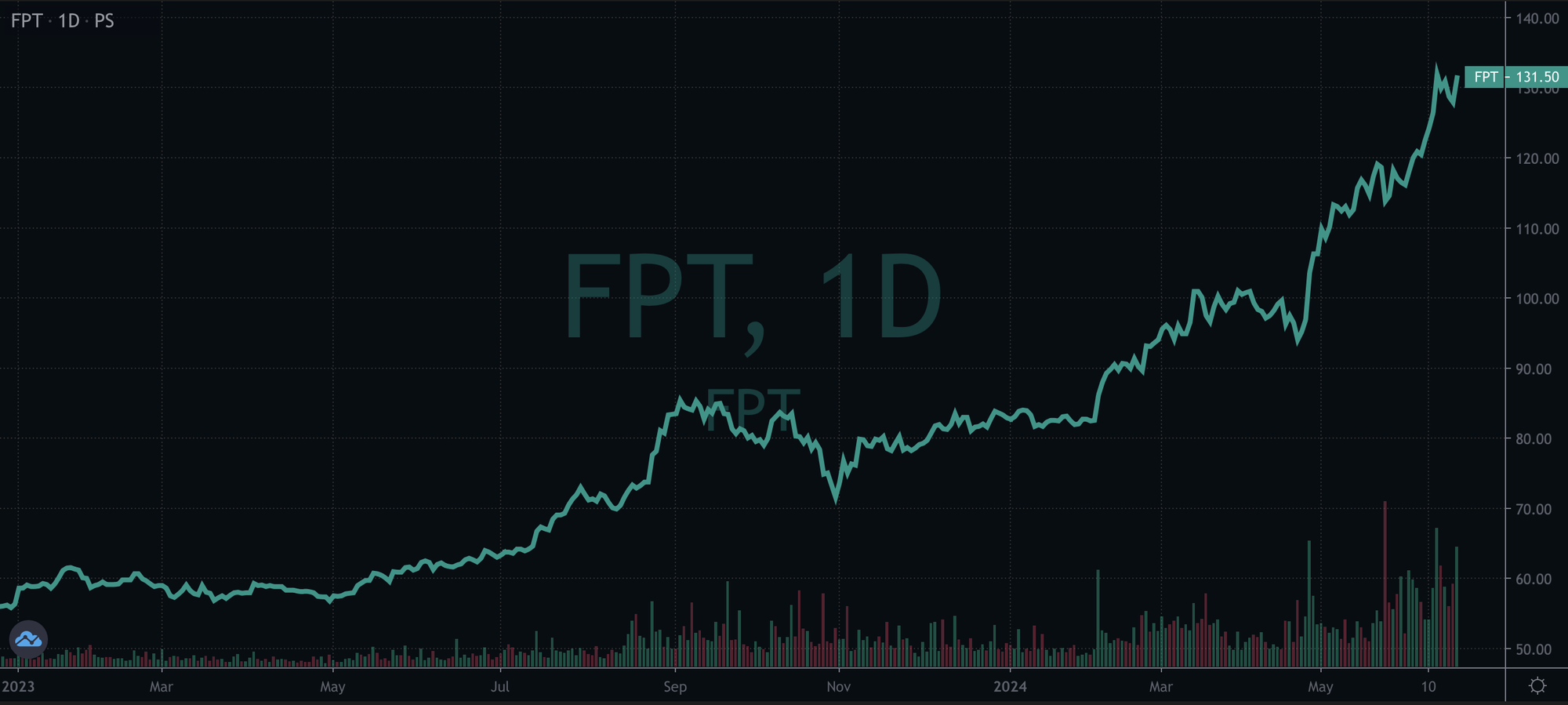

Meanwhile, very few people know what NVIDIA products are, very few people use them, ordinary people like us do not know, do not directly use them. But in fact, NVIDIA chips are playing a central role in the race to dominate the global AI market. Open AI's ChatGPT, Google's Gemini and other Chatbots, Tesla's electric cars, Metaverse systems and generative AI all need NVIDIA chips, servers and software. Amid the global AI fever, a partner of NVIDIA in Vietnam, FPT, of course, is not out of the game. The stock of this technology corporation has just had a breakthrough session to approach the historical peak. After less than 6 months, this stock has increased by 60%, thereby pushing the capitalization value to a record high of 192,000 billion VND (~8 billion USD).

A recent analysis report by VNDirect said that FPT's stock price has skyrocketed since the news of the partnership with NVIDIA appeared, with the current P/E ratio at 25.5x, an all-time high. The market is responding positively to the semiconductor story, especially when semiconductor-related stocks have been strongly revalued in recent years.

