BSC believes that putting the new trading system into operation soon will help the Vietnamese stock market achieve many goals in the near future.

The Vietnamese stock market has long been waiting for the early implementation of many new products such as allowing intraday securities trading (Day-trading), selling pending securities, short selling... to increase the attractiveness as well as diversify the choices for investors in the market.

In the Asian region, some countries with developed stock markets have also implemented the intraday stock trading mechanism, but some emerging markets are still cautious and have not considered applying it. Since May 27-28, 2024, the US, Canadian, and Mexican stock markets have also officially switched from the "T+2" payment cycle to "T+1".

In that context, BSC Research has released a report on some perspectives on payment cycles and intraday stock trading.

Market liquidity in some Asian countries often improves after adopting day-trading.

First, the analysis team presents the experience of applying payment cycles and intraday securities trading in some Asian countries.

For example, in Korea, since the adoption of Day-trading and after the Asian financial crisis (1997), the average daily trading volume has increased significantly, specifically from 41.53 million shares and 555.8 billion won (1997) to 542.01 million shares and 2.216 trillion won in 2003.

This corresponds to a 4-fold increase in transaction value and a 13-fold increase in transaction volume.

Some factors that help increase liquidity include opening policies for foreign investors, loosening margin regulations and applying new trading systems with new products and functions such as Day-trading...

However, it should be noted that during the period from 1997 to 2003, the Korean stock market experienced strong alternating cycles of price increases and price decreases – this may have affected the comparative trading value and trading volume during the study time points.

In the Taiwanese market (China), the application of day-trading also promoted trading activities, with trading value increasing by 26% during the research period.

Over the study period and sample size, the empirical findings show that intraday trading increases such as bid-ask spread, price depth, and stock volatility.

However, research shows that day-trading not only causes higher transaction costs and trading risks, but also degrades market quality – which directly harms investors' trading performance;

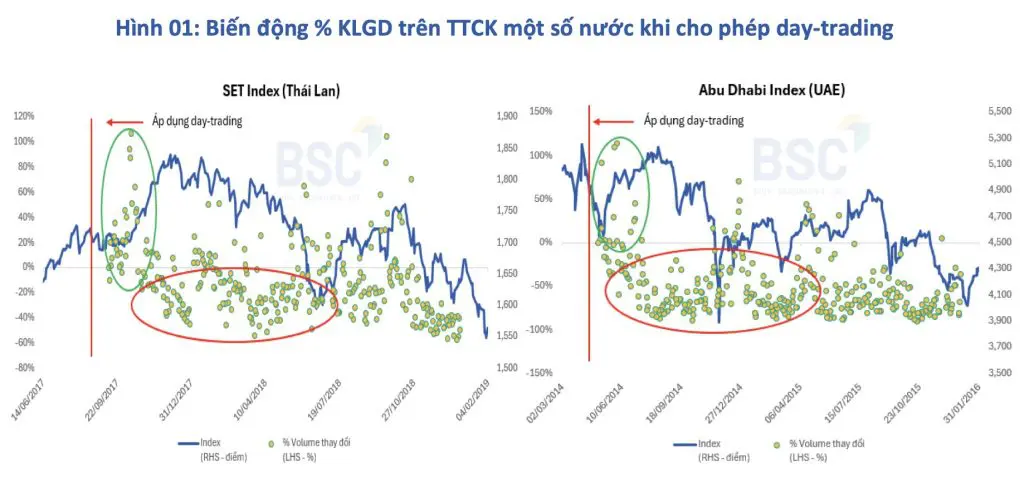

Similarly, the Thai and UAE stock markets recorded positive liquidity improvements since the introduction of day-trading, but then overall market liquidity tended to decline as the stock markets of both countries entered a downtrend.

In general, BSC believes that short-term day-trading activities will help improve market liquidity, attracting a large number of investors to participate (especially small investors).

However, in the long term, the liquidity of the entire market will depend on the world context, the domestic macroeconomic situation, as well as the growth potential of listed enterprises - the main driving force for the stock market to attract smart money and sustainable growth.

In particular, benefits always go hand in hand with risks, so from the perspective of management and participation in transactions on the stock market, management agencies as well as investors need to consider carefully before implementing/participating in new mechanisms/products - to minimize unpredictable and sudden fluctuations on the stock market.

The early operation of the KRX system will help the Vietnamese market achieve many new goals.

BSC believes that shortening the payment cycle will be the next trend of global stock markets, as recently the United States - the world's largest economy - has officially implemented the T+1 payment cycle, in developed markets day-trading activities have been implemented for a long time.

The analysis team assessed that since 2020, the management agency has made efforts to upgrade infrastructure, amend regulations and procedures to develop the stock market towards international standards and practices.

About legal regulations, issued Circular 120/2020/TT-BTC on December 31, 2020, specifically regulating the concepts of: intraday trading, pending securities... creating the premise for implementing short selling/intraday stock trading.

On August 29, 2022, Vietnam Securities Depository and Clearing Corporation (VSD) issued 02 Decisions to shorten the payment cycle from T+3 to T+2 - earlier than some major securities exchanges in the region such as Japan, Thailand, Singapore...

Since 2023, the Ministry of Finance and the State Securities Commission have actively discussed and sought opinions from market members in drafting amendments to circulars to remove bottlenecks related to the issue of "pre-funding" - aiming to upgrade Vietnam's stock market to an emerging market by 2025;

Regarding infrastructure upgrades, technological innovation, in the June 2024 announcement of the Ministry of Finance, it also emphasized the need to promptly resolve bottlenecks in the upgrading process and will update the market on the status of the KRX system. On the other hand, the State Securities Commission and market members are also actively exchanging information to resolve bottlenecks regarding "pre-funding".

Vietnam Securities Depository and Clearing Corporation and its member units have grasped and prepared the necessary conditions to be ready to deploy the central clearing counterparty (CCP) model for the basic stock market.

"Therefore, putting the new trading system into operation soon will help the Vietnamese stock market achieve many goals in the coming time, stock market liquidity will improve significantly and multi-billion dollar trading sessions will appear regularly on the market," BSC analysis team assessed.

Source: CafeF