VN-Index has increased by 10% since the beginning of the year, which is not a bad result. However, the fact that the index failed to surpass 1,300 many times, and when it finally did, it quickly lost its achievements is probably the reason why the party of Vietnamese stocks is a bit less fun.

The stock market closed the first half of 2024 with many strong fluctuations, but the upward trend remained the main trend. After a deep correction in April, the market reversed and recovered strongly. The VN-Index climbed above 1,300 points, the highest level in 2 years, before turning around and correcting in the second half of June.

However, VN-Index still recorded an increase of more than 10% since the beginning of the year, with the main driving force coming from cash flow rotating around the large-cap group. The VN30 index recorded an outstanding increase of nearly 13% since the beginning of the year, while VNMID (representing the Midcap group) increased by 11% and VNSML (representing the Penny group) increased by more than 9%. As usual, small and medium-sized stocks still fluctuated violently, increasing dramatically and decreasing deeply.

While VN-Index increased by more than 10%, HNX-Index disappointed with an increase of less than 3%. Many large-cap stocks on HNX such as IDC, PVS, SHS, HUT, etc. had unimpressive performance. MBS, PVI, VCS broke out quite strongly but not enough for HNX to have a representative on the list of billion-dollar capitalization.

Meanwhile, UPCoM-Index had a spectacular acceleration from the end of April to close the first half of the year with an increase of more than 12%. The stocks of a series of state-owned enterprises such as VGI, ACV, MVN, VEA and some private sector representatives such as FOX, MCH, QNS were the factors that helped the index achieve outstanding growth. Notably, the duo VGI and ACV also surpassed a series of big names on HoSE to enter the top 3 most valuable stocks on the Vietnamese stock market.

In fact, the increase of 10% since the beginning of the year is not a bad result. However, the fact that VN-Index repeatedly failed to surpass 1,300, and when it officially surpassed, it quickly lost the achievement is probably the reason why the party of stock investors is not happy. In that context, an investment index of HoSE has outstanding performance.

Since the beginning of the year, VNDiamond has increased by nearly 23%, which is more than double the increase of VN-Index. This index is currently near its historical peak, even higher than the period when VN-Index was above 1,500 points in April 2022. Large-weight stocks in the basket such as FPT, PNJ, GMD, REE, ACB, TCB are all near their historical peak with an increase of dozens of % since the beginning of the year.

VNDiamond is an index announced by HoSE on November 18, 2019. The biggest difference between VN Diamond and other indices is the FOL (Foreign Ownership Limit) coefficient - the limit on the holding ratio of foreign investors. Stocks with a FOL coefficient of at least 95% are likely to be considered for inclusion in the VNDiamond basket.

What numbers for the second half of the year?

In a newly published strategy report, TPS Securities' analysis team assessed that the second half of this year will be the premise for the market's Uptrend from the brighter market upgrade story when MSCI's June 2024 assessment report showed that Vietnam has improved its transferability criteria.

In addition, the KRX system is being urgently completed and is expected to be deployed from September, which will further strengthen the market's ability to upgrade. In addition, important laws such as the Land Law, Real Estate Business Law, etc., which will take effect from the third quarter of this year, will also create momentum for the market to increase points.

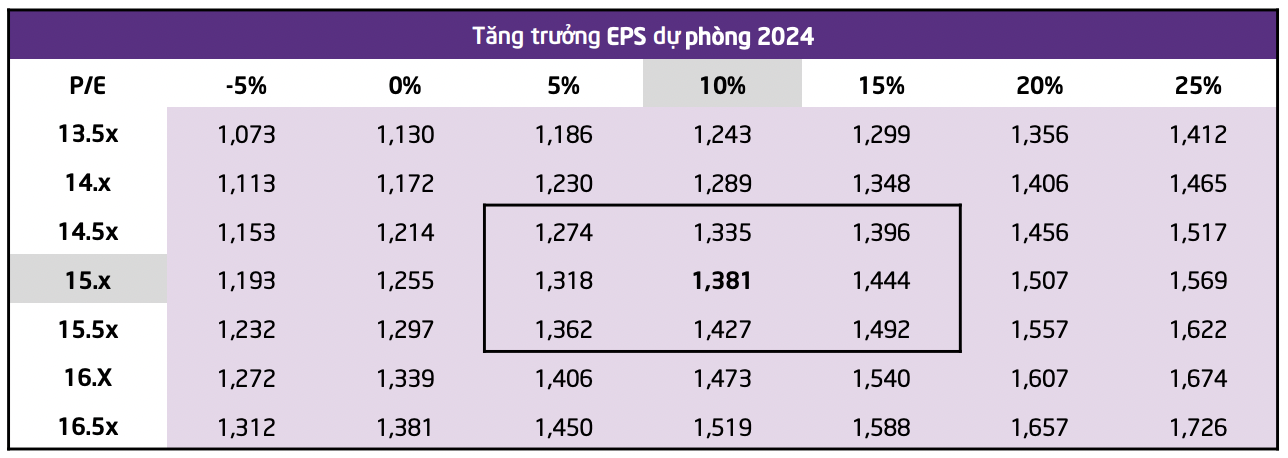

In the base scenario, TPS forecasts that the VN-Index will fluctuate around the target of 1,381 points, corresponding to a cautious growth rate of 10% for the whole year and a target P/E of 15.x times (equivalent to the average P/E of the last 10 years).

