VnDirect has just released its outlook for the stock market in June, highlighting that the earnings per share (E/P) ratio of the VN-Index increased slightly by 0.1 points % to 7.1% mainly due to improved business results in Q1/2024 of listed companies, while the VN-Index increased by 5.2% in May 2024 to 1,272.6 points.

The average 12-month mobilization interest rate of commercial banks in May 2024 has begun to reverse, increasing by about 0.1 points % compared to the previous month to 4.7%.

During the week from May 13 to May 27, the State Bank injected a net amount of VND112,639 trillion through the OMO channel to average the amount of USD sold to the market and reduce liquidity pressure. However, the State Bank then returned to net withdrawal when the interbank overnight interest rate fell sharply and fell below 3%.

In general, the gap between VN-Index's E/P and 12-month deposit interest rates is maintaining a high level compared to history, showing that the stock investment channel is still very attractive in the current low interest rate context.

On the valuation front, earnings growth will support the market’s trailing P/E valuation of 15.8x, 8.6% lower than the five-year average P/E of 17.4x, according to Bloomberg data.

The valuation of VN-Index is quite reasonable when compared to emerging markets in terms of P/E ratio and relatively cheap in terms of P/B ratio. However, the trend of improving business results in 2024 will be a strong supporting factor for the stock market. VnDirect maintains its forecast of net profit growth of companies listed on HOSE at 16-18% compared to the same period in 2024.

According to VnDirect, there is a negative correlation between the 10-year government bond yield and the P/E ratio of the VN-Index. However, after approaching the important milestone around 3%, the yield of Vietnam's 10-year government bonds has adjusted down to 2.85%. This will somewhat ease the market's previous cautious sentiment.

The stock market is converging conditions to return to a short-term uptrend because: The DXY index has weakened and the gap between international gold prices and domestic gold prices has narrowed, which will help ease exchange rate tension.

After reaching the important milestone of 3%, the yield of 10-year government bonds has turned down. Vietnam's economy recorded a stronger recovery in the manufacturing sector, thereby reinforcing the positive profit growth picture of listed enterprises in the coming quarters.

Therefore, investors can increase their stock holdings when macro indicators improve, paying special attention to sectors with supportive stories such as steel, real estate, sugar and technology. “Investors should increase their stock holdings as pressure from exchange rates and interest rates on the interbank market has cooled down,” analysts at VnDirect emphasized.

Market risks still revolve around the FED’s monetary policy. Specifically, if higher-than-expected inflation figures are announced, it will slow down the FED’s decision to lower interest rates and thereby increase pressure on Vietnam’s monetary policy.

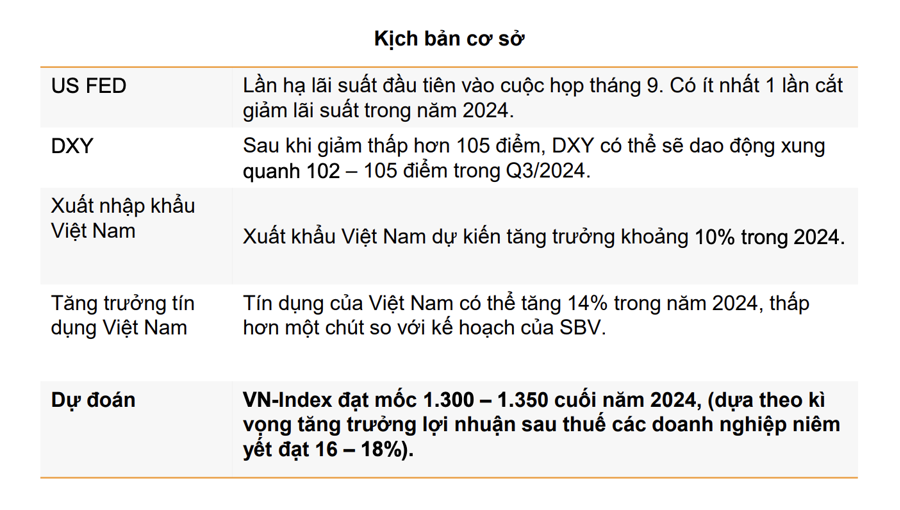

VnDirect also maintains the base case for the market in 2024 with the view that the FED will cut interest rates for the first time at its September meeting. There will be at least one interest rate cut in 2024. DXY After falling below 105 points, DXY is likely to fluctuate around 102 - 105 points in Q3/2024. Vietnam's import and export Vietnam's export is expected to grow by about 10% in 2024.

Vietnam's credit may increase by 14% in 2024, slightly lower than the SBV's plan. VN-Index is expected to reach 1,300 - 1,350 by the end of 2024, based on the expected growth of after-tax profits of listed companies at 16 - 18%.

Source: VnEconomy