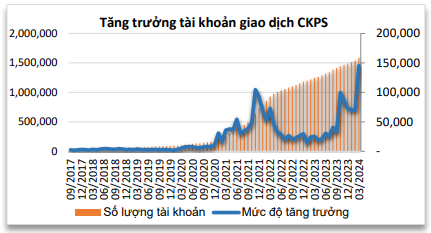

Regarding the structure of investors in the derivatives market, HNX statistics show that the number of trading accounts opened on the derivatives market increased steadily from 2017 to 2020, starting to increase sharply from the beginning of the year and reaching the highest growth around the end of 2021.

The Hanoi Stock Exchange (HNX) has just released the Vietnam derivatives market bulletin for the second quarter of 2024. According to FIA data, the total trading volume of derivatives worldwide reached 17.99 billion contracts in May, the highest level ever recorded. This figure increased by 18.5% compared to April 2024 and increased by 76.2% compared to May 2023.

Global options trading volume reached 15.44 billion contracts in May, up more than 100% year-on-year, with the majority of trading in the Asia-Pacific region. Global futures trading volume reached 2.55 billion contracts in May, up 1.7% year-on-year. Open interest at the end of May 2024 was 1.38 billion contracts. Total trading volume in May 2024 increased 4% compared to April and increased 11.7% year-on-year.

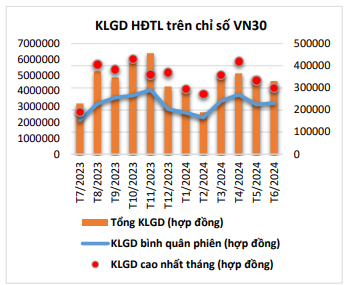

In the second quarter of 2024, the Vietnamese derivatives market traded in sync with the underlying stock market in terms of price fluctuations, with active trading as the total trading volume and average trading volume increased compared to the first quarter of 2024, respectively 24% in total trading volume and 20,02% in average trading volume. The total trading volume of the whole market reached more than 14.69 million contracts, the average trading volume reached 240 thousand contracts/session.

Regarding VN30 index futures, there were a total of 61 trading sessions in the quarter. The highest trading volume in the second quarter reached 420 thousand contracts on April 16, 2024.

Regarding the structure of investors in the derivatives market, HNX statistics show that the number of trading accounts opened on the derivatives market increased steadily from 2017 to 2020, starting to increase sharply from the beginning of the year and reaching the highest growth rate around the end of 2021. After that, the account growth rate decreased sharply until the middle of the second quarter of 2022, maintaining a relatively low and stable growth rate until the end of the third quarter of 2023. From the fourth quarter of 2023, the number of newly opened accounts increased rapidly again, reaching nearly 1.7 million by the end of the second quarter of 2024.

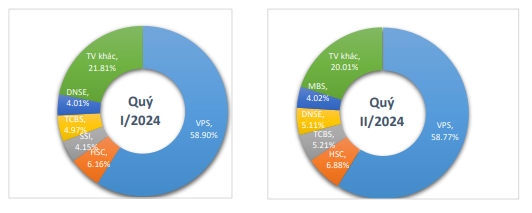

As of June 30, 2024, the Vietnamese derivatives market has 24 member securities companies. In the second quarter of 2024, the top 5 brokerage market shares in the derivatives market include VPS, HSC, TCBS, DNSE, MBS. In particular, DNSE is a prominent name when it rose to the top 4 brokerage market shares of HNX derivatives (accounting for a market share of 5,11%), just over a year after launching the Future X derivatives trading product.

Since its launch, Future X has received the attention of investors with its effective features that help investors not miss any opportunities in the derivatives market. Not only does it have an intuitive interface, easy to deposit, withdraw deposits, and place orders quickly, Future X also helps investors optimize profits thanks to the lowest contract opening deposit rate in the market, only 18,48%.

This digital securities company is also promoting derivative products through many activities, including the "Derivatives Arena" competition that attracted up to 5,000 registrants. Currently, DNSE is organizing the "Open Derivatives Arena" taking place for 12 weeks, from July 1 to September 30. With just a derivatives trading account on the Entrade X platform, investors have the opportunity to participate in the competition to "win" a series of attractive prizes with a total value of up to nearly 200 million VND.

Source: CafeF