Staking temporarily escapes the "ghost" of stocks thanks to the Howey test

For years, the crypto market in the United States has been plagued by regulatory ambiguity. In particular, staking has been under the knife of “security,” leaving both investors and blockchain companies wondering whether to continue, regulate, or stop.

However, a major turning point occurred on May 29, 2025, when the US Securities and Exchange Commission (SEC)'s Division of Corporate Finance officially published a groundbreaking guidance document: some staking activities on Proof-of-Stake (PoS) networks will not be considered securities transactions.

“This is the transparency that American users and staking providers deserve,” said SEC Commissioner Hester Peirce. “Providing security for a protocol is not a security.”

SEC Exonerates Staking: Technical Analysis from the Howey Test

The SEC relies on the Howey test – a long-standing legal standard for assessing whether a transaction is a securities offering. In the context of staking, the key factor is: do the profits from staking depend on the business/management efforts of others?

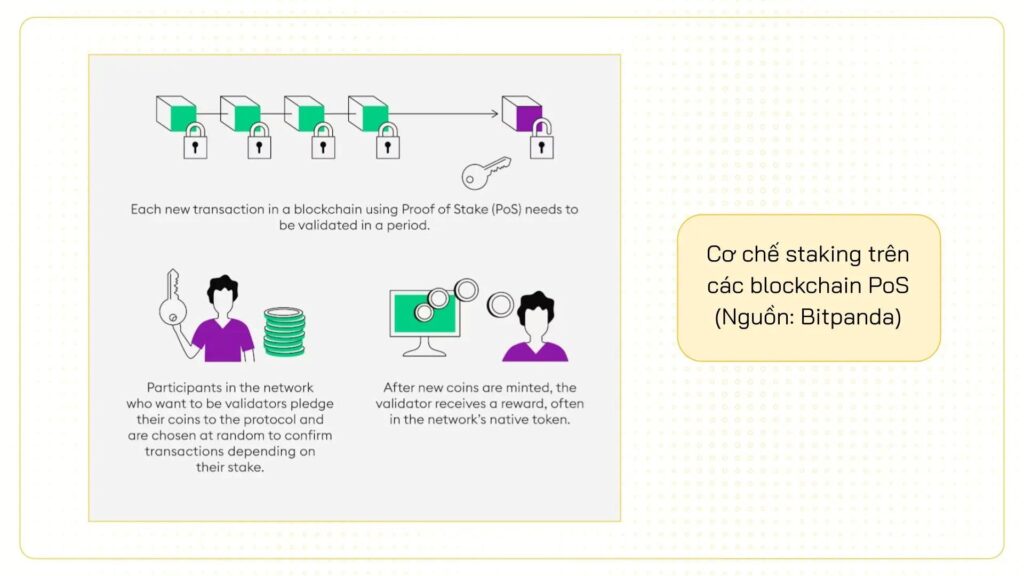

The paper analyzed three popular forms of staking:

- Self-staking: Users operate nodes themselves and stake assets with their own efforts. This is a “network service” activity and the rewards received are a reward for technical effort, not a passive investment.

- Non-custodial Staking: Users stake through a third party that provides technical support but retains custody of the assets. Since the service is only administrative, it is not considered a securities activity.

- Custodial staking: Users entrust assets to an organization to stake on their behalf, but if that organization does not use the assets for business or investment purposes, it is not considered an asset manager.

The SEC further clarified that ancillary services such as insurance slashing, asset pooling, early withdrawal, etc. also does not make staking a securities transaction.

From Confrontation to Cooperation: SEC “Rekindles Old Love” with Crypto Industry

More than just a legal document, this document is also considered a policy turning point, marking a major change in the SEC’s stance. Previously, the SEC had sued staking platforms such as Kraken, Coinbase, and MetaMask for “issuing unregistered securities”.

But by early 2025, the SEC had withdrawn its lawsuit, and the May 29 letter formalized the new direction: staking is not a security by default.

“The document paves the way for direct staking in ETP funds, or even staking through third parties,” said Rebecca Rettig, chief legal officer at Jito Labs.

As a result, investors are expecting a wave of staking-enabled ETFs to emerge. Europe has led the way, with 21Shares’ Ethereum and Solana staking ETPs reaching hundreds of millions of dollars in size. In the US, more than 70 crypto ETF applications are pending, and the SEC is likely to greenlight more after the guidance.

There is still much debate, but the direction is clear.

Despite pushback from some commissioners like Caroline Crenshaw – who called the document “fake it till you make it” – the market largely took it positively: this was the clarity crypto had been waiting for.

This is especially important for banks, exchanges, and financial service providers who want to integrate staking but are always facing legal barriers. The SEC is proactively building a friendlier environment, creating the premise for sustainable development.

HVA Group and the aspiration to lead the staking trend in Vietnam

In the context of the global gradual legalization and redefining of the role of staking, the Vietnamese market still lacks a clear legal framework or official staking products from reputable organizations. However, this is about to change.

HVA Group – a pioneering technology group investing in digital assets and in the field of blockchain and decentralized finance (DeFi) in Vietnam – is preparing to launch the first staking service exclusively for HVA investors. This will be an important breakthrough, not only helping users get closer to advanced global technologies, but also creating the foundation for future staking ETF products in the domestic market.

This event will mark an important milestone for the Vietnamese blockchain ecosystem: escaping the securities coat, transforming into the era of legal and transparent staking - where HVA Group plays a pioneering role.