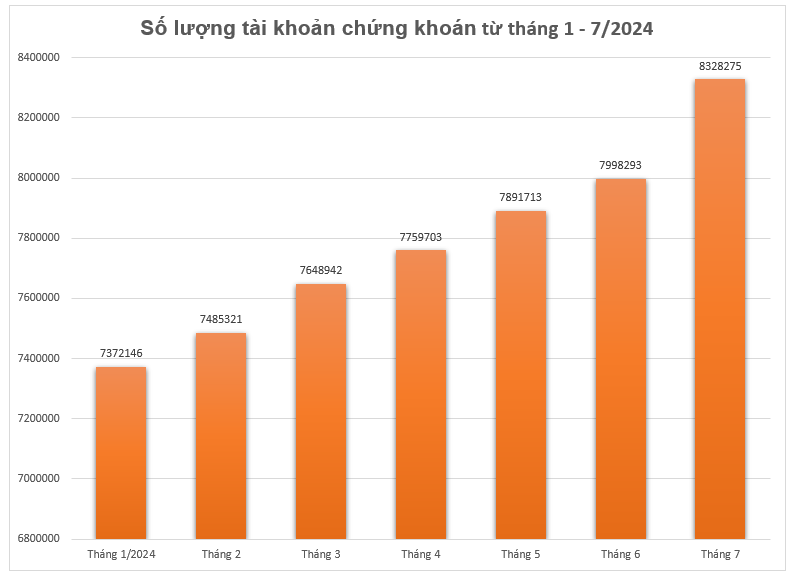

The number of domestic securities accounts has increased by nearly 1.1 million accounts.

The number of securities accounts on the Vietnamese stock market suddenly increased sharply, 3 times compared to last June.

Vietnam Securities Depository Corporation (VSDC) has just announced data related to the number of securities accounts in the domestic market.

Accordingly, by the end of July, the number of domestic individual securities trading accounts reached 8.31 million units (approximately 8.31 million/100,000 population). This figure is 329,982 accounts higher than at the end of June.

This increase is 3 times higher than June (an increase of 106,417 accounts). This is also the highest level in 2 years of the Vietnamese stock market.

Last July was also the month with the third highest number of securities accounts in Vietnam in history, after the period of May - June 2022.

In the first 7 months of the year, the number of domestic individual accounts increased by 1.08 million accounts, 92% higher than the same period last year. On average, the market increased by about 154,000 domestic individual trading accounts per month.

The increase in the number of securities accounts in July still mainly came from individual investors with 329,836 accounts. Meanwhile, the number of institutional investors increased by only 146 accounts.

It is worth mentioning that the number of accounts increased sharply while the stock market was quite gloomy at this time, with many sessions evaporating dozens of points.

A recent strategic report by SSI Securities shows that the average liquidity on the HoSE floor in July reached approximately VND17,000 billion/session, 27% lower than in June. July is the month with the lowest transactions since the beginning of the year, second only to January.

In the first 7 months of the year, the average liquidity of HoSE floor narrowed to 21,000 billion VND per session. This securities company further analyzed that the medium-term support zone of 1,145 - 1,155 for Vn-Index is expected to create balance.

Sharing the same view, Mr. Phan Dung Khanh, Investment Consulting Director - Maybank Securities Company said: "The pressure from the rising deposit interest rates, the soaring gold price and the record outstanding loans of securities companies... are also factors affecting the VN-Index.

Currently, the 1,180 - 1,200 point zone is the market's medium-term support zone."

Although there were many new risk factors in August, according to SSI, some positive factors may have been overlooked due to psychological factors such as: Exchange rate risks gradually decreasing; Positive quarterly profit recovery trend and market valuations will return to more attractive levels as prices continue to adjust.

“According to our estimates, most stock groups have 1-year estimated valuations lower than the 5-year average,” SSI analyzed.

Regarding investment strategy, SSI recommends that investors should look for opportunities in industries/stocks that still have room to expand valuation and have factors that benefit from economic recovery in the second half of the year (Consumer goods, Ports - maritime transport).

“Excessive volatility due to sentiment factors will also create good opportunities for groups of stocks with a history of paying stable cash dividends, as well as groups of stocks with strong balance sheets. The strategy recommends “Accumulating in parts when prices fall sharply,” the company emphasized.

Source: CafeF