This is one of the largest foreign funds in the Vietnamese stock market with assets under management at the end of April reaching VND20,000 billion.

After many fluctuations, the stock market in May still achieved a growth rate of over 4%. The focus last month was on businesses with their own stories, especially the rapid growth of technology stocks. The breakthrough helped not only individual investors but also large funds in the market to reap good results and Pyn Elite Fund was no exception.

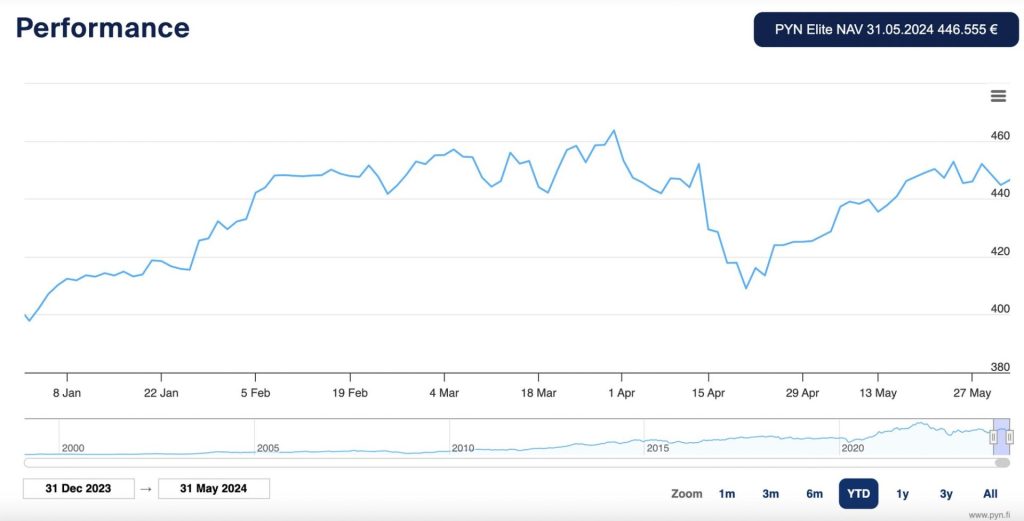

According to newly updated data, the investment performance of the foreign fund from Finland reached 4,96% in May, more positive than the increase of VN-Index. This is also the month Pyn Elite Fund recorded positive performance again after the previous April was more negative than 8%.

Accumulated from the beginning of 2024 to the end of May, foreign funds achieved a performance of 11,09%, equivalent to the growth of the general market.

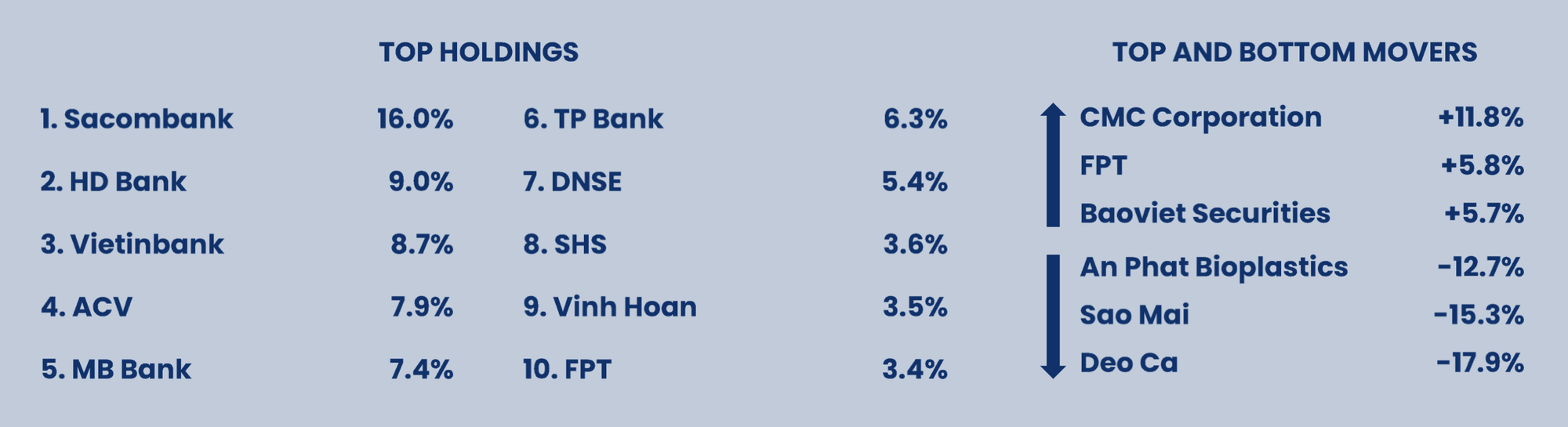

This result partly comes from the sharp increase in FPT's market price in April, but it does not rule out the possibility that Pyn Elite Fund has bought more. In case of buying more, the fund may have to accept a difference (premium) of about 7% compared to the market price because this stock is often full of room.

