Individual investors today net bought 571.1 billion VND, of which net matched buying was 547.0 billion VND...

At the end of the trading session on July 25, 2024, the VN-Index decreased by 0.43% to close at 1,233.19 points. The total transaction value on the 3 floors reached 13,028.7 billion VND, down -35.8% compared to the previous session. Of which, the transaction value on the HoSE floor reached 11,699 billion VND.

In terms of order matching alone, the total market transaction value reached VND10,850.36 billion, down VND401.3 billion compared to the previous session, down VND431.3 billion compared to the average of 5 sessions and down VND411.3 billion compared to the average of 20 sessions.

By industry, liquidity decreased across the board, notably in Banking, Real Estate, Securities, Retail, Oil & Gas, Aquaculture & Seafood, Construction, Chemicals, and conversely a slight INCREASE in the Beer industry. In terms of price fluctuations, Banking, Securities, Steel, Retail, Information Technology, Aviation decreased while the remaining industries increased.

Foreign investors net sold 472.7 billion VND, of which matching transactions alone net sold 495.7 billion VND.

Foreign net buying mainly comes from the Information Technology and Insurance groups. Top foreign net buying includes the following codes: FPT, BID, FRT, FUESSVFL, SCS, BCM, DGC, E1VFVN30, HAH, BVH.

The foreign net sellers are the Financial Services group. The top foreign net sellers include: SSI, VHM, HPG, VPB, TCB, PDR, VIX, POW, DXG.

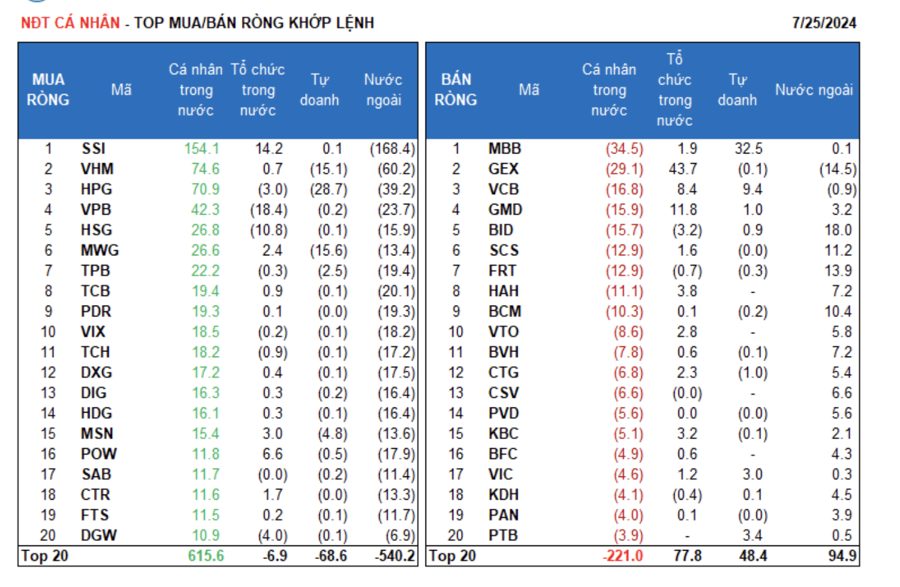

Individual investors net bought VND571.1 billion, of which they net bought VND547.0 billion in matched orders. In terms of matched orders alone, they net bought 14/18 sectors, mainly in the Financial Services sector. The top net buys of individual investors focused on: SSI, VHM, HPG, VPB, HSG, MWG, TPB, TCB, PDR, VIX.

Net selling side: they net sold 4/18 industries, mainly Industrial Goods & Services, Insurance. Top net sellers include: MBB, GEX, VCB, GMD, BID, SCS, HAH, BCM, VTO.

Self-employed people net sold 16.5 billion VND, of which matching orders alone net sold 76.1 billion VND.

Domestic institutional investors net sold 65.0 billion VND, and in terms of matching orders alone, they net bought 24.8 billion VND.

In terms of matched transactions alone: Domestic organizations net sold 11/18 sectors, the largest value was in the Basic Resources group. Top net sellers were VPB, FPT, FUESSVFL, DGC, HSG, E1VFVN30, VNM, LCG, HVN, MSB. The largest net buying value was in the Industrial Goods & Services group. Top net buyers were GEX, SSI, GMD, FUEVFVND, STB, VCB, POW, GVR, REE, VSC.

Today's negotiated transactions reached VND2,178.4 billion, up +4.2% compared to the previous session and contributing VND16.7% to the total transaction value.

Today, there were notable negotiated transactions between foreign organizations in large-cap stocks (VIC, CTG, FPT, PNJ, MBB). With VIC shares, 10 million units (equivalent to 420 billion VND) were transferred.

In addition, individual investors continued to trade in mid-cap stocks (KDC, SBT, KOS, MSB, CMG) and MWG.

Cash flow allocation proportion decreased in Securities, Retail, Chemicals, Construction, Agriculture & Seafood Farming, Plastics, Rubber & Fiber, Oil & Gas, Mobile Telecommunications while increased in Banking, Real Estate, Steel, Software, Aviation, Electricity Production & Distribution, Water Transport.

In terms of order matching alone, the cash flow allocation ratio increased in the large-cap VN30 and small-cap VNSML groups, while decreasing in the mid-cap VNMID group.

Source: VnEconomy