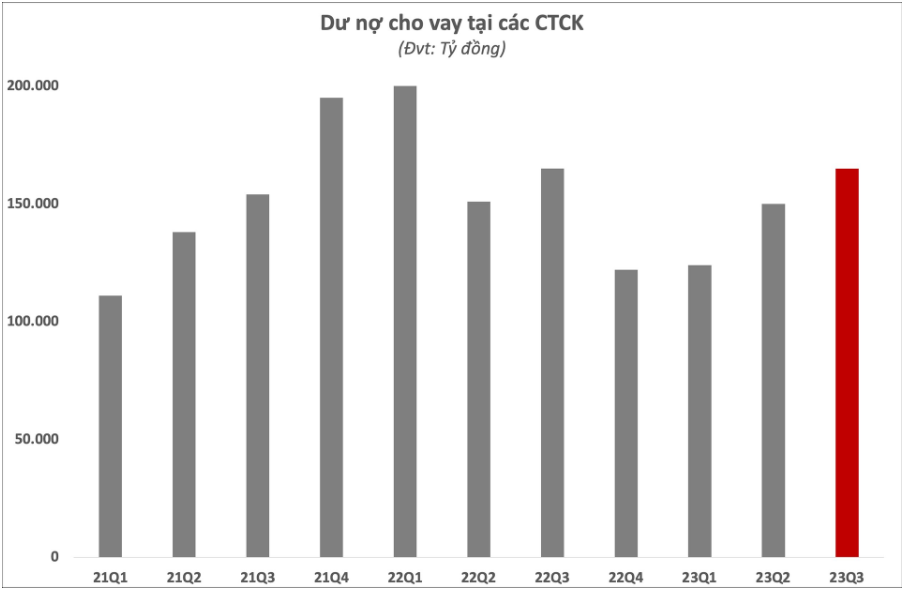

The Vietnamese stock market continued its strong recovery in the first half of the third quarter of 2023. Improved investor sentiment helped a strong cash flow into the market, leading to a continuous increase in the demand for leverage (margin). Despite strong fluctuations at the end of the quarter, the outstanding loans at securities companies at the end of the third quarter still recorded an impressive increase.

Accordingly, outstanding loans at securities companies at the end of the third quarter were estimated at VND165,000 billion, an increase of VND15,000 billion compared to the end of the second quarter and an increase of VND43,000 billion compared to the beginning of the year. Compared to the peak at the end of the first quarter of last year, the figure was still about VND35,000 billion less.

Of which, margin debt increased by about 17,000 billion compared to the end of the second quarter, estimated at 159,000 billion VND as of September 30, the rest is advance payment for sales.

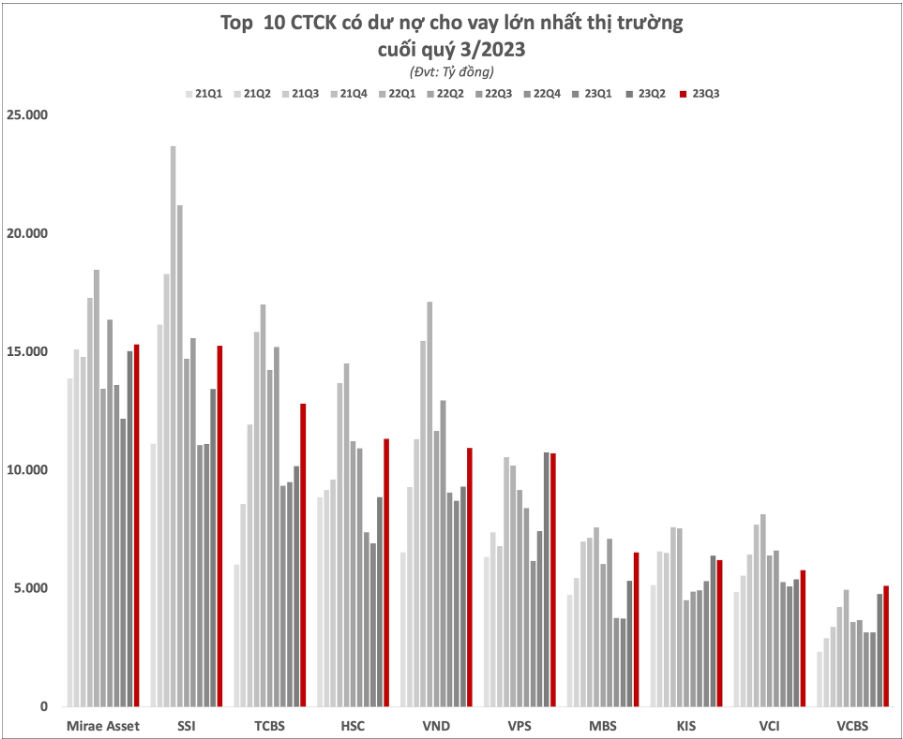

This is also the first time in more than a year (from the first quarter of 2022) that the market has recorded 6 securities companies with outstanding loans of over VND 10,000 billion. VNDirect and HSC have returned to the list, while Mirae Asset, (HM:SSI), TCBS and VPS continue to maintain outstanding loans of tens of billions.

