The second quarter financial reporting season has reached its peak, the market has passed the information “lowland” but the reaction has not been very positive, with the VN-Index losing the 1,265 point mark last week. Next week, analysts believe that the sideways trend may continue.

VN-Index continued to correct last week. Strong selling pressure appeared in the mid- and small-cap groups, especially with stocks whose second-quarter business results were not as expected.

At the end of the week, VN-Index decreased by 1,251 TP3T compared to the previous week, to 1,264 points. Trading volume increased by 11,611 TP3T compared to the previous week, showing strong selling pressure in many stocks, as well as a sudden increase in banking stocks.

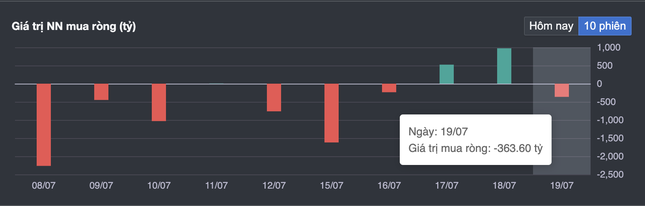

Foreign investors maintained a net selling position with a total value of more than 720 billion VND. Investors sold heavily stocks that had increased significantly in the previous period, such as FPT, HVN, GVR... (partly due to the psychological impact of profit-taking of technology stocks in the US market after a period of rapid increase).

Most real estate stocks had a negative trading week, with the focus being on QCG shares, which fell 24% (before information in the last trading session of the week about the Investigation Police Agency issuing a decision to prosecute, temporarily detain, and search warrant for Ms. Nguyen Thi Nhu Loan - General Director of Quoc Cuong Gia Lai Joint Stock Company).

In contrast to the growth in Q2 business results, the securities group had a week of declining trading points. On the contrary, the industry that contributed most positively to the market was banking, with MBB leading the way, followed by ACB, TPB, LPB...

The analysis team of Saigon - Hanoi Securities (SHS) commented that in the short term, the trend of VN-Index became less positive, when it could not maintain the support zone around 1,275 points, corresponding to the average price of the last 20 sessions. Accordingly, the main index was under strong selling pressure to the support zone around 1,255 points before recovering slightly.

In the short term, SHS believes that the market will have negative developments with many stocks showing strong differentiation, especially in the context of investors waiting for business results information to update fundamental factors.

“Short-term investors should maintain a reasonable weight. Medium- and long-term investors should hold their current portfolios, and positions considering increasing their weights should be carefully evaluated based on the second quarter business results and year-end prospects of leading companies.

When the VN-Index continues to adjust, if the weight is below the average, disbursement can be considered when the VN-Index returns to around 1,250 points. The target is the leading stocks with good growth in Q2 business results and positive prospects at the end of the year," SHS recommended.

From the perspective of Bao Viet Securities (BVSC), the medium-term trend of the market is still assessed positively thanks to the low interest rate environment, cooling exchange rate pressure, positive credit growth and strong business results in the last 2 quarters of the year. On that basis, BVSC assesses that the market's decline is just a normal correction in a medium-term uptrend.

Investors are recommended to focus on groups with good growth in Q2 business results, prioritizing available positions.

According to experts from Construction Securities (CSI), the positive signal has not appeared clearly enough, the market trend is in a sideways channel, which may continue in the sessions of next week. Investors should maintain their current portfolio and be patient until there is profit before increasing the proportion.

Source: CafeF