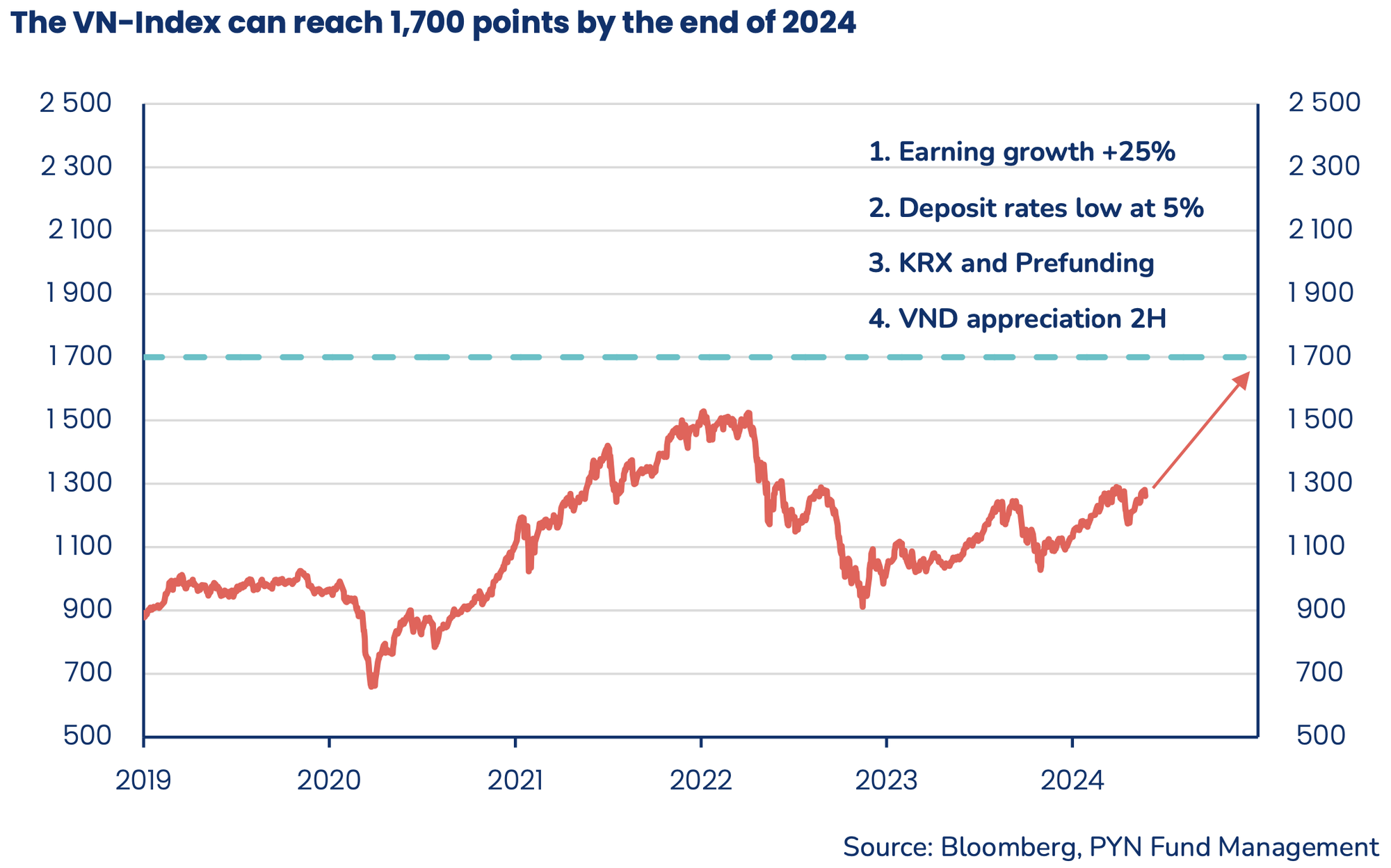

Securities companies unanimously forecast the VN-Index will reach 1,400-1,500 points in the rest of the year, but Pyn Elite Fund believes the index can rise further with a positive view based on income growth.