From a more optimistic perspective, VN-Index could reach 1,444 points with a profit growth scenario of 15% when macro difficulties will ease and global central banks will loosen monetary policies. Thereby stimulating consumption growth again, creating a premise for Vietnam's export activities.

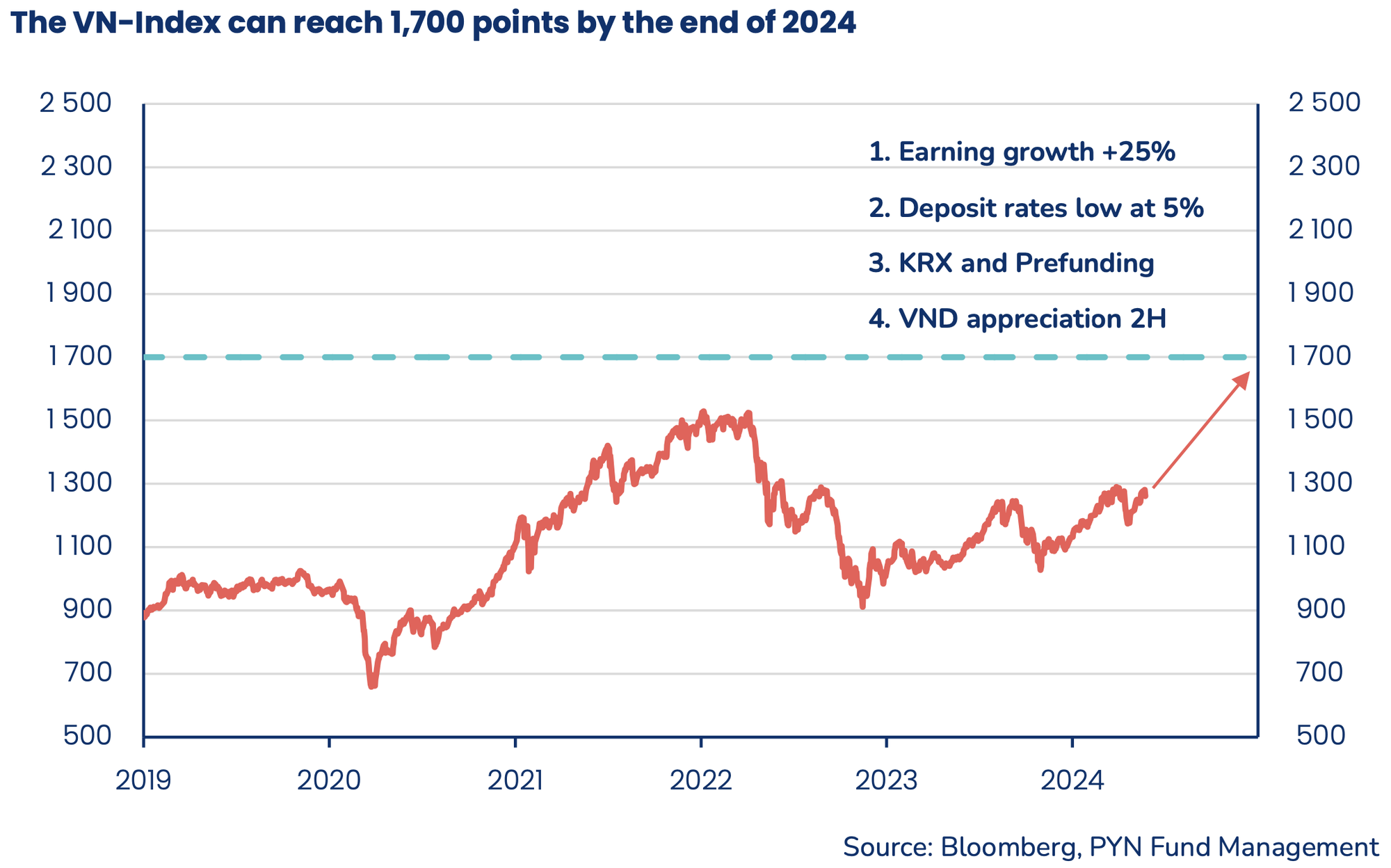

More optimistically, Petri Deryng - head of Pyn Elite Fund in the letter sent to investors in the second quarter of 2024 continued to express confidence that VN-Index could reach 1,700 points by the end of 2024. Based on the consensus forecast of securities companies, VN-Index will reach 1,400-1,500 points in the rest of the year. However, with a positive view based on income growth, this foreign fund believes that the index can increase higher this year.

In addition to strong earnings growth, the foreign fund also pointed out other factors that could boost domestic investor sentiment, even leading to a strong momentum at the stock market level. First, the expectation that the upcoming US interest rate cut will ease pressure on the VND, which is negatively affecting the Vietnamese stock market.

In addition, the new KRX trading system is expected to be deployed this year and the bottleneck of foreign institutional investors' pre-trading deposits may be resolved as soon as the third quarter, which will have a positive impact on the market. In addition, Pyn Elite Fund also expects interest rates in Vietnam to remain at a very moderate level, thereby promoting economic growth.

Source: CafeF