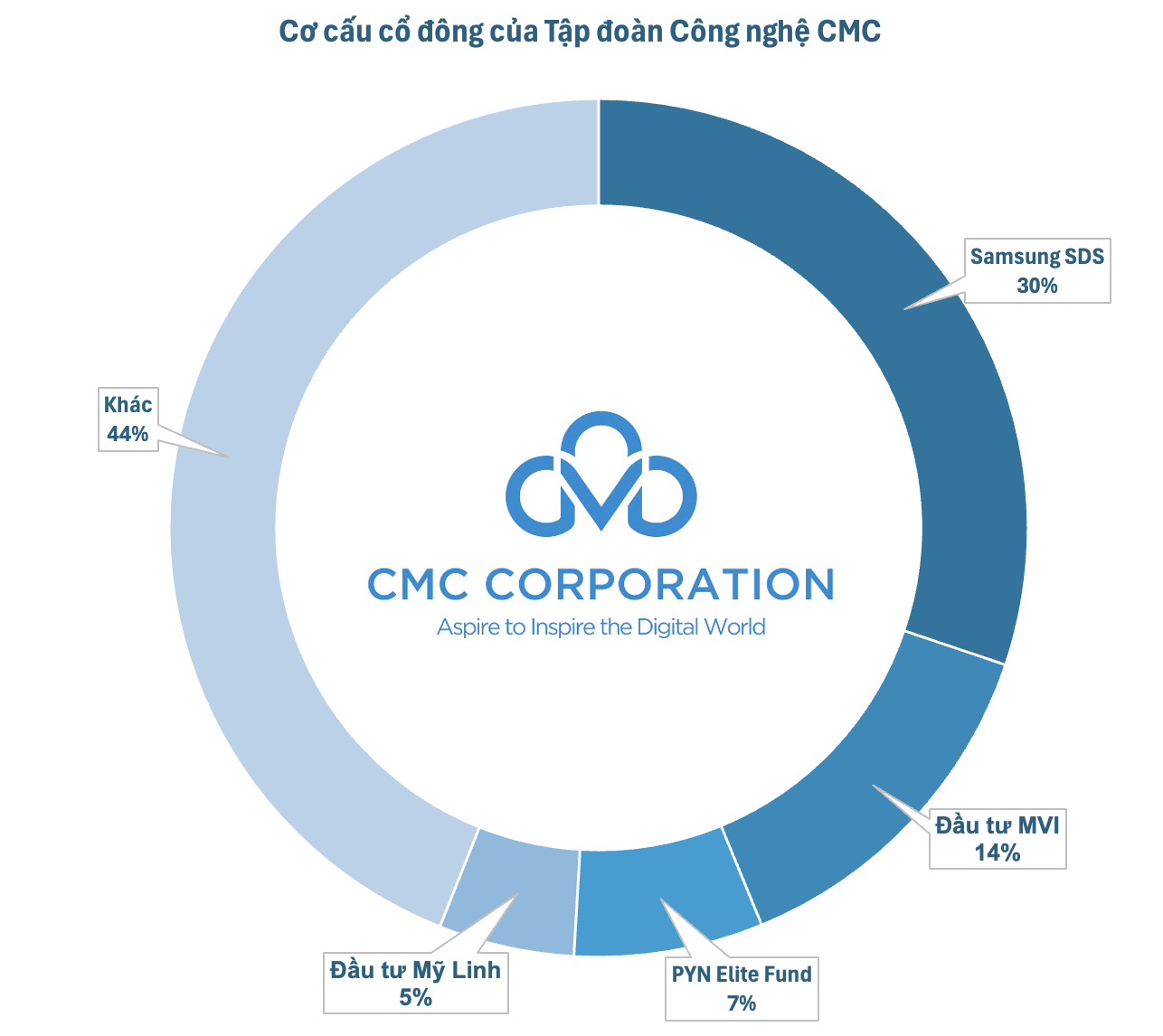

In addition to FPT, Pyn Elite Fund also invested heavily in another Vietnamese technology stock, CMC Corp (code CMG). The foreign fund from Finland is currently the third largest shareholder in this group with a capital ratio of 7%, only after Samsung SDS and MVI Investment. CMG is also the best performing stock in the fund's portfolio in April 2024 and shows no signs of stopping.

