VIMC shares have increased by 150% since the beginning of June while Viettel Global is one of the "hottest" names on the Vietnamese stock market since the beginning of the year with an increase of 310%.

The Vietnamese stock market has recently witnessed many stocks "rising like rockets". Among them, the two "giants" on the UPCoM floor are Viettel Global Investment Corporation (Viettel Global – code VGI) and Vietnam National Shipping Lines (VIMC – code MVN) is making a very strong impression.

Since the beginning of June, MVN shares have increased by 150%, climbing to 48,000 VND/share. VIMC's market capitalization has also increased by nearly 35,000 billion (~1.5 billion USD) in less than 3 weeks, to nearly 57,500 billion VND (~2.5 billion USD), the highest in the port and shipping industry. This figure is only slightly lower than the record level this enterprise achieved in August 2021.

Meanwhile, VGI is one of the stocks with the strongest growth on the stock exchange since the beginning of the year with 310%. This stock is currently at 105,900 VND/share, the highest since its listing in September 2018. Viettel Global's capitalization has also set a record of nearly 322,000 billion VND (~13.5 billion USD), an increase of nearly 250,000 billion (~10 billion USD) in less than half a year.

This figure puts Viettel Global ahead of Vingroup, Vinhomes, Hoa Phat, FPT, Vinamilk and a series of banks such as BIDV, VietinBank, Techcombank, VPBank in the list of the most valuable names on the stock exchange, only behind Vietcombank. The capitalization of this telecommunications and technology "giant" has approximated the total value of all more than 300 enterprises listed on HNX.

A rather coincidental point between VGI and MVN is that both stocks were listed on the stock exchange in 2018, VGI on September 25 and MVN on October 8. These two stocks were listed in the wave of State-owned enterprises (SOEs) equitizing and trading on UPCoM after Circular 180/2015/TT-BTC (Circular 180) was issued.

The story of eliminating accumulated losses, a special common point between the two "giants"

In addition to being listed on the stock exchange in 2018, Viettel Global and VIMC are actually two businesses with many differences in scale, field of operation, market, etc. However, the recent increase in the two stocks VGI and MVN has been unexpectedly supported by a special common point, which is the story of eliminating accumulated losses.