Most securities companies recorded an increase in outstanding loans at the end of the third quarter compared to June 30. Particularly in the top 10 securities companies with the largest outstanding loans in the market, except for VPS and KIS Securities, which recorded a slight decrease, all the remaining names expanded their lending activities in the last quarter.

In which, SSI, TCBS, HSC, VNDirect and MBS (HN:MBS) recorded outstanding loans increasing by over a thousand billion in the third quarter. TCBS alone was the name with the strongest increase in outstanding loans, more than 2,600 billion VND to reach 12,827 billion. The two companies leading in outstanding loans, Mirae Asset and SSI, increased by 282 billion and 1,830 billion VND respectively compared to the end of the second quarter.

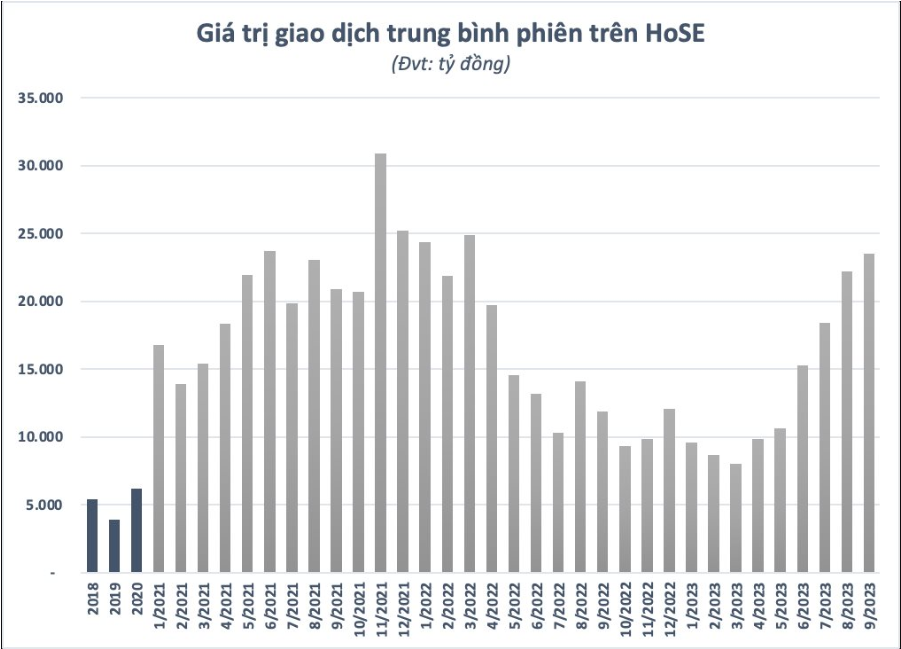

According to data from the Vietnam Securities Depository (VSD), the number of newly opened accounts has exceeded 100,000 accounts in recent months. By the end of September, the total number of domestic individual investor accounts had exceeded 7.76 million accounts, equivalent to more than 81.3 million people. Along with the sharp increase in the number of accounts, the liquidity of the stock market has improved positively, and billion-dollar trading sessions have gradually reappeared.

Investors re-entering the stock market, in addition to the amount of money transferred from traditional channels such as savings, they are also more daring in using margin.

The increase in outstanding loans in the securities group is likely to have occurred in the first half of the third quarter, coinciding with a favorable market period and low interest rates. However, many experts believe that the strong selling pressure from the second half of August was partly due to the “margin call” sale, bringing outstanding loans down to a slightly lower level.

In fact, the continuous reduction in deposit interest rates since the beginning of the year has made the stock market gradually more attractive than at the beginning of 2023. The expected reduction in interest rates will gradually have a positive impact on market income as well as reduce the opportunity cost when investing in stocks, so a part of bank deposits can shift to the stock channel, although the number may not be too large.

However, the remaining room for further interest rate reduction is not large. According to a report from Dragon Capital, domestic interest rates are unlikely to decrease further if the USD strengthens and the yield on 10-year US government bonds continues to rise in the coming time. External factors continue to put pressure on the Vietnamese Dong, along with domestic inflation increasing for 2 consecutive months, leading to limited room for further monetary policy easing by the State Bank.

Growth expectations due to attractive valuations

Although the macro situation still has many factors that can affect it, the Vietnamese market is still expected in the coming period, especially from foreign investors.

Dragon Capital has a scenario that the stock market is entering a recovery cycle, but the profit outlook is not clear, so the uptrend is still volatile. However, when the profit outlook improves, the market recovery cycle will be clearer, investors should not expect a 15-20% decline in the market.

Pyn Elite Fund also forecasts that the earnings growth of listed companies in 2024 will reach a high level, around 25-30%, and expects earnings growth to remain quite good for the next few years. In addition to the forecast for profit growth, Pyn Elite Fund also highly appreciates the strong upward potential of the market in the coming time. According to this foreign fund from Finland, the P/S ratio (price to revenue) is showing that the Vietnamese stock market is relatively undervalued compared to early 2022. The fund believes that the market has the potential to return to the above valuation level in the next 12 months, corresponding to the expectation that the P/S ratio will increase from 1.3 to over 2.0 when the disruption to the financial system is gradually decreasing, promising businesses are improved thanks to more favorable economic conditions and accelerated earnings growth.

Source: Investing.com