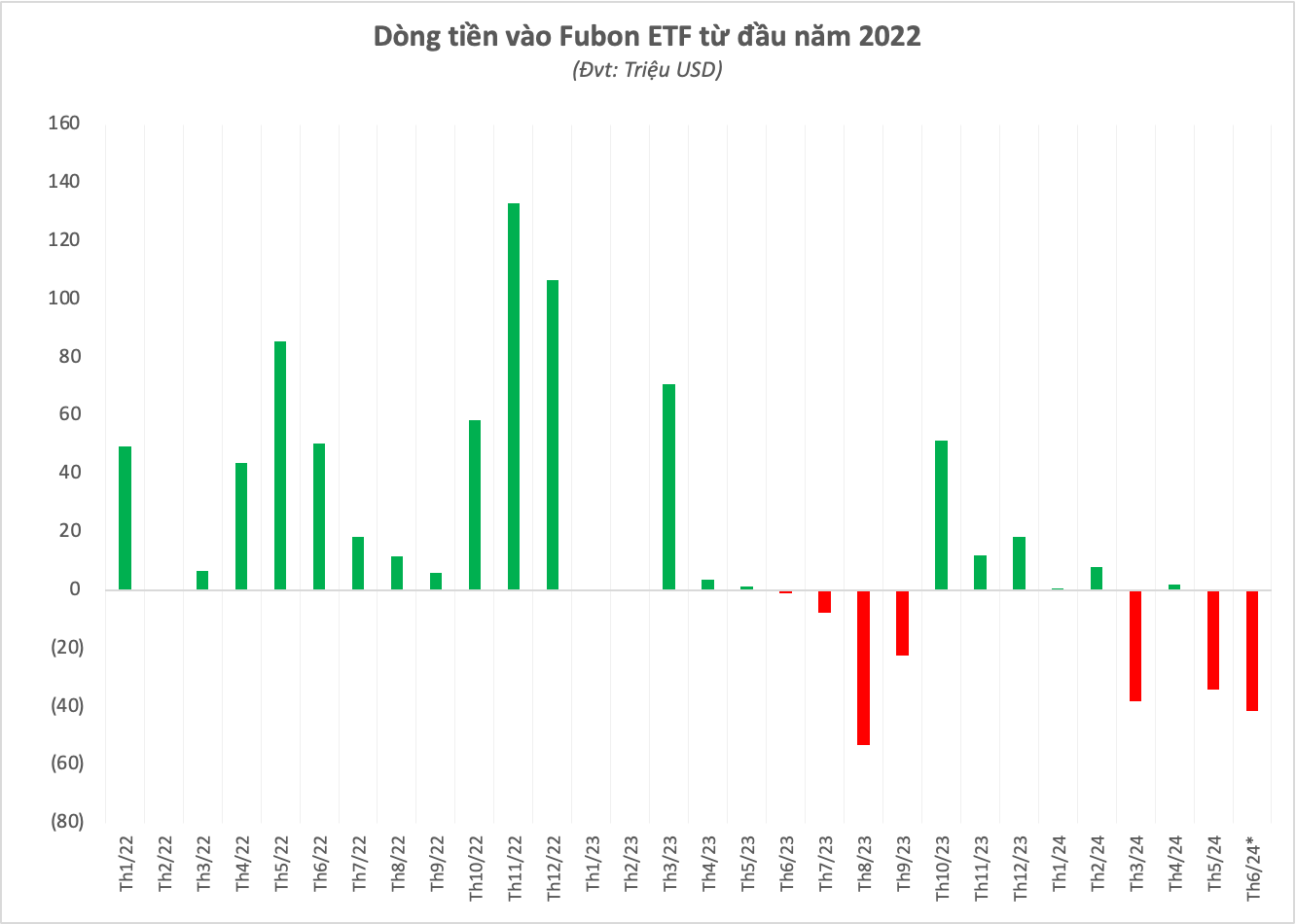

Since investing in the Vietnamese market in March 2021, Fubon ETF has never experienced a period of strong capital withdrawal like the current one.

Recently, foreign investors have increased their net selling in the Vietnamese stock market. Since the beginning of 2024, the net selling value of foreign investors on HoSE has exceeded VND48,000 billion. The number is likely to continue to increase as the selling pressure shows no signs of stopping. The record net selling figure of foreign investors was recorded in 2021 with more than VND58,000 billion.

The reversal of foreign capital flows is partly due to the recent strong withdrawal of capital from ETF funds, especially Fubon ETF. Foreign funds from Taiwan (China) have suddenly seen capital withdrawals for 2 consecutive months with increasing value. Since the beginning of May, the fund has had a net withdrawal of 75 million USD (~1,900 billion VND).

Accumulated from the beginning of 2024, the capital flow from this foreign fund recorded a net withdrawal of nearly 103 million USD, equivalent to nearly 2,600 billion VND of Vietnamese stocks being net sold. Since investing in the Vietnamese market from March 2021, Fubon ETF has never experienced a period of strong capital withdrawal like the current one.