Petri Deryng, head of Pyn Elite Fund, has just sent a letter to investors in the second quarter of 2024, continuing to express his confidence that the VN-Index can reach 1,700 points by the end of 2024. Based on the consensus forecast of securities companies, the VN-Index will reach 1,400-1,500 points in the rest of the year. However, with a positive view based on income growth, this foreign fund believes that the index can increase even higher this year.

In addition to strong earnings growth, the foreign fund also pointed out other factors that could boost domestic investor sentiment, even leading to a strong momentum at the stock market level. First, the expectation that the upcoming US interest rate cut will ease pressure on the VND, which is negatively affecting the Vietnamese stock market.

In addition, the new KRX trading system is expected to be deployed this year and the bottleneck of foreign institutional investors' pre-trading deposits may be resolved as soon as the third quarter, which will have a positive impact on the market. In addition, Pyn Elite Fund also expects interest rates in Vietnam to remain at a very moderate level, thereby promoting economic growth.

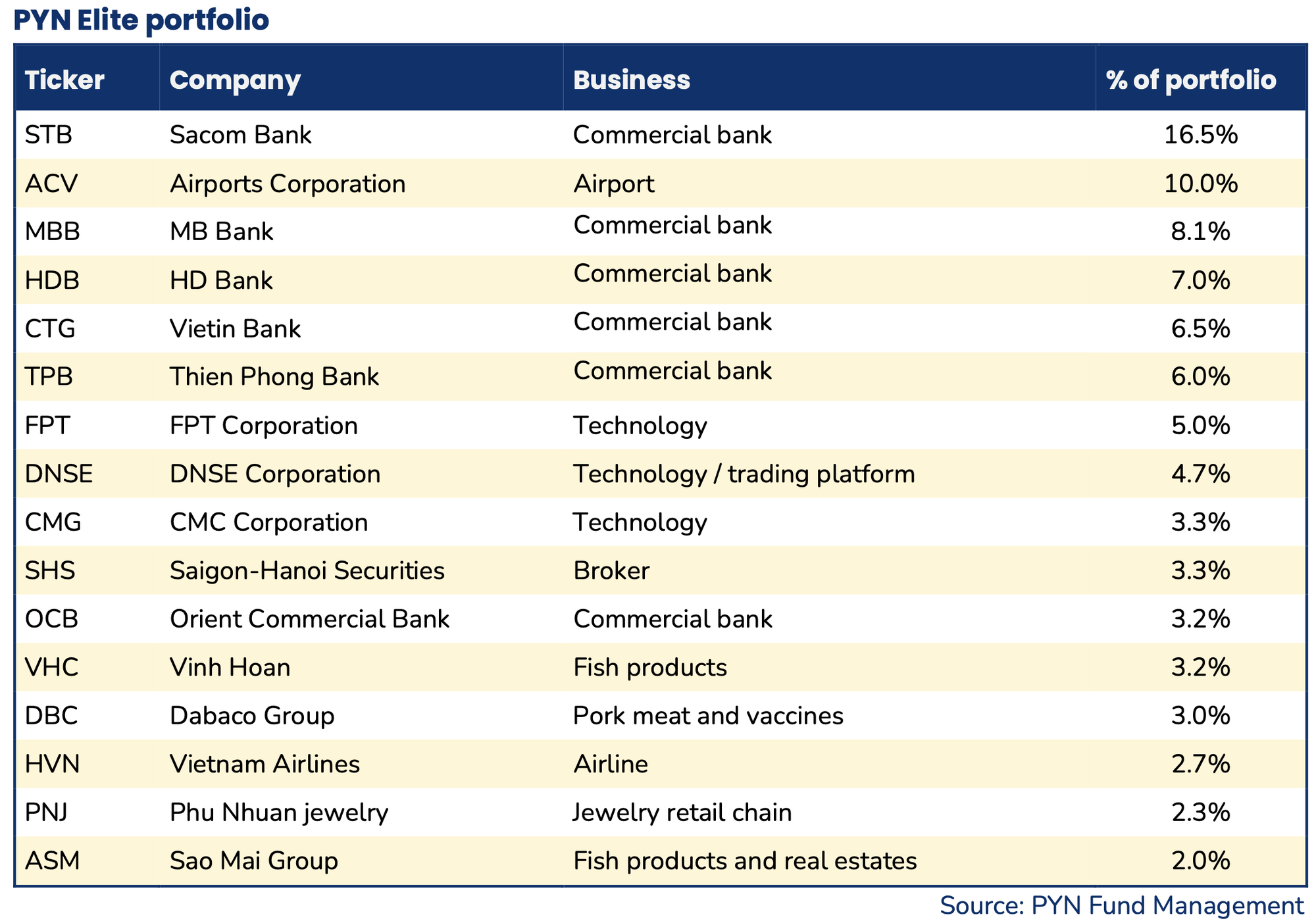

Pyn Elite Fund is one of the largest foreign funds investing in the Vietnamese stock market with assets under management at the end of May reaching 780 million EUR (21,000 billion VND). The fund has a fairly open investment appetite with a portfolio ranging from Bluechips to Midcap, Penny, and even unlisted companies.

Updated as of June 24, the fund's 16 largest investments account for a total of 86.8%. Among them, many "hot" stocks that have increased sharply recently such as ACV, Vietnam Airlines (HVN), FPT, CMC Corp (CMG), Dabaco (DBC), ... are all present. In addition, Pyn Elite Fund's portfolio also has a name that is preparing to be listed on HoSE, DNSE.

In a letter to investors, the head of Pyn Elite Fund also explained some investments in the fund's portfolio:

