This assessment is based on expectations of market-wide earnings growth in the second half of 2024.

In its newly released second-half strategy report, MB Securities (MBS) expects the economic growth momentum in the third and fourth quarters to reach 6.61% and 6.51% year-on-year, respectively, thanks to the recovery of exports as well as investment expansion and more effective investment disbursement.

Regarding the world macro situation, MBS Research said global growth is forecast to stabilize at 2.6% this year.Several central banks are ready to ease and the Fed is expected to start cutting interest rates once or twice in the second half of the year, which will create a more favorable environment for stocks. Emerging Market including Vietnam“, the report stated.

VN-Index will reach 1,350 - 1,380 points

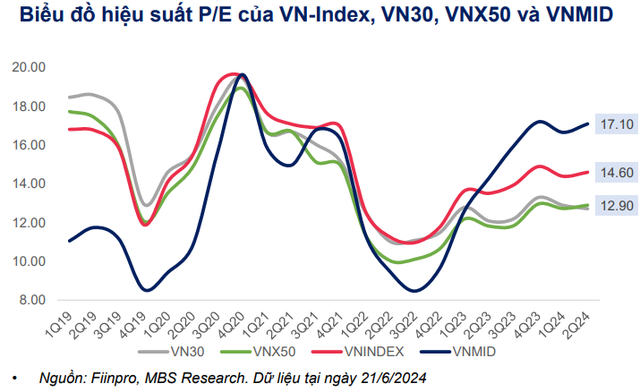

Regarding the stock market, VN-Index ended June 2024 at 1,250 points, among the best performers in the region. The recent increase in mid-cap stocks has pushed VNMID's valuation to 17.1 times P/E, about 17% higher than VN-Index. Although the market has increased strongly, MBS's analysis team believes that there is still room for further gains.

The analysis team forecasts that the VN-Index will reach 1,350 - 1,380 points by the end of the year in case the profit growth of enterprises reaches 20% in 2024 and the target P/E is from 12 to 12.5 times.

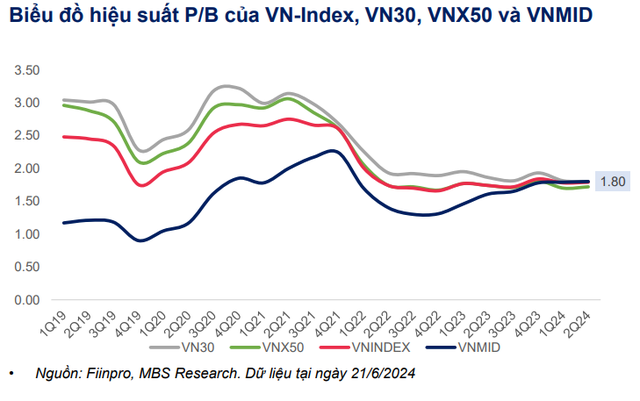

According to MBS Research, the valuation of large-cap stocks is attractive in terms of profit growth potential in the 2024-2025 fiscal year compared to other groups. Because, mid-cap stocks are currently trading at P/B equivalent to large-cap stocks. Meanwhile, the valuation of large-cap stocks (represented by VN30 and VNX50) is about 11% lower than the market average.

Market-wide profit growth to soar in second half of 2024

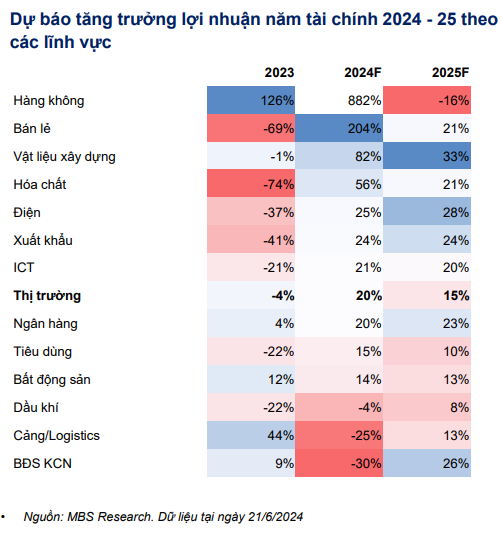

In addition, MBS Research is optimistic about the growth of the total market profit in the second half of 2024, which will be a good signal for further expansion of the stock market. After a modest growth of only 5.3% in Q1/2024, MBS forecasts that the total market profit will increase by 9.5% over the same period in Q2 and increase by 33.1% and 21.9% in Q3 and Q4, respectively.

For the full year 2024, the analysis team expects market earnings to increase by 201TP3M yoy from the low base of 2023. Some of the key drivers for the improvement in market earnings come from solid business performance across sectors such as banking, retail, construction materials and electricity.

Source: CafeF