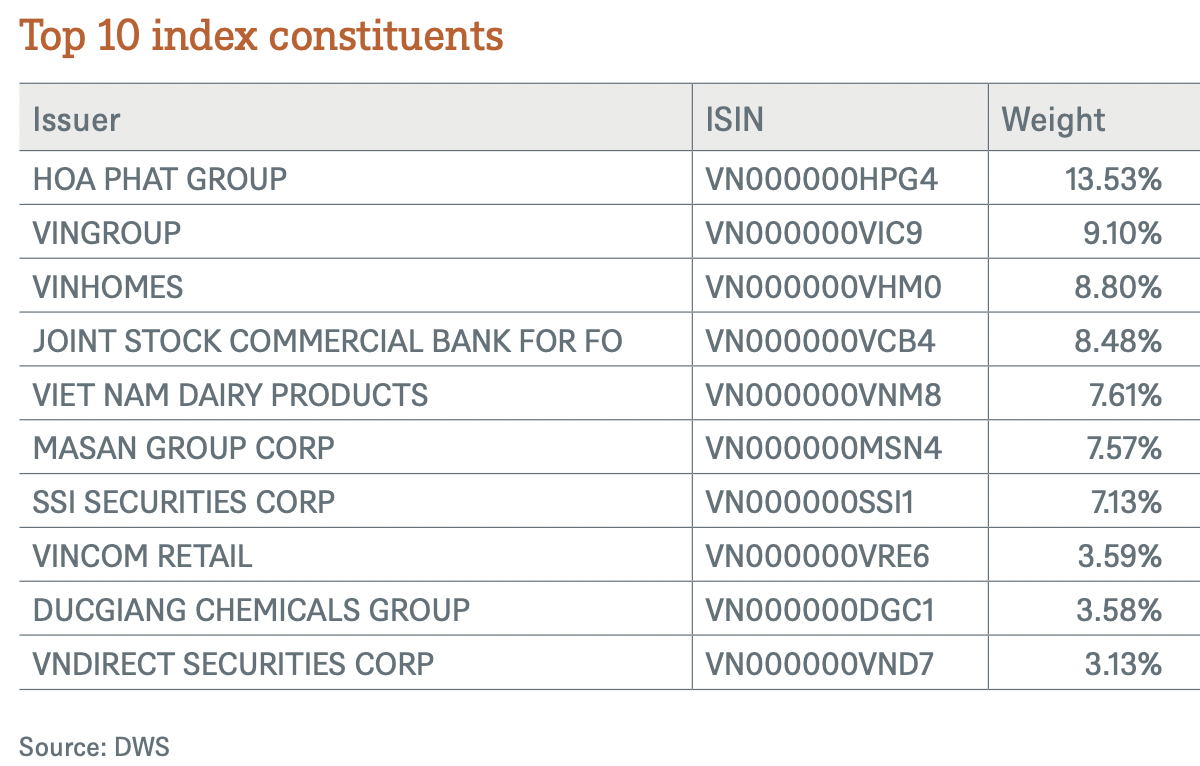

Currently, Fubon ETF is the largest ETF investing in the Vietnamese stock market with NAV up to 23.4 billion TWD (~724 million USD, equivalent to 18,400 billion VND). Fubon ETF invests in Vietnamese stocks according to the reference index FTSE Vietnam 30 Index including 30 stocks.

The stocks with the largest weight in the Fubon ETF portfolio include HPG (10.8%), VIC (8.5%), VHM (8.2%), VCB (8.2 %), MSN (7.6%),...

