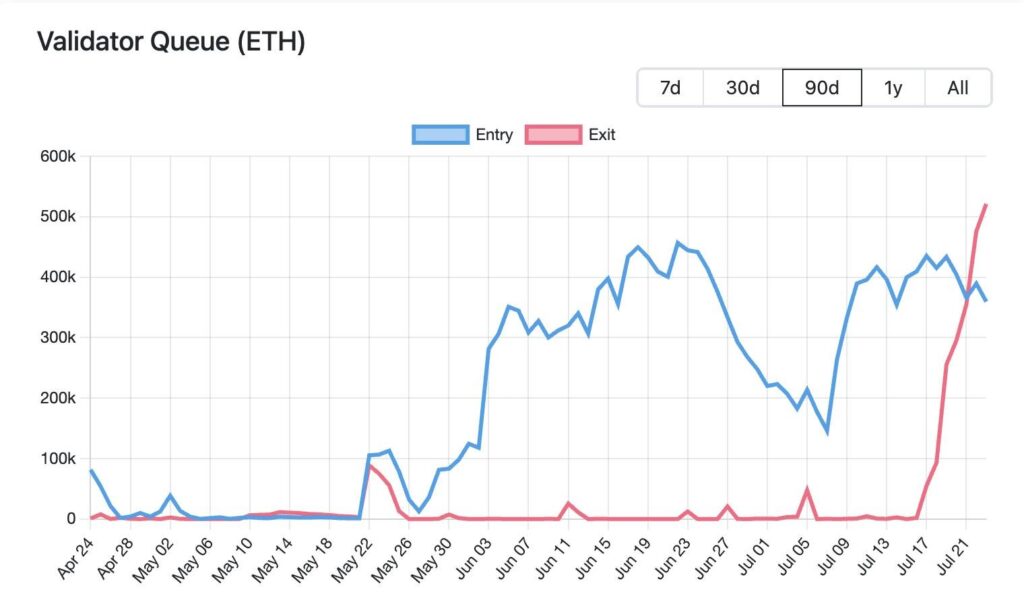

The cryptocurrency market is witnessing an interesting correction as the number of validators waiting to unstake ETH surged to a yearly high. According to data from the Ethereum Validator Queue, as of the afternoon of July 22 (US time), about 519,000 ETH – equivalent to $1.92 billion – were waiting to be withdrawn from the Ethereum network. This is the largest unstake queue since January 2024, with a wait time of more than 9 days, even those who unstake via Lido had to wait up to 18 days.

The Reason Behind the ETH Unstaking Wave

Analysts believe that the main reason comes from large-scale profit-taking activities after ETH increased sharply from the bottom of 1,500 USD (April 2025) to more than 3,800 USD (mid-July 2025), equivalent to an increase of more than 160%. Andy Cronk, co-founder of Figment - the world's leading staking company, commented:

“When prices rise sharply, both retail and institutional investors tend to unstake to lock in profits. This cycle has repeated itself many times over the market phases.”

In addition, another hypothesis is that Justin Sun's moves to withdraw ETH from the Aave lending platform caused ETH borrowing rates to increase sharply, forcing many investors to reduce their positions, leading to an increase in the amount of ETH waiting to unstake.

ETH Staking Demand Remains Extremely Strong

Interestingly, at the same time as the unstaking queue, 357,000 ETH (worth about $1.3 billion) was also waiting in the staking queue to be staked into the network, with a waiting time of more than 6 days. This shows that the demand for staking ETH is still very high, especially from public companies and financial institutions.

Notable examples include SharpLink Gaming (SBET) and Bitmine (BMNR). In just a few months since late May 2025, SharpLink has accumulated over $1.35 billion in ETH and staked most of it to optimize long-term returns.

According to experts at HVA Group, this is an inevitable trend as Ethereum is gradually becoming a strategic reserve asset for businesses, instead of just a speculative tool. HVA Group, with extensive experience in digital financial investment and digital asset strategy consulting, believes that:

- The current unstake does not mean a sell-off, but mainly a capital adjustment by institutions.

- ETH staking is becoming a long-term trend, especially for businesses looking to optimize their digital treasury.

Ethereum – From Speculative Instrument to Strategic Reserve Asset

While the over 519,000 ETH waiting to be unstaken may cause some investors to fear selling pressure, the numbers suggest that this is just a natural market correction cycle. The large amount of ETH waiting to be staked proves that long-term confidence in Ethereum remains strong.

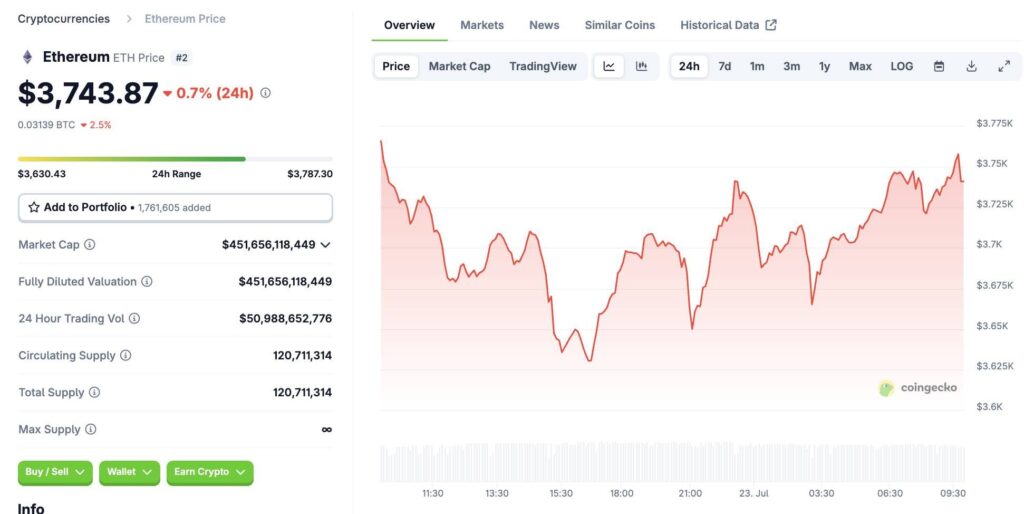

At the time of writing, ETH is trading around $3,700, down slightly by 0.7% in the past 24 hours. According to HVA Group, in the context of global financial institutions increasingly viewing Ethereum as a long-term strategic reserve asset, utilizing staking to optimize profits will continue to be the mainstream trend in the coming time.