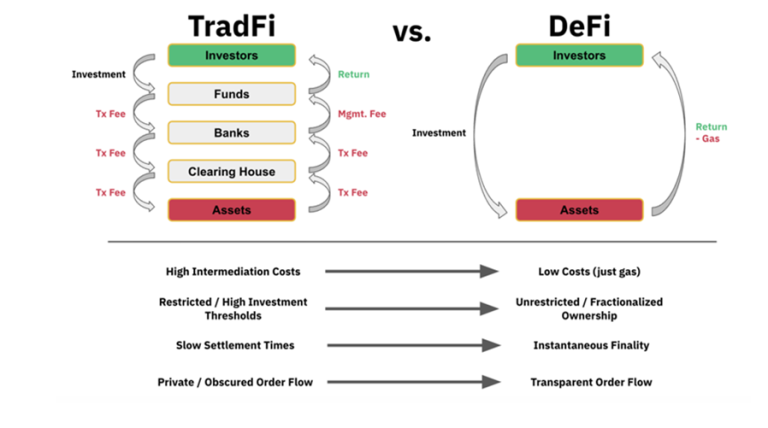

Currently, financial services must go through licensed institutions that act as intermediaries to ensure transactions are carried out. But with the rapid development of technology and real life, this is a bottleneck.

Reliance on intermediaries can lead to transactions that are time-consuming, costly, and lack transparency. Reliance on these institutions can make access to financial services difficult, as billions of people in the underbanked population remain unbanked.

The convergence of Real World Assets (RWA), blockchain technology, decentralized finance (DeFi) and traditional finance (TraFi) has significantly evolved the global financial business environment.

Decentralized Finance (DeFi) has reduced dependence on intermediary institutions, democratizing access to financial services.

DeFi leverages blockchain technology, with its immutable public ledger, distributed software applications, cryptocurrencies, digital assets, and smart contracts that have enabled people to use financial services without the need for financial institutions as intermediaries.

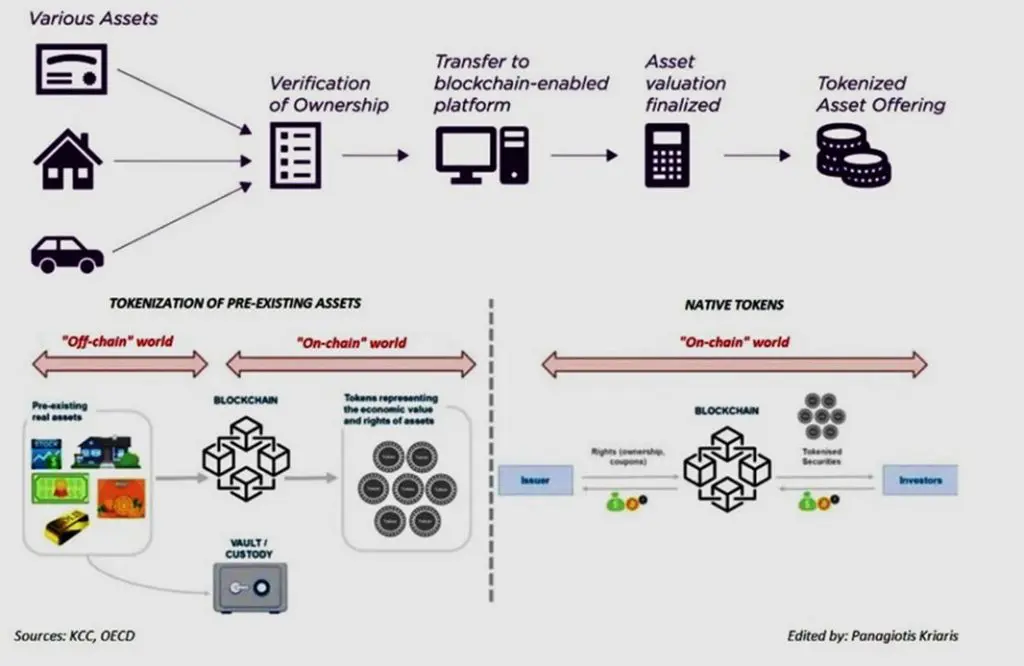

Real World Assets (RWA) include real estate, commodities, machinery, intellectual property, securities and unmarketed financial instruments.

By tokenizing these illiquid assets, investors with small capital can transparently access high-value assets that were previously out of reach. Additionally, these assets are traded on digital exchanges, opening up new avenues for cross-border access and investment.

Challenges for regulators

Many financial regulators around the world are also actively involved in developing regulatory frameworks specifically designed to govern decentralized finance (DeFi) and the tokenization of real-world assets (RWAs).

These frameworks are carefully designed to address a range of concerns and consider relevant issues, focusing primarily on investor protection, implementing secure custody solutions, enforcing strict compliance measures and protecting the integrity of financial markets in general.

To achieve these goals, financial regulators are working closely with stakeholders, conducting risk assessments and leveraging innovative technologies to develop standards and regulations that adapt to the dynamic nature of digital assets.

The main tasks include issuing regulations, establishing clear rules and guidelines for services related to decentralized finance DeFi, issuance, custody and trading of security tokens.

define stakeholder responsibilities, set strict compliance requirements to minimize fraud and illegal activities, and implement strong monitoring and enforcement mechanisms to maintain market integrity and investor confidence.