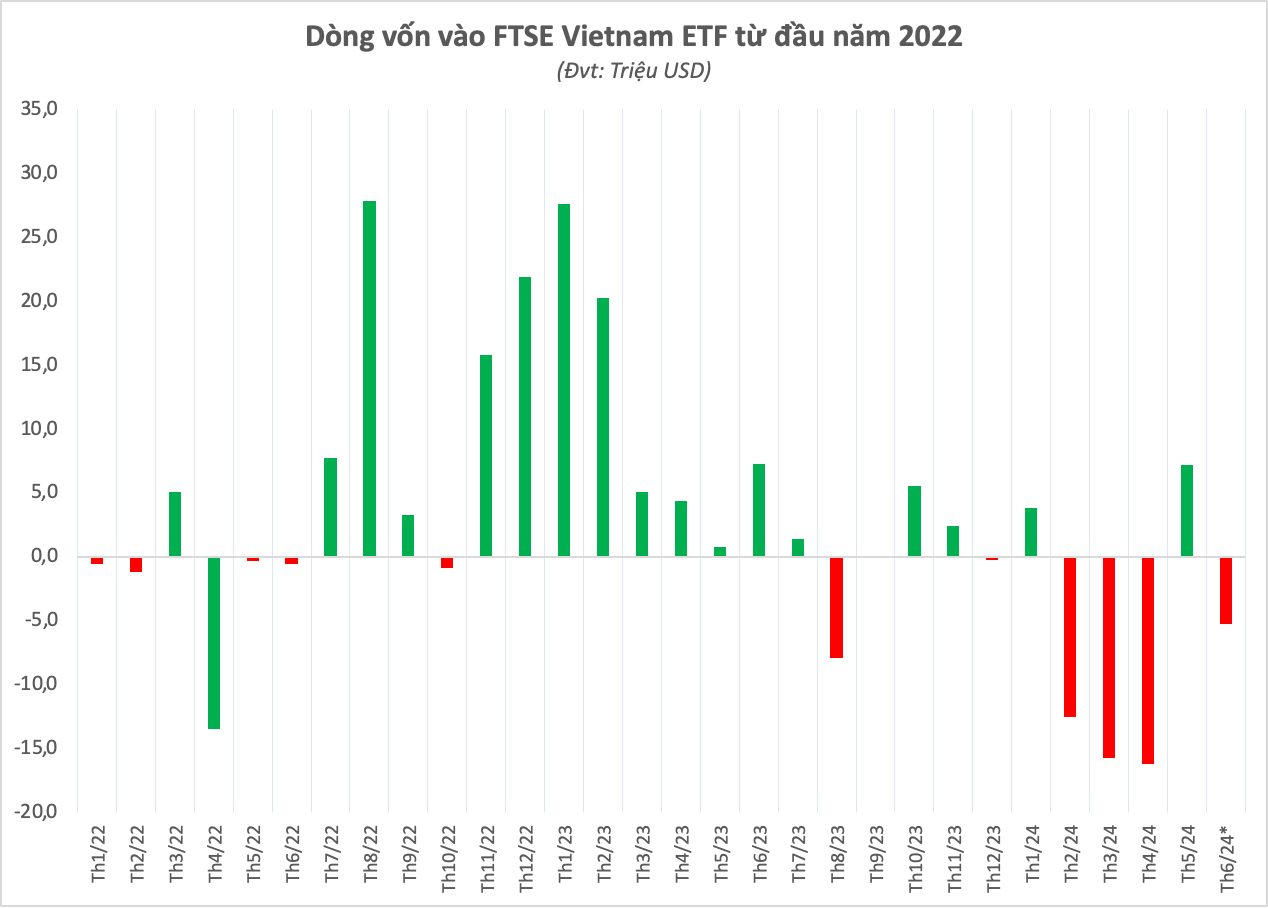

Similarly, one of the oldest foreign ETFs on the Vietnamese stock market, FTSE Vietnam ETF, is also experiencing a strong net withdrawal trend. Since the beginning of June 2024, FTSE Vietnam ETF has seen a net withdrawal of more than 5.3 million USD (~131 billion VND).

In fact, the capital flow through FTSE Vietnam ETF has begun to reverse since the end of 2023. Since December 2023, this ETF has been withdrawn quite strongly every month and only slowed down slightly in January and April 2024. Accordingly, the total value of capital flow into FTSE Vietnam ETF from the beginning of 2024 to now is negative nearly 39 million USD, equivalent to a net sale of about 970 billion VND.

By June 21, 2024, the fund's NAV will be only about 306 million USD, equivalent to 7,800 billion VND. This ETF invests in 100% Vietnamese stocks simulating the FTSE Vietnam Index.

Relatedly, the FTSE Vietnam Index reference index in the review last June added TCH and did not remove any stocks, thereby increasing the number of Vietnamese stocks to 28 codes. In the past, these ETF restructuring activities had a great impact on the market. However, with the strong growth in market size and the wave of individual investors participating "massively", the impact of these ETF portfolio reshuffling sessions has been significantly narrowed.

Currently, stocks HPG, VIC, VHM, VCB, VNM, MSN,… are the names with the leading proportion in the FTSE Vietnam ETF portfolio.

The difference in interest rate environment, monetary policy, high exchange rate… has significantly impacted the actions of foreign investors. This has caused capital restructuring activities globally, weaker growth markets, depreciated currencies or frontier markets will be strongly withdrawn to allocate capital to more efficient markets. Not only Vietnam, but also regional markets such as Thailand and China are clearly affected.

Some specific stories in the Vietnamese stock market can also have a negative impact on foreign investors, such as the transition to the new KRX system that cannot be implemented yet, or the difference in proportion between industry groups on the floor, and the lack of "good" products such as manufacturing, industry, technology, medical, health care, etc.

According to Mr. Nguyen Anh Khoa, Head of Agriseco Securities Research, despite the net selling of foreign investors, the VN-Index is still relatively positive, increasing by 13,28% since the beginning of this year, mainly supported by domestic capital flows. In addition, major central banks in the world are getting closer to the monetary policy easing cycle, which will help reduce exchange rate pressure in the coming time. In addition, the end of June - early July is also the season for announcing the Q2/2024 business results of listed enterprises. With the prospect of positive profit growth across the market, the net selling pressure of foreign investors will not have a significant impact and investors can prioritize focusing on the profit prospects of industry groups, thereby screening potential stocks with room for growth and attractive valuations to find quality investment opportunities.

Source: CafeF