How to allocate investment capital to small and mid-cap stocks requires certain considerations and strategies to achieve the highest efficiency. First, it is extremely important to understand the nature and characteristics of each company in the portfolio. This requires a careful analysis of the growth potential, financial situation, and prospects of each business. Next, it is indispensable to allocate investment capital reasonably, diversify the portfolio, and manage risks. In this way, investors can optimize profits from small-cap stocks in the most effective way.

1. Looking back at small and mid-cap stocks in 2023

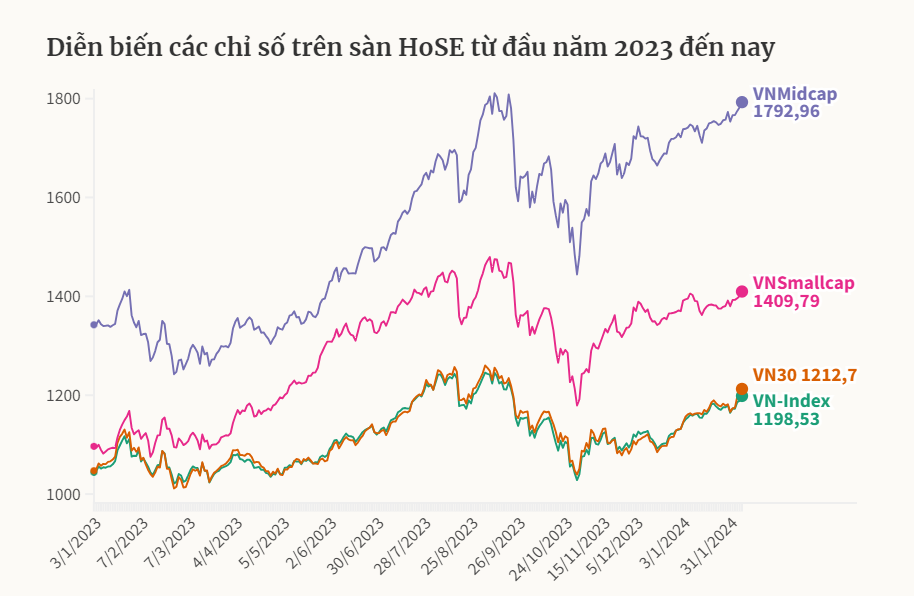

The mid- and small-cap group recorded an incredible growth in 2023, far surpassing the general market. While the VN-Index only increased by 12.2%, the VNMidcap and VNSmallcap groups increased sharply by more than 32% and nearly 29%, respectively. This boom has promoted the development of the HoSE exchange, with stocks such as VIX, CTD, BSI, FTS, QCG standing out in the strongest price increase.

Looking at the end of January 2024, the performance of the small and mid-cap group continued to outperform. VNMidcap has accumulated growth of more than 37% compared to the beginning of the year, while VNSmallcap has also recorded an increase of nearly 32.5%. This means that both groups have achieved performance twice as high as the general market.

Growth performance of mid and small stocks in 2023.

2. Risk management in small cap stock investment

Experts say that stock prices often reflect the growth of a company, including sales, profits and company size. Small and medium-sized enterprises are often in the main growth stage, so they have more room to grow than large corporations. However, with higher risk, stock volatility is often greater and requires a higher rate of return from investors.

Research on the US stock market has also shown that small-cap stocks tend to have better returns than stocks of large corporations. However, success in small and mid-cap stocks does not mean that all investors can make a profit. This is something to remember to avoid making wrong investment decisions.

The Market Access Fund (VESAF) is a typical example of the success of the small and mid-cap group, with a growth performance of nearly 31%, the second highest in the market. However, this fund has also measured the risk level of each group of stocks and selected stocks with lower risk than the general market, but bringing outstanding profits.

While mid-cap and small-cap stocks offer attractive returns, they also come with higher risks and lower liquidity. Therefore, only investors with the right risk appetite should invest in this group. For non-professional investors, choosing stocks in this group requires caution and a thorough analysis of many factors.

3. Small cap stock investment strategy

The stock market is currently witnessing fluctuations within a narrow range, with clear differentiation between sectors and stock groups. Investment funds are restructuring their portfolios, focusing on indices such as Vn30, VnDiamond, VnFinlead, leading to great pressure on large-cap stocks and banking groups. Current cash flow is focused on individual stocks, especially those with their own corporate stories.

Regarding short-term price movements, VN-Index may correct to the previous accumulation price zone at 1158-1165 points before aiming for the target of nearly 1200-1220 points. Investors need to maintain their holding status and choose opportunities to buy and trade a portion of the proportion when the market approaches the resistance zone of 1200-1220 points.

Consensus cash flow can help the market break out in a positive trend, however, it is necessary to pay attention to the divergence pressure and market sentiment in the next trading sessions. We recommend investors to hold the proportion of stocks that attract good cash flow and consider partial disbursement for stocks that are accumulating well in the support zone.

Small-cap stocks are cheap compared to the general market, with an average price-to-earnings (P/E) ratio of less than 10 times. Although the price movement is not positive, there are still small and medium-sized enterprises with stable basic operations and steady annual growth, creating opportunities for investors. However, investing in this group of stocks is not without risks, due to low competition and information transparency. Investors need to select stocks that are truly undervalued by the market.

Finding investment opportunities in small and mid-cap stocks requires caution and understanding of the business. Businesses in the fields of industrial paper, warehouse services, ports, aviation services, technology, pharmaceuticals, etc. are considered to have many opportunities.

Smart money often looks for opportunities in mid- and small-cap stocks, as they have the potential to rise more strongly in some periods. However, it is important to note that not all stocks have the potential to rise in price, and can be very risky to hold.

Valuation and selection of stocks in the small and mid-cap group are often done through the asset method, discounted cash flow or comparison with companies in the same industry. Investors need to have patience and understanding of the market to find worthwhile investment opportunities.

Source: Onstocks