Profit-taking pressure suddenly increased sharply when VN-Index approached the 1,290-point mark. However, with the shining of banking stocks and some pillar stocks, the market still ended today's session (July 16) in a "green" state.

After a slight increase in the morning session, the market gradually weakened in the afternoon session as investors took advantage of the opportunity to take profits from stocks at the peak.

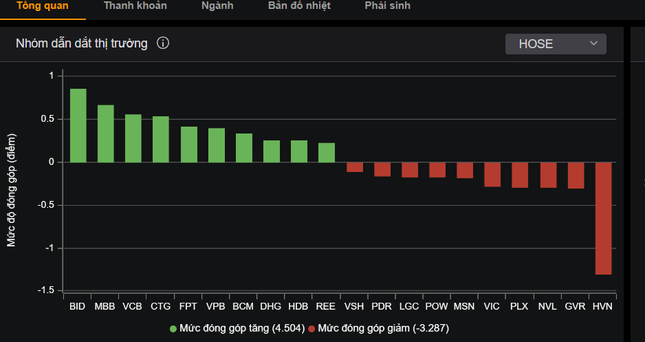

The focus was on the banking pillars (all closing in green), of which MBB had the best increase, up 2.2% with leading liquidity on the entire floor. Of the 10 stocks that contributed most positively to the VN-Index, banking stocks accounted for more than half, including BID, MBB, VCB, CTG, VPB and HDB, respectively.

The market at one point increased by more than 10 points and broke out strongly, but the cash flow refused to buy at high prices, causing the index to narrow its growth momentum.

In today's session, pharmaceutical and healthcare stocks continued to make a strong impression when many codes were in purple. Specifically, DCL, IMP, VDP, DBD, DHG, OPC, JVC, DBT all closed at ceiling prices. However, apart from DCL with more than 2.3 million units matched, the majority only had around 0.3 million units matched, so it was not enough to become a driving force for the market.

Stocks such as textiles, logistics, energy, and services unexpectedly increased sharply, such as HTG and QNP when they hit the ceiling price, TIP increased by 4.3%, REE increased by 2.6%... Meanwhile, the transportation group tended to be divided when HVN shares were strongly sold, falling to the floor price with a volume of more than 10 million units - the highest in the past month.

At the end of trading, the HOSE floor had 211 stocks increasing and 215 stocks decreasing. After 4 adjustment sessions, the VN-Index increased by 1.36 points, to 1,281.1 points. The trading value on the HOSE floor was at a low of 16,400 billion VND, but still increased by more than 2,100 billion VND compared to yesterday's session.

Notably, foreign investors continued to net sell but the value dropped sharply to about 235 billion VND, the lowest level in the past two weeks.

Source: CafeF