In the stock market, the act of buying and selling stocks ex-dividend date is something investors need to pay attention to. This date can affect their interests. To better understand the ex-dividend date, read the following article by HVA to increase efficiency in the investment process.

>>> See more articles: FIND OUT THE TOP 10 WORLD STOCK EXCHANGES

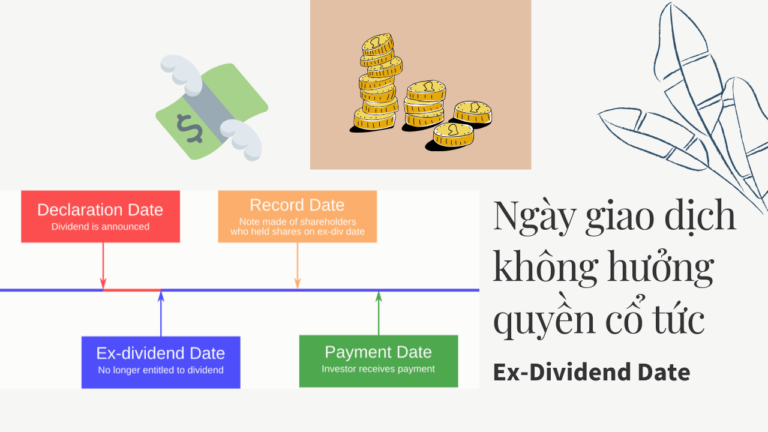

1. What is the ex-dividend date?

Ex-dividend date (abbreviated as GDKHQ) is the day on which the stock transaction takes place, but the stock buyer does not enjoy the rights related to the stock they have purchased. Specifically, they do not receive dividends, participate in the purchase of additional shares, participate in shareholders' meetings, or receive other rights related to the stock. The main purpose of this day is to close the list of shareholders who own the company's shares at that time.

For transactions with a settlement date of T+3, if an investor purchases shares 2 days before the registration date, they will not be counted as shareholders of record. This is because the transaction has not been settled and therefore they will not be entitled to the rights associated with that share. Therefore, the T+3, T+2 and T+1 dates are usually considered ex-dividend trading dates.

Stock price fluctuations on ex-dividend date:

- Before the ex-dividend date, the stock price usually increases due to increased trading volume from investors.

- Before trading begins on the ex-dividend date, the stock exchange typically adjusts the stock price downward by the amount of dividend expected to be paid.

- This decrease actually reflects market sentiment, as fewer people want to buy shares on the ex-dividend date because they do not receive the related rights. However, it also makes sense, as dividends typically come from a company's reserves, reducing the value of the company.

- Buying stocks just before the ex-dividend date usually doesn’t pay off because the stock price drops by the value of the dividend. Likewise, investors who buy after the ex-dividend date often pay a “discount” to make up for the dividends they miss out on.

- Since stock prices tend to fall with the dividend amount on the ex-dividend date, breaking even is highly likely, not to mention brokerage fees for buying and selling transactions.

2. Terms related to non-dividend transactions

What is the last date of registration?

Last day of registration is the date on which the list of shareholders who own shares of the company, these people have the right to exercise their rights as shareholders. For investors who buy shares before the ex-dividend date, they will automatically be included in the list of entitled people.

However, if an investor purchases shares on or after this date, they will not be counted and will not be entitled to shareholder benefits. Typically, the ex-dividend date occurs immediately before the record date. In the event that the record date is a Monday of the following week, the ex-dividend date will occur on the Friday of that week.

It is important to remember that the ex-dividend date and the final record date are different, so you need to clearly distinguish between them before making a transaction.

What is the payment date?

In addition to the concept of a final registration date, Payment date also related to the ex-dividend date. The payment date is the date on which the dividend is paid to the investor, either in cash or in shares, according to the number of shares they own. This is an important part of the process of investing in the stock market and should be taken into account. For more information, you can refer to the related article.

When investing on the ex-dividend date, the stock price may undergo adjustments. Most investors usually choose to buy stocks on the ex-dividend date to receive the corresponding benefits and dividends.

However, some investor They choose to buy on the ex-dividend date in the hope that the share price will fall by then, and they can still receive a portion of the dividend without taking too much of a hit to the share price. This sometimes means accepting that their entitlement is not complete, but the value of the dividend is not much different from normal.

3. Advantages and disadvantages of buying and selling on the ex-dividend date

Advantage:

- Most investors buy stocks on the ex-dividend date to receive the full benefit and corresponding dividend value. However, some people choose to buy on the ex-dividend date because:

- Stock prices may correct downwards, due to reduced buying demand.

- The ex-dividend date can provide the dual benefit of temporary capital gains and the prospect of receiving dividends later. When the stock price exceeds the dividend amount, it is a good opportunity to make a profit.

- Investors can actively trade stocks, buying/selling as soon as they arrive in their accounts. For stocks with rights, they have to wait until after the dividend is paid to be able to sell the stocks, but by then, the price may have changed.

- The ex-dividend date is an important factor for stock management and deciding when to buy/sell.

Disadvantages:

- The buyer does not receive any benefits from the purchased shares, and the dividends will belong to the seller.

- It is not possible to accurately predict stock price movements based on the ex-dividend date, but rather on market psychology.

4. Do I receive dividends when selling securities on the ex-dividend date?

So if the stock sale transaction is on ex-dividend date Will investors receive dividends? Specifically, when investors receive notice that the shares they own will be paid cash dividends, the price of the shares on the day will be adjusted down corresponding to the dividends paid. Therefore, when on the ex-dividend date, investors sell shares, on the dividend payment date, they will still receive that amount according to the original regulations.