In addition, regulators are actively engaging in dialogue with industry stakeholders, seeking feedback and recommendations to ensure that regulatory frameworks strike the right balance between promoting innovation and measuring potential risks.

Institutional investors, including pension funds, asset managers, and hedge funds, are increasingly recognizing the potential benefits of DeFi decentralized financial services as well as tokenizing real assets RWA as a strategic tool to optimize their portfolios for private investments that they do not want to publicize.

Additionally, adopting RWA tokens with DeFi can streamline payment processes, reduce transaction costs, and improve operational efficiency for institutional investors.

Opportunities and trends

To gain a competitive advantage over their rivals, traditional financial institutions (TraFi) are developing their own or partnering with technology partners to embrace innovation and leverage emerging technologies in projects such as:

1. Integrating Blockchain Technology into Traditional Finance

Financial institutions, especially the TraFi platform, are strategically integrating blockchain technology into their operations to optimize processes, streamline workflows, and improve overall efficiency in traditional financial systems.

Upgrading to TraFi + DeFi, they reduce administrative procedures, eliminate redundant intermediaries, and automate cumbersome tasks. This approach not only reduces operating costs but also improves transparency and data integrity.

2. Facilitating cross-border payments

TraFi solutions are leveraging blockchain networks to revolutionize cross-border payments, remittances and trade finance, providing faster, more cost-effective and more accessible financial services to individuals and businesses around the world.

By harnessing the decentralized architecture and data integrity features of blockchain, the TraFi + DeFi platform enables seamless and near-instant settlement of cross-border transactions, avoiding the inefficiencies of traditional methods.

This transformative approach improves the speed and affordability of cross-border payments, while expanding financial inclusion by providing vulnerable people with reliable and affordable money transfer services.

Furthermore, TraFi + DeFi solutions empower businesses involved in international trade to streamline payment processes, mitigate currency exchange rate risks, and optimize working capital management, driving global economic growth and prosperity.

3. Tokenize real assets RWA to create liquidity and mobilize development capital

Tokenizing real-world assets RWA into digitally traded securities is a major step forward in digitization and adoption of blockchain technology in the financial sector.

Applying blockchain technology and smart contracts, cutting out intermediaries, using algorithms to ensure security, effectively preventing counterfeiting to carry out the issuance, management and trading of tokens reduces the cost of issuing securities, increases liquidity, thereby promoting the growth of market value in general.

This process will completely revolutionize the way physical assets are managed and traded, bringing many benefits and opportunities to businesses and investors.

4. Synthetic Assets Development

Integrated Assets play a pivotal role in expanding the derivatives market. The platform provides investors with access to diverse investment opportunities and risk management tools, enhances market liquidity and efficiency, and fosters innovation and accessibility in the derivatives space.

Integrated assets serve as a powerful tool for risk management, allowing investors to implement various strategies such as hedging, speculation, and portfolio diversification.

DeFi derivatives derived from an underlying value, such as stocks, currencies, bonds etc. can be created using smart contracts.

Together with the smart contract automated market maker (AMM) algorithm and liquidity pool, this integrated asset increases trading volume, ensures the efficient operation of the DeFi platform and increases passive income for investors who put tokens into liquidity pools.

5. Emphasis on regulatory compliance

Stakeholders must invest efforts to closely monitor and regulate the market to ensure transparency, fairness and stability, while addressing concerns related to leverage, counterparty risk and systemic risk.

Aims to promote market integrity, enhance trust and confidence among investors and stakeholders, and strike a balance between innovation and investor protection.

TraFi + DeFi platforms both prioritize compliance with strict anti-money laundering (AML), know your customer (KYC) and other regulatory requirements to maintain the integrity of the financial markets.

By implementing robust compliance measures and deploying sophisticated identity verification protocols, platforms mitigate financial crime risks, protect against fraudulent activities, and foster trust and confidence among regulators, financial institutions, and end users.

Through their unwavering commitment to regulatory compliance, these platforms further strengthen the legitimacy and credibility of blockchain-based financial services, paving the way for wider adoption and acceptance in the financial ecosystem.

The challenges

Despite rapid growth and innovation, DeFi + TraFi developments both face regulatory challenges related to investor protection, market manipulation, smart contract security, and compliance with existing financial regulations.

Regulators must step up to learn and regulate this dynamic landscape to ensure consumer safety, market integrity, and system stability. An effective regulatory framework is essential to mitigate risks, promote transparency, and foster responsible innovation in the DeFi + TraFi ecosystem.

Conclude

The convergence of real-world assets (RWAs), blockchain technology, decentralized finance (DeFi), and traditional finance (TraFi) holds enormous transformative potential for the future of finance.

While these trends present great opportunities for innovation and growth, they also present regulatory and operational challenges that require proactive collaboration from stakeholders, regulators and policymakers.

The intersection of RWA, blockchain, DeFi, and TraFi marks a shift in the global financial system, presenting unprecedented opportunities to enhance liquidity, efficiency, and accessibility.

However, it also poses huge challenges related to regulatory compliance, investor protection and technological advancement due to this convergence and working together to promote a safe, transparent and inclusive financial ecosystem must be a priority for all stakeholders.

Through collective action and cooperation, stakeholders can harness the full potential of this convergence and build a fairer and more resilient financial system for the future, effectively navigating the complexities of the digital economy and leveraging its potential to drive sustainable growth.

Mr. Luu Tuong Bach

Chairman of Audit Committee & Member of Board of Directors

HVA Investment Joint Stock Company