Tesla (TSLA) has just announced its Q2/2025 business results with a mixed financial picture: revenue dropped sharply, but the value of its Bitcoin portfolio skyrocketed, providing an unexpected bright spot in the context of a challenging global electric vehicle market.

Sharp drop in revenue – Big challenge for electric vehicle segment

According to the financial report, Tesla's second quarter 2025 revenue decreased by 12% compared to the same period last year, reaching only 22.5 billion USD - the largest decrease in 10 years.

- Vehicle deliveries: down 12.6%, to 143,535 units.

- Earnings per share (EPS): down 23%, to $0.40.

- Core electric vehicle revenue: down 16%, to only 16.66 billion USD.

Tesla's electric vehicle market share also continued to shrink, falling to 46.2%, while rival General Motors (GM) increased sharply from 10.8% to 14.9% in just one quarter.

However, Tesla's revenue and EPS were still close to market expectations ($22.5 billion vs. $22.3 billion forecast; EPS $0.40 in line with forecast). TSLA shares rose slightly by 0.71% in after-hours trading, trading around $331.56/share.

Bitcoin – Unexpected bright spot thanks to new accounting standards

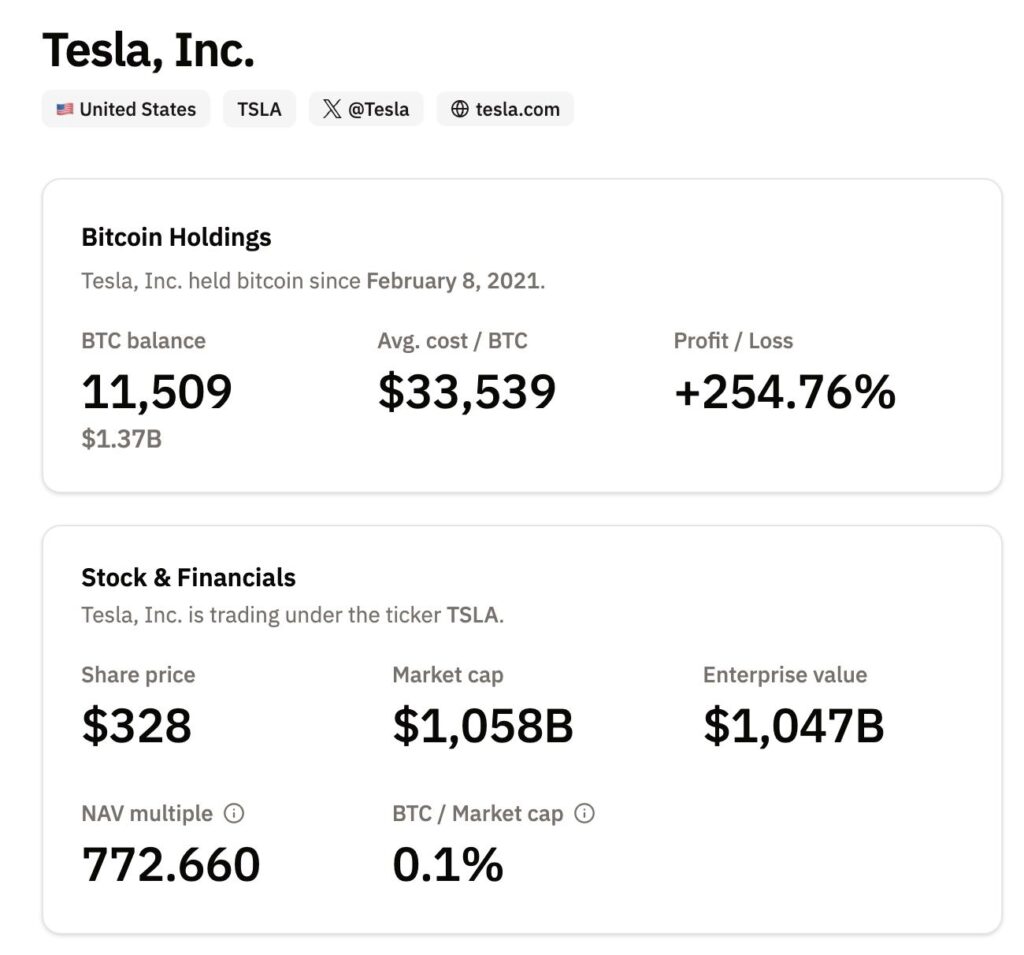

One of the most notable bright spots is Tesla’s Bitcoin portfolio. According to BitcoinTreasuries.net, the company currently holds 11,509 BTC, ranking 10th globally on the list of the largest public companies owning Bitcoin.

With Bitcoin currently priced at around $119,000/BTC (up from $83,000/BTC in early April), the total value of this portfolio has increased by around 30% in Q2, equivalent to $1.2 – $1.36 billion.

This growth is attributed to a major change in accounting regulations by the US Financial Accounting Standards Board (FASB). From the first quarter of 2025, companies will be allowed to account for digital assets at quarterly market value, instead of at the lowest historical cost as before.

This allows unrealized gains from Bitcoin to be more clearly recognized on financial statements, providing shareholders with a more realistic view of the performance of the digital asset.

Strategic Lesson: Flexible Finance in Volatile Times

Despite the difficulties in the electric vehicle segment, Tesla's strategy of investing in digital assets has partly offset the revenue pressure, while demonstrating the company's long-term vision in diversifying its asset portfolio.

This is also the modern financial trend that HVA Group has always emphasized in recent market analysis reports. With experience in researching and consulting on digital asset investment strategies, HVA Group believes that integrating digital assets such as Bitcoin into a corporate financial portfolio not only brings short-term value but is also a strategic step to preserve and increase capital value in the long term.

Conclude

Tesla is facing many challenges in its core business, but its strategic investment in Bitcoin shows that a flexible approach to finance can yield significant benefits amid volatility.

HVA Group believes that in the future, the application of digital assets to corporate financial strategies will become an important part for global corporations to maintain competitive advantages and increase shareholder value.