The Q2 earnings season has passed, but it will be a good reference to predict the recovery of corporate profits at the end of the year. Therefore, this is the time to think long-term."

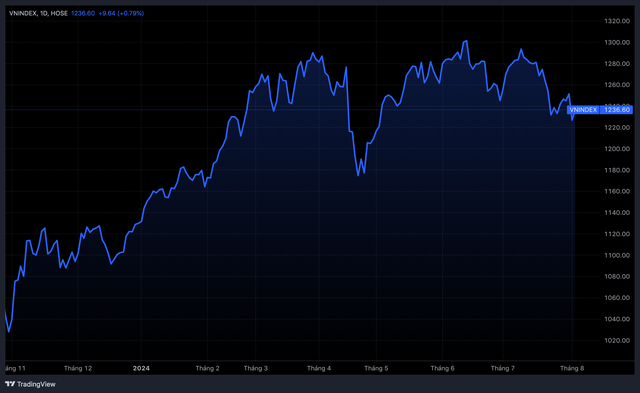

The Vietnamese stock market has just experienced a relatively strong trading week (July 29 - August 2), in the context of extremely cautious demand. The sellers were more aggressive in the last two trading sessions of the week, causing the index to correct sharply, at its lowest point the index was only more than 9 points away from the 1,200 point mark.

At the end of the week, VN-Index decreased by 5.51 points (-0.44%) compared to the previous week, closing at 1,236.6 points. Overall, for the whole month of July, VN-Index increased slightly by 6 points (+0.5%) compared to June.

It is not yet possible to confirm that VN-Index has bottomed out.

In the short term, the Vietnamese stock market is facing a lot of pressure as the VN-Index has lost its short- and medium-term support trend line, as well as failed to recover and test the resistance/support zone at 1,255 - 1,260 points, corresponding to the long-term moving average MA100.

According to Mr. Bao, some recent news related to geopolitical instability in the world and the continuously increasing savings interest rates may make investors more cautious.

In addition, August 5, 2024 will be the last day for ETFs tracking VN30, VNFinlead and VNMidcap to complete the restructuring according to the new portfolio announced in the July review, so there will be some large transactions appearing in the market affecting the index in the context of current "exhausted" liquidity.

The positive point of the cash flow is that the net selling momentum of foreign investors has slowed down, the net selling value in July decreased by half compared to the previous month. The net selling trend of foreign investors seems to end soon when the State Bank of Vietnam has recently made many moves to help stabilize the exchange rate as well as the Fed has made moves to reduce interest rates at the end of the year.

After the Q2 earnings season, the stock market started August with relatively negative short-term developments. This was also a period with a gap in information about businesses, so The market will depend largely on the growth prospects of the macro economy and other market factors.

Accordingly, Vietnam's economy has shown many signs of improvement in recent months thanks to increased domestic and international demand. Vietnamese enterprises have increased imports of raw materials and production materials to meet orders. The currency and foreign exchange markets have also been stable, creating a favorable macro environment for economic development.

About strategy, Mr. Bao recommends that short- and medium-term investors should maintain a safe portfolio weight with above-average purchasing power, consider reducing the weight of stocks with unsatisfactory Q2 results, and adhere to the stop-loss principle if any, in the context of the risk of increased selling pressure.

However, we should not panic and sell off during the fluctuations in the session when the VN-Index is approaching the strong psychological support level of 1,200 points. This is a relatively attractive price range as well as having relatively good active demand.

VN-Index may "dip" below 1,200 points, but will recover

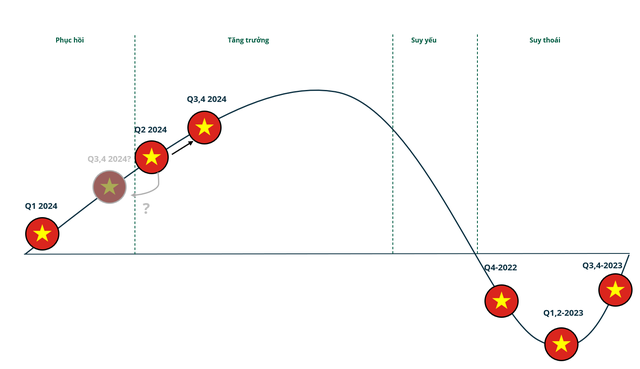

Looking at the domestic context, many economic bright spots and uncertainties are gradually passing. Macro data still show a positive and solid economic recovery. Regardless of short-term psychology and cash flow, a solid economic recovery is always an important foundation for the market.

Regarding breadth, Mr. Huy said that about 50% of stocks on HOSE maintained the 200-day moving average (MA200), large stocks were even more positive when there was not much adjustment.

Normally, the expert observed that when VN-Index broke MA200, it was in sync with major stock markets breaking MA200. Currently, the US, China, and European stock markets are all relatively far from MA200. Except for the Japanese stock market, which broke MA200, it can be seen that MA200 can still withstand this correction.

Based on the above observations, the possibility of VN-Index breaking MA 200 (equivalent to the point level around 1,200) is quite low: "The market may retest MA200 around 1,200 points but will maintain and recover as what happened last weekend. It is difficult to expect excitement but perhaps we should not be pessimistic.“.

The Q2 business results season has passed but will be a good reference to predict the recovery momentum of corporate profits at the end of the year. Thanks to that, This is the time to think long term.

Experts emphasize three major stories that will impact the market throughout the second half of the year: (1) Loose economic policies, (2) Economic recovery momentum, and (3) the upgrade story. In which, the economic recovery momentum and the upgrade prospect will become clearer.

Investors are advised to focus on leading stocks with good quality to catch up with the profit recovery momentum. The industries that benefit from the economic recovery momentum are simply Banking, Financial Services, Consumer, Construction Materials, Basic Resources, Retail... and avoid stocks with poor fundamentals at this time.

VN-Index soon returns to short-term uptrend

The market previously operated on expectations and Q2 results were already priced in.

When the information was released, it was understandable that investors had a profit-taking mentality in the session on August 1. In addition, investors were also cautious, tending to stand aside to observe developments and wait for important information such as exchange rate developments, inflation and Fed decisions... This caused the market to appear in a "silent" state like the current one.

The double top pattern has been confirmed on the VN-Index with a price target of 1,180-1,200 points. After reaching this price target, the market may form an important bottom from 1,180-1,200 points and return to the uptrend. Therefore, this correction should be considered a technical correction rather than the start of a new trend.

Liquidity often reflects investor sentiment, low liquidity shows that investors are somewhat cautious about the market recovery. Although selling pressure may increase, experts believe that cash flow is still in the market and waiting for the right time to disburse again.

Despite recording a decline in July 2024, the market is still in an uptrend from the end of 2024. This trend is supported by positive business results of enterprises in the context of economic recovery.

Despite cautious assessments of short-term market trends, KIS experts believe that the current correction will quickly end and the market will return to a long-term uptrend as the economy continues to thrive.

Regarding short-term investment strategies, Mr. Hieu recommends that investors should keep their stock ratio at a safe level and wait for clear bottoming signals. When there is a reasonable disbursement point, investors can open investment positions in the medium and long term.

Source: CafeF