As of May 10, 2024, FPT is no longer in the top 10 portfolio, on the contrary, CMG has risen to the top 8 portfolio of Pyn Elite Fund with a weight of 4.1%.

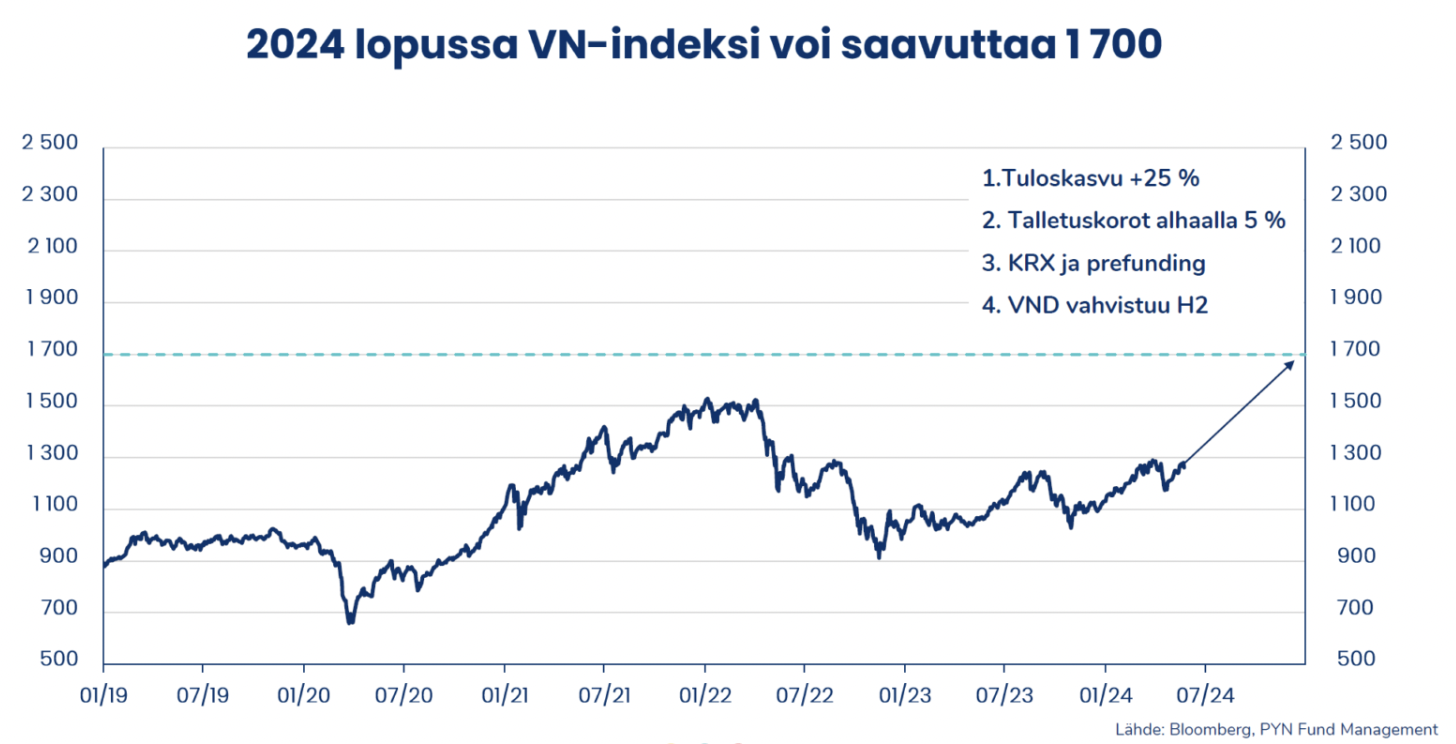

Holding many stocks with positive trends helps Pyn Elite Fund feel confident even though the investment performance last month was not as expected. In a recent letter to investors, the head of the fund, Petri Deryng, expressed his expectation for a better and clearer recovery in business results for listed companies in 2024. Interest rates are expected to remain at a moderate level. As the year ends, the USD may begin to weaken, in which case the VND may strengthen and have a positive impact on stock market sentiment.

According to Mr. Petri Deryng, one of the stories that could have a strong impact on the Vietnamese stock market in the near future is the launch of the new trading system KRX, which involves intraday trading and short selling.

The VN-Index target is forecast by experts and securities companies at a moderate level around 1,400-1,500 points. However, Mr. Petri Deryng believes that the 1,700 point level can be achieved by the end of 2024.

Source: CafeF