For example, stock X on the HOSE has a market price of VND15,000/share at the end of the previous trading day. In addition, they are announced to pay dividends at VND1,000/share. From there, the Stock Exchange will adjust the reasonable price on the ex-right date such that the reference price of the stock will fall to VND14,000/share.

That is in ex-dividend date, if investors sell the shares they are holding, they will still receive dividends. If investors do not buy, they will not receive dividends. Therefore, at this time, the seller owns the shares and the buyer will not be on the list of shareholders of stock issuing company.

5. How to calculate stock price after receiving rights

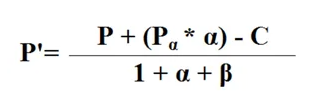

Calculate stock price after cash dividend

Formula for calculating stock price after cash dividend:

P' = (P + (Pa xa) – C) / (1 + a + b)

In there:

P': Stock price after rights exercise. Includes cash dividends, bonus shares and additional shares issued.

P: Stock price before exercising rights

Pa: Additional issued share price for preferential purchase rights

a: Ratio of additional shares issued for preferential purchase rights. Unit of calculation %

b: Bonus stock distribution ratio, dividend payment by stock. Unit of calculation %

C: Cash dividends.

Illustrative example

Shares of A on January 7, 2016 have a price of P = 30,000 VND. January 8, 2016 is the ex-dividend date (EXD) to pay dividends for shares of A.

Cash dividend at the rate of 10% is equivalent to receiving 1,000 VND. => C = 1,000 VND.

Applying the formula according to the Law of Conservation of Capital and Cash Flow we get; we can remember: Mathematically dividing is the same as not dividing:

P' = P – C = 30,000 – 1,000 = 29,000 VND (because there is no additional share issuance ratio).

At that time, 1 old A share priced at 30,000 VND becomes 1 A' share after price division at 29,000 VND and 1,000 VND in dividends.

How to calculate stock price after stock dividend or bonus shares

Stock dividend at a ratio of 100:10 (ie 10% - or if you have 100 B shares before the split, you will receive 10 more B shares after the split) => b = 10%.

Bonus shares to shareholders at a ratio of 100:20 (ie 20%) => b = 20%.

At this point, mathematically, dividing is the same as not dividing. Then, if 100 B shares are priced at 17,000 VND, then after dividing the price, how much will 130 B shares cost (these 130 shares are equal to 100 original shares, 10 dividend shares (10%) and 20 bonus shares (20%)).

The result is 13,000 VND/share B after division.

Apply the formula: P' = P / (1 + b) = 17,000 / (1+10% +20%) = 13,000 VND

Learn about RSI index in stocks, this is the relative strength index. Relative strength index determines price trends to help make investment decisions.

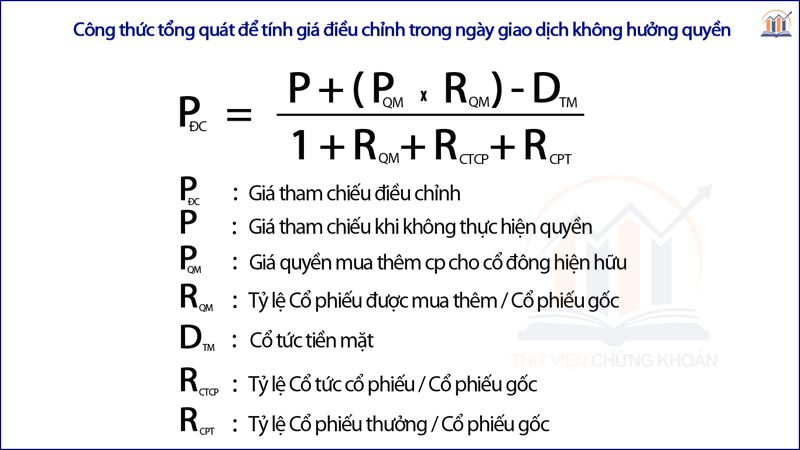

How to calculate adjusted price of shares on ex-dividend date

Since dividends are a fixed payment that cannot be changed, paying a dividend will result in a company having to pay a sum of money out of the company's book assets and the company's accounts. Therefore, paying a dividend can have an impact on the stock price. As an investor, you need to understand how to adjust after a dividend payment on the ex-dividend date.

The stock price after the ex-dividend date will be adjusted down in proportion to the dividend rate paid. Normally, when we receive news of a bonus, it means that we will have something more, our assets will increase. However, in stock investment, when a company announces a dividend in cash or shares, in essence, our assets will remain the same, no more, no less.

That is why the reference price of the stock on the ex-right trading date must be adjusted down. After this date, the price will be adjusted again.

In there:

P: Current price

P': Price on transaction date

P⍺: Price of additional issued shares

⍺: Ratio of additional shares issued

ꞵ: Bonus stock dividend ratio (stock dividend)

C: Cash dividend

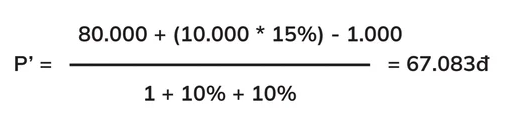

Illustrative example

Share C on February 21, 2022 is priced at VND 80,000. February 22, 2022 is the ex-dividend date of share C with the following rights:

- Cash dividend rate: 10% or 1,000 VND.

- Bonus stock ratio: 10%

- Additional issuance at the rate: 15% price 10,000 VND.

So the price of stock C on the ex-dividend date of February 22, 2022 is calculated as follows:

Source: Onstocks