Technical signals show that the stock market still has upward momentum in June, but it is difficult to have a breakthrough and it is necessary to be cautious in preparing for "pullback" waves appearing after a significant recovery and the 1,260 point area is the short-term support level for the index.

In a recent report, SSI Research stated that the stock market continued its recovery throughout May and is currently slowing down as it approaches the strong resistance level of 1,285-1,292. Thanks to the push from individual cash flow and strong bottom-fishing force, the overall picture of the market has a bright but differentiated tone throughout May. The highlight is the cash flow trend towards the low-mid-cap group with some groups of stocks in the IT, Retail, Steel, Energy, and Finance sectors recovering strongly and even surpassing historical peaks.

Technical signals show that the market still has upward momentum in June, but it is difficult to break out and it is necessary to be cautious in preparing for "pullback" phases appearing after a significant recovery and the 1,260 point area is the short-term support level for the index.

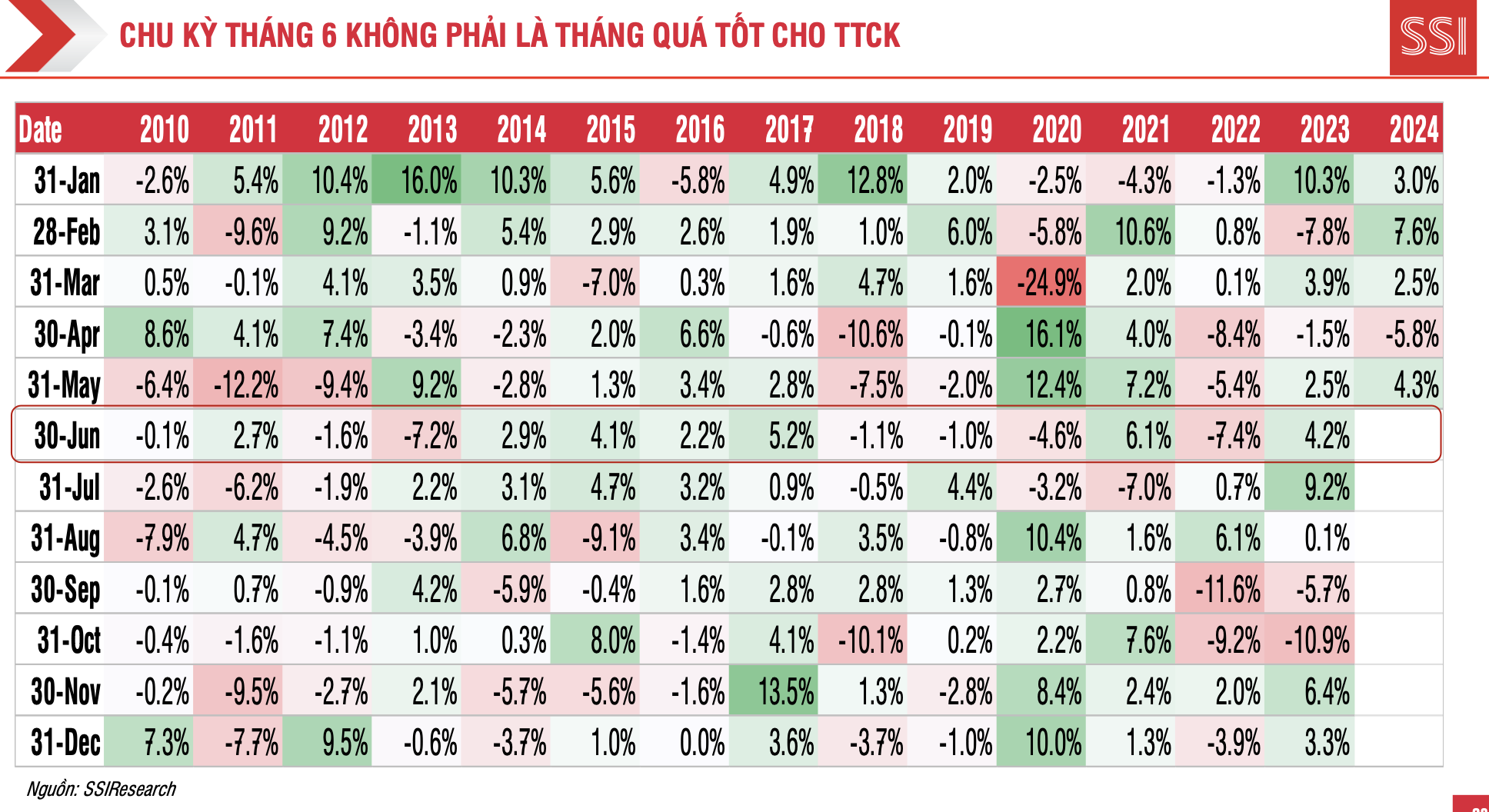

In addition, the stock market has just gone through a period of strong fluctuations from adjustment to recovery and needs time to consolidate supply and demand above the old peak. In particular, according to SSI Research statistics from 2010 to now, June is not a really positive month for the stock market, especially in the context that the VN-Index has recovered nearly 10%.

SSI Research believes that profit-taking to preserve profits and lower debt ratios towards the end of Q2 may make it difficult for the market to break out in the short term. In the short term, opportunities will come from expectations for Q2 business results or information related to the Circular allowing securities companies to implement payment support for institutional investors.

After highlighting the timing of stock selection last month, the team of analysts said that taking advantage of high price zones to preserve portfolio performance is a strategy that can be suitable in the current market context.

On the buying side, diversifying the portfolio by industry can help investors proactively anticipate the continuously rotating cash flow and limit risks. The proportion of stocks continues to be maintained at a balanced level, only buying during corrections and the selection should focus on stocks with high and stable growth potential.

Many industry groups will recover in turn on the basis of last year's very low comparison. According to SSI Research's estimates, stocks with solid business growth in the Retail, Fertilizer, Steel-Galvanized Steel, Securities and Export sectors will have the most opportunities in 2024. Meanwhile, the market's attention has also expanded to some industry groups with almost flat valuations since the beginning of 2023, such as the Food and Beverage and Utilities (Electricity) groups and stocks expected to pay high dividends.

Looking at the medium- and long-term prospects of the stock market, the analysis team still has a positive assessment when looking at the big picture. Maintaining a flexible monetary policy and an expansionary fiscal policy in 2024 will help production, trade, investment and consumption activities recover in turn. Therefore, the expectation of the business results of listed companies returning to the growth trajectory is one of the main drivers for the Vietnamese stock market in Q2 and the second half of 2024.

In addition, the measures to resolve the problems in upgrading to emerging markets of FTSE Russel will be more specific, which is also an important factor for the stock market. The second half of the year is also the time when investors begin to set expectations for 2025 and there are grounds to believe that there will be better recoveries in the world economy and Vietnam, while risk factors will also be more clearly present and may have a lighter impact on the market.

Source: CafeF