Midcap stocks Midcap stocks are typically companies with average market capitalization. They are often considered to have high growth potential and stability compared to smallcap stocks. This makes midcap stocks a popular choice for investors who want to balance risk and profit opportunities. With relatively good liquidity and positive market potential, midcap stocks are an indispensable part of the investment portfolio of many professional investors. Join HVA to learn more about midcap stocks and role of stock market.

1. What are Midcap stocks?

Midcap stocks represents medium-sized companies on the stock market, with capitalization values usually ranging from VND 1,000 to VND 10,000 billion. These companies are considered to have higher growth and development potential than large enterprises, however, they also come with a higher level of risk than small companies.

>>> See more articles: Comparing Common Stock and Preferred Stock: Pointing Out the Differences

In the classification of stock indexes, Midcap Companies are often classified in the middle segment, between small (Small Cap) and large (Large Cap) companies. This is the group with stock price at an average level, offering high profit potential for investors in both the medium and long term.

Characteristics of Midcap stocks

Midcap Stock Group have their own characteristics that investors need to understand to distinguish and evaluate compared to other types of stocks on the market. Below is a summary of some outstanding characteristics of the Midcaps group:

- Stability: Midcap stocks usually include small and medium sized companies, but they are all operating stably for a long period of time.

- Diversified profession: Midcap companies operate in important industries such as transportation, electricity, transportation, housing, and energy. This is a key industry group, always ensuring a sustained growth rate, helping to maintain the industry's stable position.

- High growth potential: Midcaps stocks have high growth potential because they are in the development and investment stage. It can be seen that the revenue of these companies can double or triple compared to the present.

- Low capitalization: The total market capitalization of Midcap stocks in the market accounts for only about 22% of market value. This shows that, despite their high growth potential, they still have low capitalization compared to large companies.

These characteristics help investors better understand the nature and potential of Midcaps stocks in the process of investing and managing their portfolios.

Midcap stocks have good liquidity and positive market potential.

2. Advantages and disadvantages of Midcap stocks

Although only accounting for 22% of total market capitalization, midcap stocks are highly appreciated and are preferred by many investors. This is a group of stocks with a lot of potential but of course there will still be risks involved. So Advantages and disadvantages of Midcap stocks What is that?

Advantages of Midcap stocks:

- Mid-range price: Share Midcap stocks are often cheaper and more traded than Bluechips, making it easier for investors to choose and participate in the market.

- High liquidity: Compared to Penny stocks, Midcap stocks have higher liquidity because they attract many investors, bringing in a large trading volume.

- High profit rate: Midcap companies usually have higher profit margins than Large Cap companies because they are in the development stage and have high growth potential.

- Great investment opportunity: Midcap stocks offer more future investment opportunities than Large Cap stocks and have higher liquidity, reducing risks compared to Small Cap stocks, suitable for all types of investors.

- Multi-industry investment opportunities: Midcap companies often operate in a variety of industries, providing diversity and choice for investors.

Disadvantages of Midcap stocks:

- Price movements are difficult to predict: Midcap stocks often have more unpredictable price movements than Large Cap stocks because they are in the development stage and have high volatility.

- High risk when the market is volatile: Although more stable than Penny stocks, Midcap stocks are still heavily influenced by the general market and are at risk of experiencing difficulties when the market fluctuates strongly.

- Risk of price manipulation and speculation: Compared to Large Cap stocks, Midcap stocks are at higher risk of price manipulation and speculation due to their average capitalization and uncontrolled market value.

3. Should I invest in Midcap stocks?

Based on the above analysis, it can be seen that Midcap stocks are a group of stocks with high growth potential and profit opportunities. In stable market conditions, Midcap stocks often have a higher chance of increasing in price than Large Cap stocks and carry a lower level of risk than Small Cap stocks.

Midcap companies are often in the mid-cap group, which gives them higher resilience and is considered a group of stocks that balance growth and stability.

However, no one can predict market trends accurately. Vietnam's basic stock market always contain unpredictable risks. Therefore, to decide whether to invest in Midcap stocks or not, you need to rely on your financial ability and investment goals. Determining your risk tolerance is important to make the most appropriate decision.

Furthermore, before deciding to invest in Midcap stocks, you should also consult financial experts or experienced investors for advice and to make safe investment decisions. Investors also need to consider factors such as the current economic situation and future market forecasts, stock price evaluation and the company's financial statements before deciding to invest.

