KBSV lowered the index's target P/E to 15x (from 15.3 reflecting the forecast of a higher interest rate base) and lowered its profit growth forecast for listed companies on the HSX to 14% (from 19%).

The Vietnamese stock market fluctuated in the first half of the year and was divided into two phases. The first phase lasted until the end of the first quarter, with the VN-Index continuing its recovery trend from the end of 2023 thanks to the driving forces of low interest rates and economic recovery.

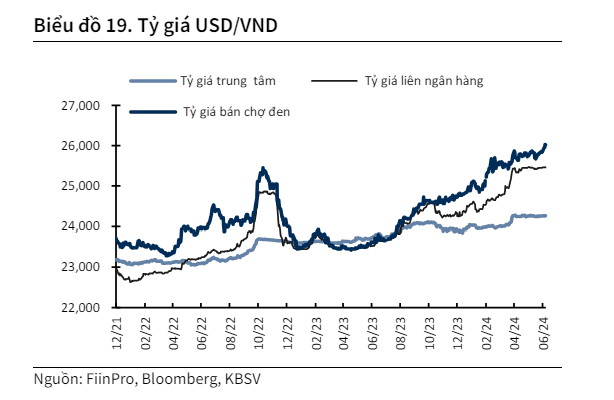

In the later period, exchange rate pressure, the upward trend of deposit interest rates, and net selling by foreign investors caused the market to fluctuate and adjust towards the end of the quarter. For the first half of 2024, the VN-Index increased by 10% in points and the transaction value in the first 6 months of 2024 increased by 83% over the same period.

Looking at the market outlook in the second half of 2024, KBSV Securities believes that several key factors will shape the trend of the Vietnamese stock market.

KBSV lowered its average EPS growth forecast for listed companies on the HSX to 14% (from 19% in the latest report) after the first quarter figures were not as optimistic as expected. This forecast reduction also reflects a more cautious view on two large-cap industries such as banking and real estate in the face of the rising trend of interest rates and the slow recovery of the real estate market. However, this increase of 14% is still considered a high increase, supporting the trend of the stock market in general.

In addition, the upward trend of interest rates due to exchange rate pressure is also a factor affecting the market. The analysis team forecasts that the mobilization interest rate will continue to increase by 0.7% - 1% in the second half of 2024, putting pressure on the stock market. This is a result of the State Bank's exchange rate stabilization policies such as net withdrawal through the treasury bill channel, selling foreign exchange reserves (estimated at 6 billion USD in the first half of the year), raising OMO and treasury bill interest rates. Exchange rate pressure is forecast to remain tense in the third quarter, before cooling down in the fourth quarter thanks to the FED's interest rate cut as well as increased foreign currency from remittances, and exports entering the peak season.

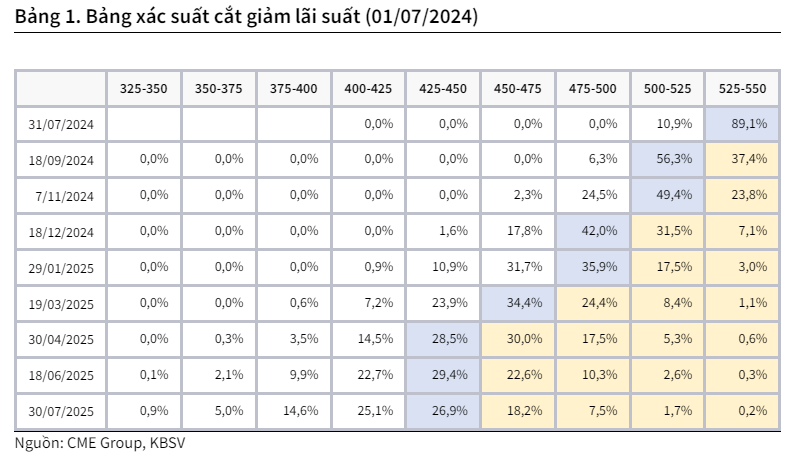

Regarding the FED's monetary policy, KBSV lowered its forecast for the number of times the FED will cut interest rates this year to 1, instead of the forecast of 3 times in the latest report. This will cause the exchange rate pressure to remain tense for at least the first half of the third quarter, before cooling down in the fourth quarter, after the FED cut interest rates in September and foreign currency supply was strongly supported by remittances and the peak export season at the end of the year.

With the current economic data of the US economy, the FED can completely delay the interest rate cut until after September this year. In addition, the expectation of the first interest rate cut is 25bps (not too large), meaning that the interest rate is still at a relatively high level. Accordingly, the USD maintains its strength combined with the interest rate difference between USD and VND, causing tension on the exchange rate.

“The low interest rate level will likely have to increase to reduce the pressure. This will have a relatively negative impact on the development of the domestic stock market. In addition, the psychology of investors expecting an early interest rate cut by the FED this year will be affected when it does not meet expectations, which may cause short-term selling pressure., KBSV report said.

Regarding the market outlook in 2024, KBSV reduced the expected score of the VN-Index at the end of the year to 1,320 points (from 1,360 points in the latest report). This is the result of lowering the target P/E of the index to 15 times (from 15.3 in the latest report - reflecting the forecast of a higher interest rate base), and lowering the profit growth forecast of enterprises listed on the HSX to 14% (from 19% in the latest report).

Source: CafeF