According to a recent report by DSC Securities, FPT's decision to invest 200 million USD in an "AI factory" and build a roadmap for developing semiconductor human resources in the context of an expected shortage of more than 80% of human resources in the next 10 years will fully take advantage of the wave of investment in artificial intelligence AI in foreign markets.

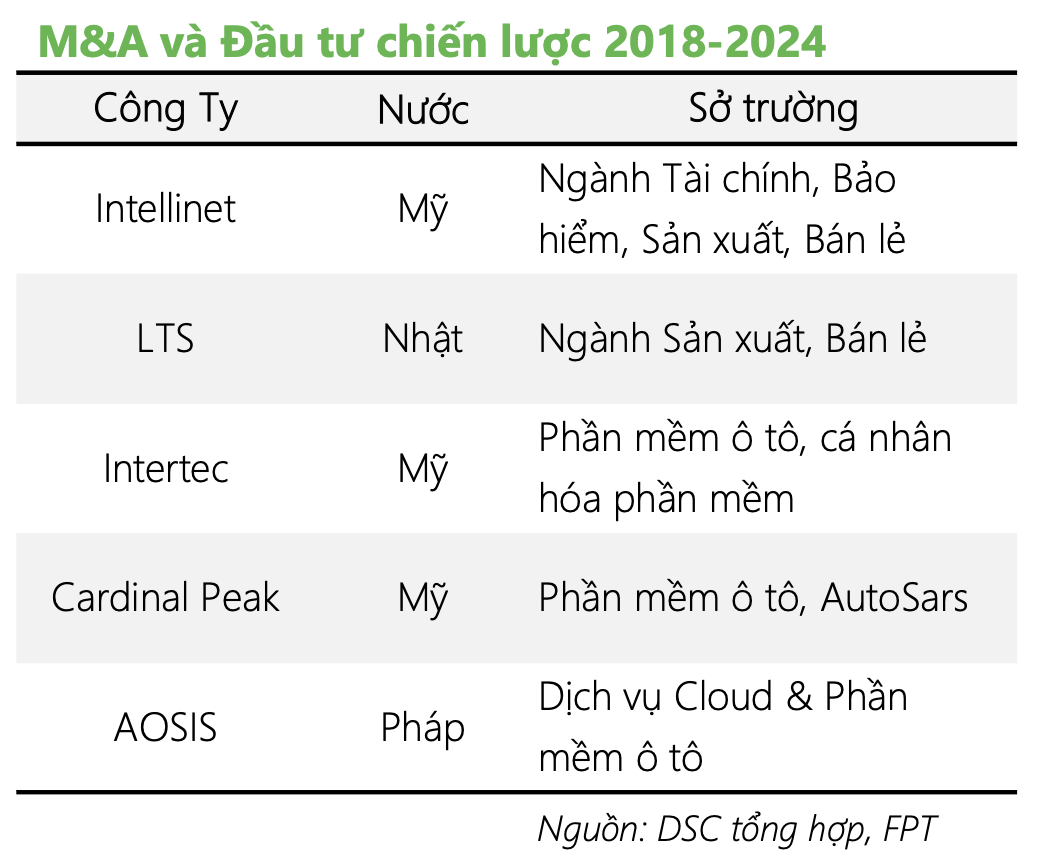

“FPT will achieve growth of 22% in foreign IT and 21% in Education from 2025 thanks to current investment in NVIDIA's latest technology”, DSC report stated. FPT's growth records in the past 5 years can be partly explained by FPT's M&A expansion strategy in the US, European, and Japanese markets.

DSC believes that the benefits from M&A and strategic investment have been more clearly reflected in the business results in the first 3 months of 2024, when the number of customers contributing over 1 million USD increased by 25% compared to the same period. Based on FPT's steady annual cash flow and ability to raise capital, DSC believes that M&A will continue in the Japanese market to increase sales.

In the first 5 months of the year, FPT's overseas IT Services segment achieved revenue of VND 11,998 billion, an increase of 29.81% YoY over the same period in 2023, led by growth from all 4 markets. The domestic IT Services segment recorded revenue of VND 2,515 billion, equivalent to a growth of 5.41% YoY, driven by investment demand for technology from the banking & finance sector.

Thanks to that, FPT continued to maintain steady growth after the first 5 months of the year with revenue reaching VND 23,916 billion and profit before tax (PBT) reaching VND 4,313 billion, up 19.91% and 19.51% over the same period. Profit after tax for parent company shareholders also increased 21.21% to VND 3,052 billion, corresponding to EPS of VND 2,403/share.

In 2024, FPT plans to achieve record high business results with revenue of VND 61,850 billion (~USD 2.5 billion) and pre-tax profit of VND 10,875 billion, both up about 18% compared to the results achieved in 2023. With the results achieved after the first 4 months of the year, the group has achieved 39% of the revenue plan and 40% of the profit target.

Source: CafeF