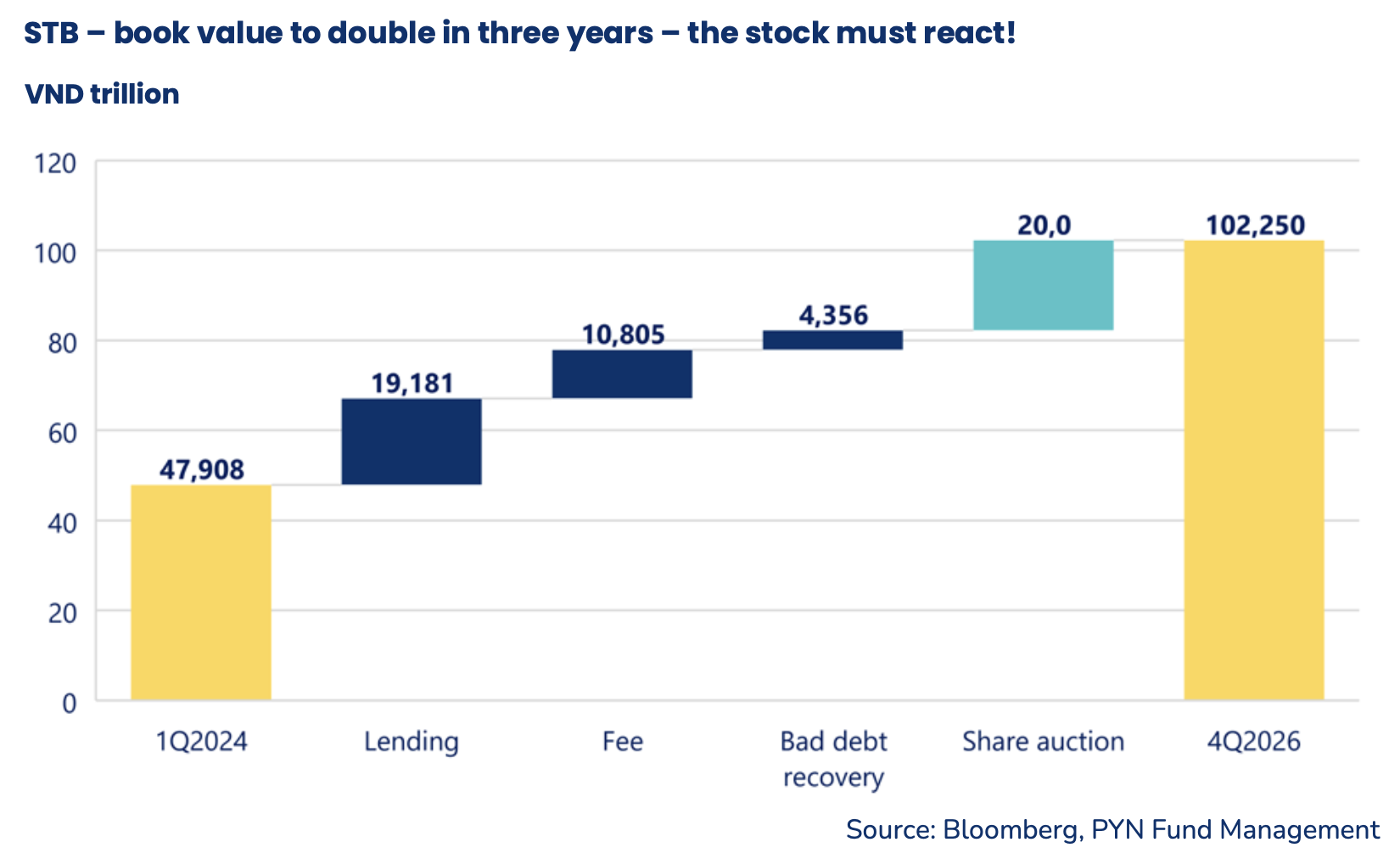

Sacombank (STB) is currently the stock with a large proportion in the Pyn Elite Fund portfolio with a proportion of 16.5%. The fund has invested in this stock since November 2022, meaning it has held it for about 1.5 years. The foreign fund from Finland expects the most notable increase in the stock price to occur between 2024 and 2026.

The story supporting STB is the auction of 32.5% of Tram Be shares (controlled by the State Bank). If successful, Pyn Elite Fund expects Sacombank to be able to record almost all of its VND20,000 billion receivables on its equity, significantly increasing the bank's advantage. According to this foreign fund, Sacombank can increase the company's equity to VND102,000 billion in the 2024-2026 period from the current level of VND48,000 billion.

The second largest investment in the Pyn Elite Fund’s portfolio is Airports Corporation of Vietnam (ACV), a stock the fund has been holding since the Covid period. ACV is currently investing in an additional terminal at Tan Son Nhat Airport and the mega-project Long Thanh Airport. Both projects are expected to be completed on schedule or even slightly ahead of schedule.

According to Pyn Elite Fund, passenger traffic in air transport is growing rapidly and ACV is expected to achieve good earnings growth in 2024 and 2025. “Airport business is like printing money: strong cash flow and high profitability are typical of this industry. ACV’s operating profit margin will easily stay above 60%”, the fund manager stressed.