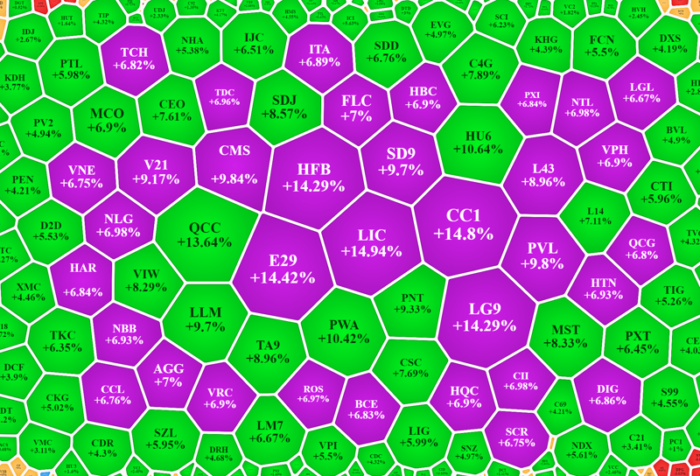

4. List of midcap stocks 2024

>>> See more articles: FIND OUT THE TOP 10 WORLD STOCK EXCHANGES

Midcap stocks are issued by companies with average capitalization. So which companies are they? Here are midcap stock list 2024 for investors reference:

- BVS – Bao Viet Securities Corporation: BVS is one of the leading securities companies in Vietnam, providing diverse and quality financial services.

- CSV – Southern Basic Chemicals Joint Stock CompanyCSV is one of the leading chemical manufacturers and suppliers in the Southern region, with diverse and high quality products.

- CTD – Coteccons Construction Joint Stock Company: CTD is one of the leading construction companies in Vietnam, with prestige and experience in implementing large construction projects.

- DGW – Digital World Joint Stock Company: DGW is one of the leading technology retailers in Vietnam, providing the latest technology products and quality services.

- FRT – FPT Digital Retail Joint Stock Company: FRT is one of the leading digital retailers in Vietnam, with a wide network of stores and professional services.

- FTS – FPT Securities Joint Stock Company: FTS is one of the leading securities companies in Vietnam, providing quality and reputable financial services.

- GEG – Gia Lai Electricity Joint Stock Company: GEG is one of the leading companies operating in the electricity sector in Vietnam, with large projects and development potential.

- HAX – Hang Xanh Auto Service Joint Stock Company: HAX is one of the leading enterprises operating in the automobile sector in Vietnam, providing quality automobile products and services.

- HBC – Hoa Binh Construction Group Corporation: HBC is one of the leading construction corporations in Vietnam, participating in many important and prestigious projects in the industry.

- HPX – Hai Phat Investment Joint Stock Company: HPX is one of the leading multi-industry investment companies in Vietnam, operating in many fields and has high development potential.

- NAF – Nafoods Group Joint Stock Company: NAF is one of the leading food manufacturing and processing enterprises in Vietnam, with quality products and prestigious brands.

- PAN – Pan Group Corporation: PAN is one of the corporations operating in many business fields, from real estate to manufacturing and services, with the mission of sustainable development.

- SKG – Superdong High Speed Boat Joint Stock Company – Kien Giang: SKG is one of the leading companies operating in the field of maritime transport in Vietnam, providing quality transportation services.

- TIP – Tin Nghia Industrial Park Development JSC: TIP is one of the leading industrial park development companies in Vietnam, providing land and factory services to businesses.

- VSC – Vietnam Container Corporation: VSC is one of the leading container manufacturing enterprises in Vietnam, providing quality and diverse products to domestic and foreign markets.

These companies all have growth potential and significant influence in the Vietnamese stock market.

List of midcap stocks on the Vietnamese stock market.

5. What should you pay attention to when investing in Midcap stocks?

When invest in midcap stocks, there are a few things you need to consider:

– Higher risk: Midcap stocks usually carry a higher level of risk than blue-chip stocks. Therefore, consider carefully before deciding to invest.

– Choose a stable company: Choose companies with higher stability and profitability by referring to the financial statements and business operations of the enterprise.

– Correlation assessment: Refer to the current economic situation and future forecasts, as well as indicators such as P/B, P/E to evaluate the correlation of the stock code with businesses in the same industry.

– Psychological control: Keep a stable mentality and do not let emotions affect your trading decisions. Avoid playing based on crowd psychology to avoid losses.

– Diversify your portfolio: Don't put everything in one basket. Diversify your portfolio by choosing between Midcap, Penny and Large cap stocks.

– Periodic check: Regularly check your Midcap stock portfolio. If the stock is slowing down, consider cutting your profits and looking for other investment opportunities.

The stock market offers many profitable opportunities, but it also comes with many risks. Therefore, it is important to accumulate knowledge before investing. buy stock Investment is extremely important.

Source: Onstocks