Selling pressure increased in the afternoon session, causing the VN-Index to gradually narrow its upward momentum. In addition, there was also restructuring activity of ETFs (exchange-traded funds). The shake-up occurred in the last session of the week.

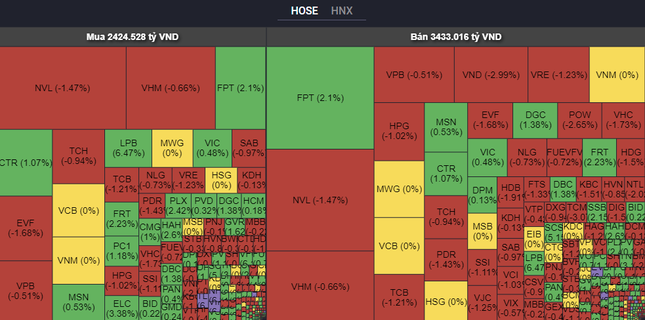

The main index weakened and fell below the reference. HPG, HDB, VHM, VCB, ACB… were the stocks that had the most negative impact. The sellers dominated with 234 stocks falling in price, outnumbering the number of stocks increasing. Cash flow was significantly more cautious than yesterday, needing to confirm the trend in the next few sessions.

Leading sectors with a large impact on the market such as banking, real estate, securities, etc. all adjusted. Except for LPB, the banking group was relatively gloomy. Bright spots continued to come from technology stocks, with FPT at the center. FPT shares increased by 2.1% despite strong net selling by foreign investors.

Stock groups are differentiated in the context that high liquidity codes such as VND, VIX, SSI... all decreased in price.

MSCI (US) has announced its regular market classification results. MSCI has not yet added Vietnam to the list of countries to be considered for upgrading from a frontier market to an emerging market. However, MSCI assessed that the Vietnamese market has made some progress, improving its transferability thanks to increased off-exchange transactions and physical transfers without prior approval from the regulatory agency.

The rare bright spot of the session came from steel stocks, when TLH, SMC, and TVN all hit the ceiling. The shipping group continued to increase amid skyrocketing global container shipping prices. MVN and VIP hit the ceiling. HAH, VSC, GMD, and VOS were all in the green.

At the end of the trading session, VN-Index decreased by 0.28 points (0.02%) to 1,282.02 points. HNX-Index increased by 0.4 points (0.16%) to 244.36 points. UPCoM-Index increased by 1.31 points (1.32%) to 100.58 points.

Liquidity decreased with HoSE matching value of more than 18,700 billion VND. Foreign investors net sold more than 1,000 billion VND, focusing on FPT, VND, VRE, HPG, POW...

Source: CafeF