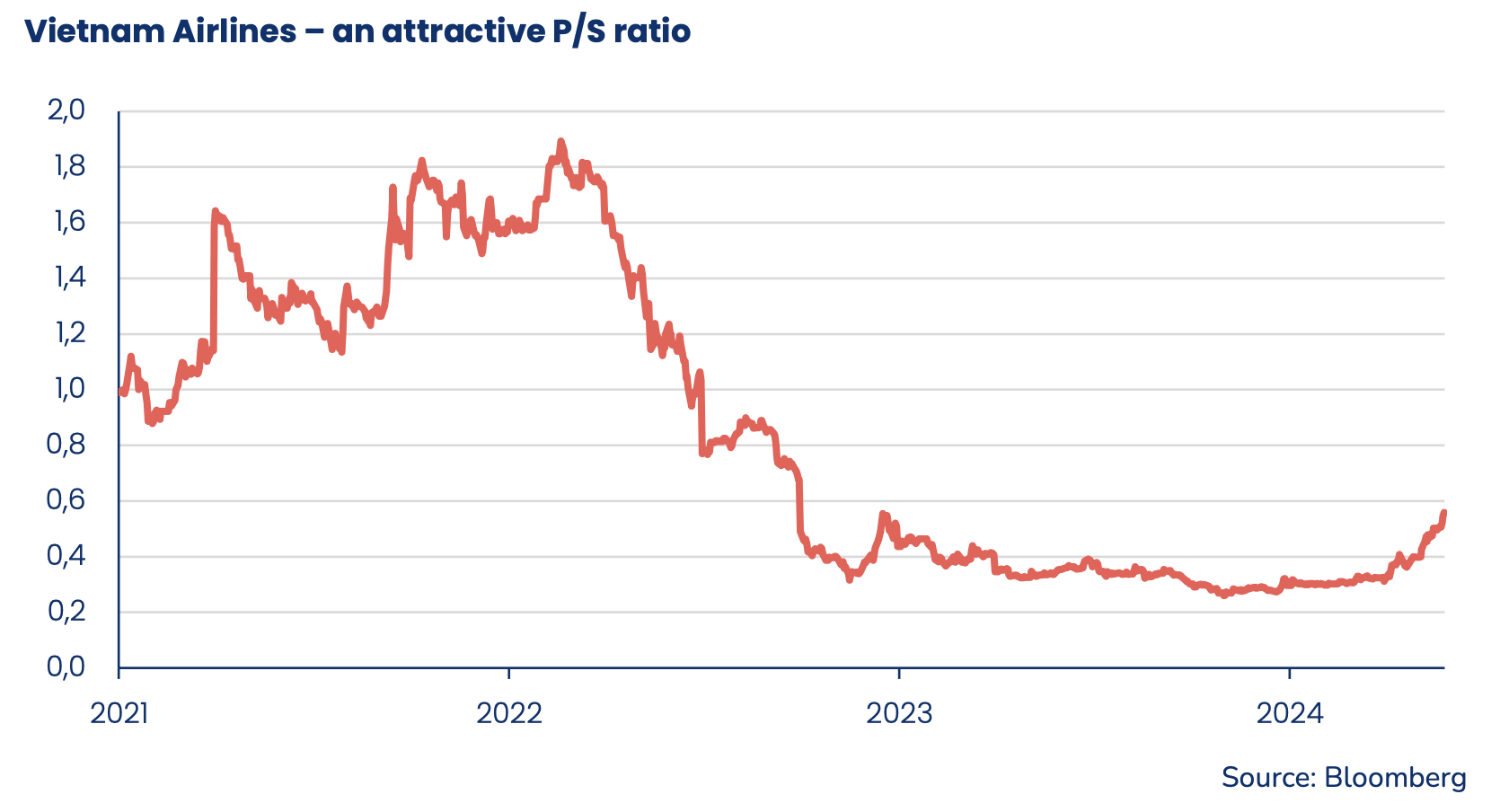

Another notable airline stock in Pyn Elite Fund's portfolio is Vietnam Airlines (HVN). This foreign fund collects shares HVN since May and currently holds about 1% of the company's shares, corresponding to about 3% of the investment portfolio. According to the head of the fund, Vietnam Airlines has accumulated losses over the past few years, but is expected to have a strong change in income this year and in fact the first months of the year have been profitable.