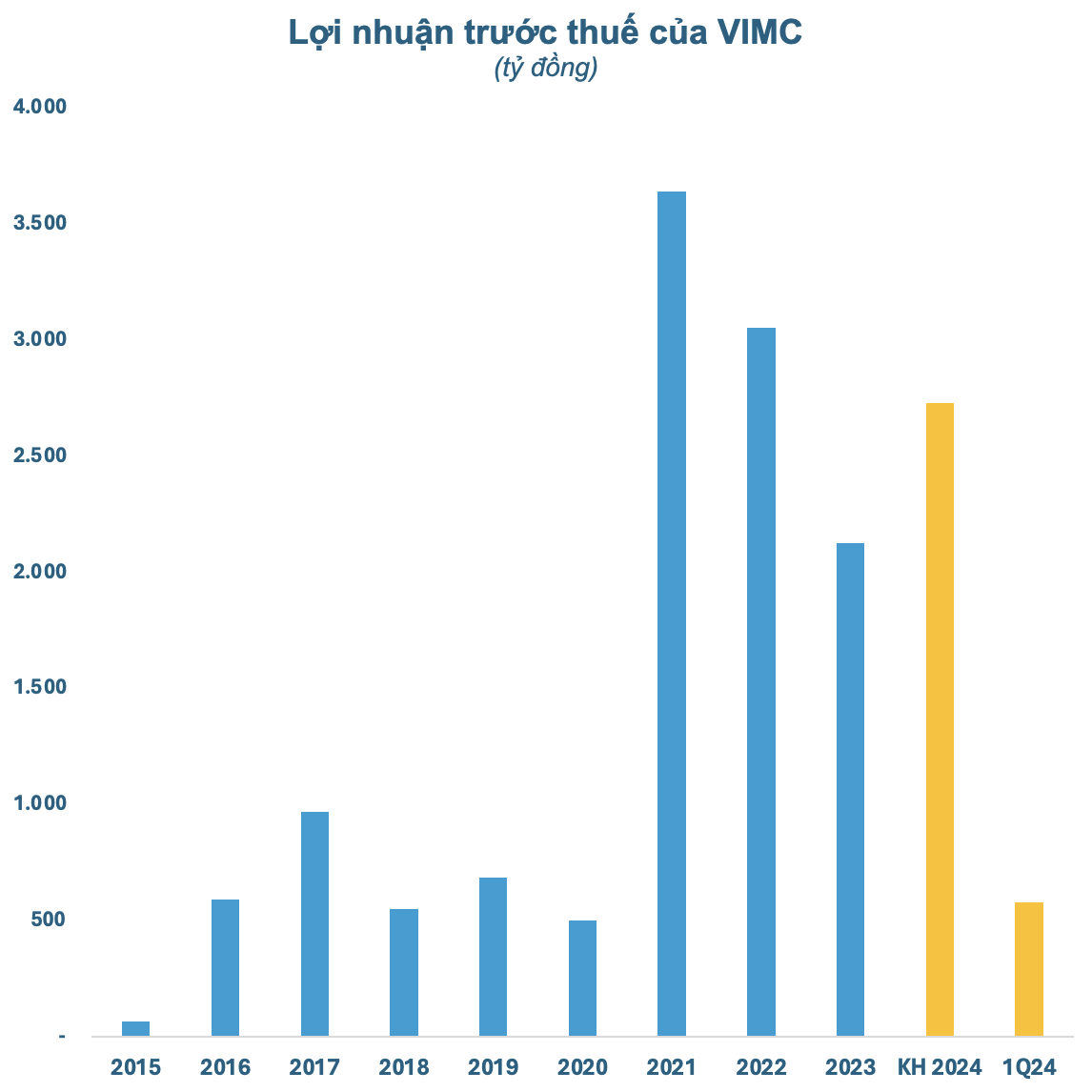

In the past, VIMC (formerly known as Vinalines) had many years of ineffective business operations leading to accumulated losses of thousands of billions of VND. However, the situation has changed positively, especially in the period 2021-2023, this enterprise earned thousands of billions of VND in profits each year, thereby significantly narrowing the accumulated losses.

In the first quarter of 2024, VIMC recorded revenue of VND 3,596 billion and pre-tax profit of VND 576 billion, up 26% and 19% respectively compared to the same period in 2023. Profit after tax was VND 479 billion, up 21% compared to the first quarter of 2023, of which net profit attributable to parent company shareholders reached more than VND 342 billion. This result helped VIMC officially erase accumulated losses after many years.

In 2024, VIMC targets consolidated revenue of VND 13,450 billion and pre-tax profit of VND 2,730 billion, respectively increasing by 51% and 281% compared to 2023. With the results achieved after the first quarter of the year, the leading enterprise in the port and shipping industry has achieved 261% of its revenue plan and 211% of its profit target for the whole year.

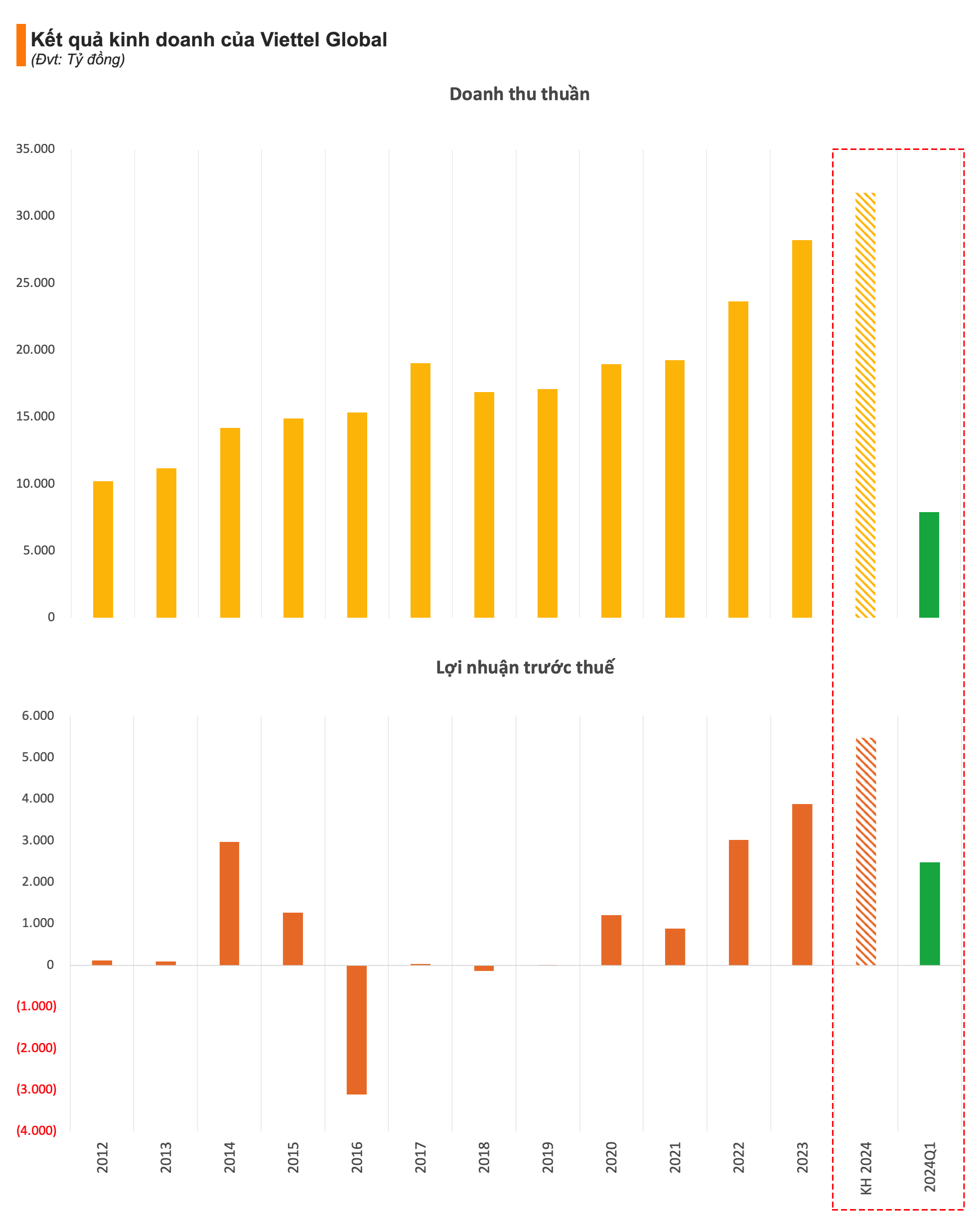

Similarly, Viettel Global is also nearing its goal of eliminating accumulated losses after many years of thriving business. In the first quarter of 2024, the corporation recorded revenue of VND 7,907 billion, an increase of VND 221 billion over the same period last year. Viettel Global's consolidated profit after tax reached VND 1,633 billion, an increase of VND 1,751 billion over the same period in 2023 and the highest level since the third quarter of 2022.

As of the end of the first quarter of 2024, Viettel Global still had an accumulated loss of nearly VND2,100 billion. However, the corporation's board of directors said that with the current growth momentum, Viettel Global will try its best to handle it and if no major risks arise, it is expected that the accumulated loss will end in 2025. At that time, Viettel Global will be able to calculate the dividend payment plan.

In 2024, Viettel Global aims to have 2 million more telecommunications subscribers and 6 million digital subscribers. Accordingly, the corporation plans to achieve total consolidated revenue in 2024 of VND 31,746 billion (equivalent to 2023), consolidated pre-tax profit of VND 5,477 billion, an increase of 41.2% compared to 2023.

Fascinating personal stories

VIMC is the largest fleet owner in the country and plays an important role in the economic transport. VIMC's fleet currently accounts for 251 TP3T of the total fleet capacity in the country, including large bulk carriers up to 73,000 DWT, annually transporting 601 TP3T of import and export goods to Vietnam, contributing to the expansion of Vietnam's trade to many countries and territories.

The Corporation currently has 34 member enterprises, of which it owns shares in 16 seaport enterprises, managing and operating more than 13,000 m of wharfs (accounting for about 30% of the total national wharfs). Some of the key ports in the country include Hai Phong port, Saigon port, Da Nang port and Quy Nhon port.

The stock’s rise is also supported by soaring container freight rates, as seen during the Covid era. According to experts, freight rates may continue to rise as the conflict in the Red Sea shows no signs of abating, demand for goods recovers, and a shortage of containers at major export ports puts strong pressure on freight rates as the peak season approaches. The high anchoring of freight rates is expected to have a positive impact on shipping companies.

In addition, eliminating all accumulated losses is also a premise for VIMC to implement the charter capital increase plan approved by the 2024 Annual General Meeting of Shareholders. According to the policy, the State's share ownership ratio at VIMC will be reduced to 65% of charter capital. VIMC's Board of Directors said that the goal of issuing shares to increase capital this time will give priority to existing shareholders, issuing to partners specializing in container transportation to cooperate in developing this special type of freight transport.

Meanwhile, Viettel Global was established in 2007, with the mission of making Viettel a strong international telecommunications group. Recently, Movitel - a brand of Viettel Global has risen to the top 1 in Mozambique, helping the company have 7 out of 10 telecommunications brands with the leading market share in the host countries, including: Movitel (Mozambique), Lumitel (Burundi), Telemor (East Timor), Metfone (Cambodia), Mytel (Myanmar), Unitel (Laos) and Natcom (Haiti).

In a recent analysis report, ABS Securities assessed that with the advantage of having 7/10 market companies ranking top 1 in market share in the mobile segment, Viettel Global will continue to affirm its position in the world market and other developing countries. However, traditional telecommunications services have gradually become saturated and the level of telecommunications penetration in many countries is starting to reach its threshold.

Therefore, implementing Viettel Global's new investment strategy of gradually shifting to digital services for corporate customers, digital services for technology customers and e-finance will be a move to help the corporation improve its position and continue to develop effective business operations in the context of fierce competition in the world's telecommunications industry.

Source: CafeF