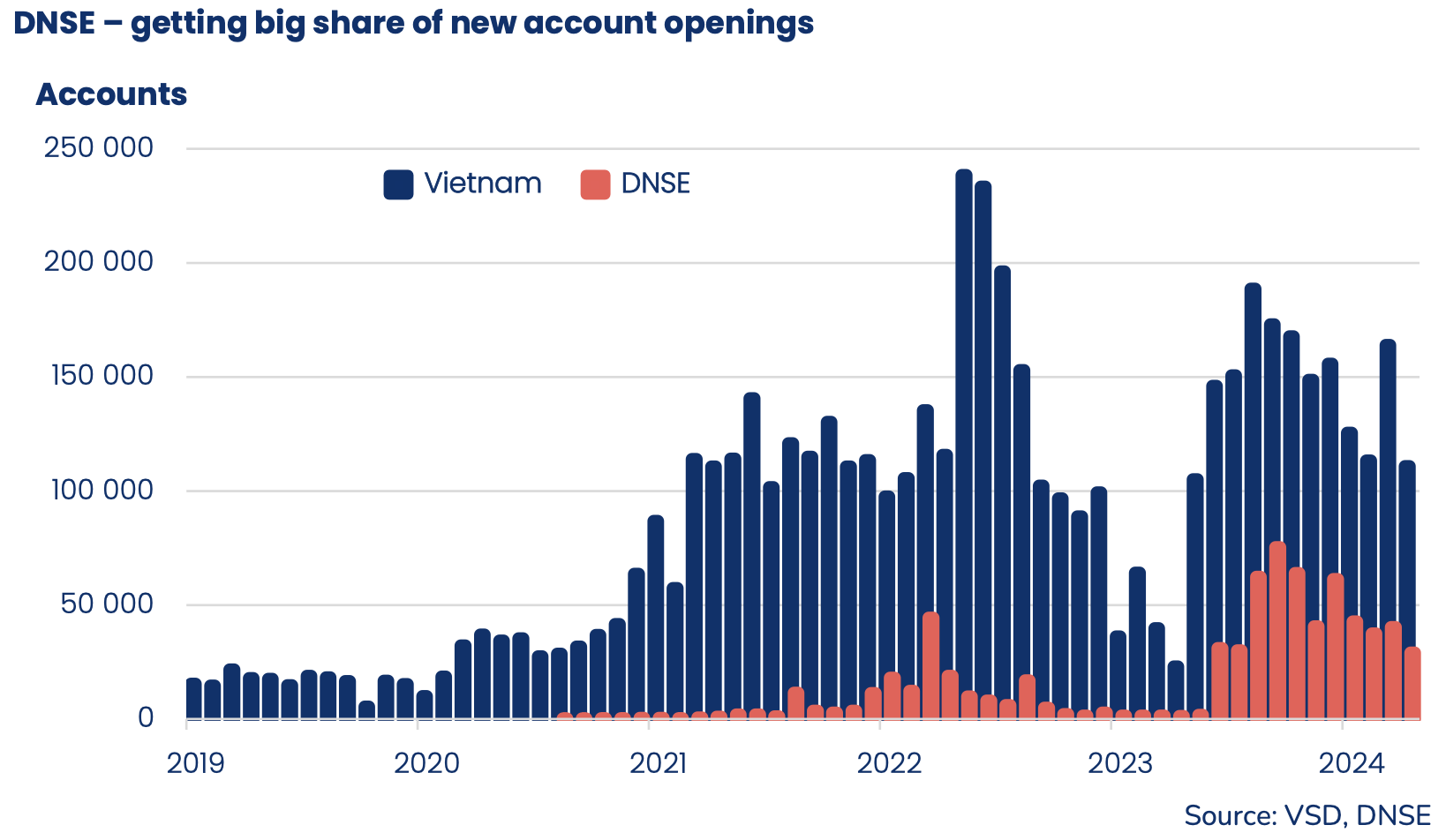

As for DNSE, Pyn Elite Fund is holding 11% of this securities company’s capital (4.8% of the fund’s portfolio). According to this foreign fund, securities stocks with high “beta” are likely to skyrocket in bull markets and fall sharply in bear markets. “It is unlikely that PYN Elite Fund will hold securities company stocks for a long time, but DNSE is different,” said Mr. Petri Deryng.

DNSE successfully completed its IPO in January 2024 and will be the center of attention when it is listed on HoSE in early July. PYN Elite Fund highly appreciates the company's ability to increase market share. DNSE's short-term goal is to achieve a market share of 3%, and long-term is 5%. This foreign fund expects the trading volume on the Vietnamese stock exchange to continue to grow in the coming time.

For the aquaculture sector, Pyn Elite Fund believes that Vietnam is a major producer of fish products. Meanwhile, the price and production cycle of pangasius fillets clearly bottomed out last year, which is why the fund added Vinh Hoan (VHC) and Sao Mai (ASM) as new stocks to its portfolio by the end of 2023.

“Export companies have fixed prices set 6–12 months in advance for major international customers, which means there is a delay before changes in the price cycle are reflected in earnings”, head of Pyn Elite Fund commented.

For the livestock industry, Pyn Elite Fund chose Dabaco (DBC). With current pig prices, the fund evaluates companies in the industry that are expected to bring high income in 2024. In the past few years, Dabaco has actively developed a new business, which is the research of African swine fever vaccine. This is the main reason why this foreign fund invested in Dabaco.

Source: CafeF