It is possible that foreign ETF funds with a scale of hundreds of millions of USD have sold the remaining few Vietnamese stocks in their portfolios in the past two sessions on July 2-3. This is expected to contribute to reducing the supply of stocks from foreign investors in the coming time.

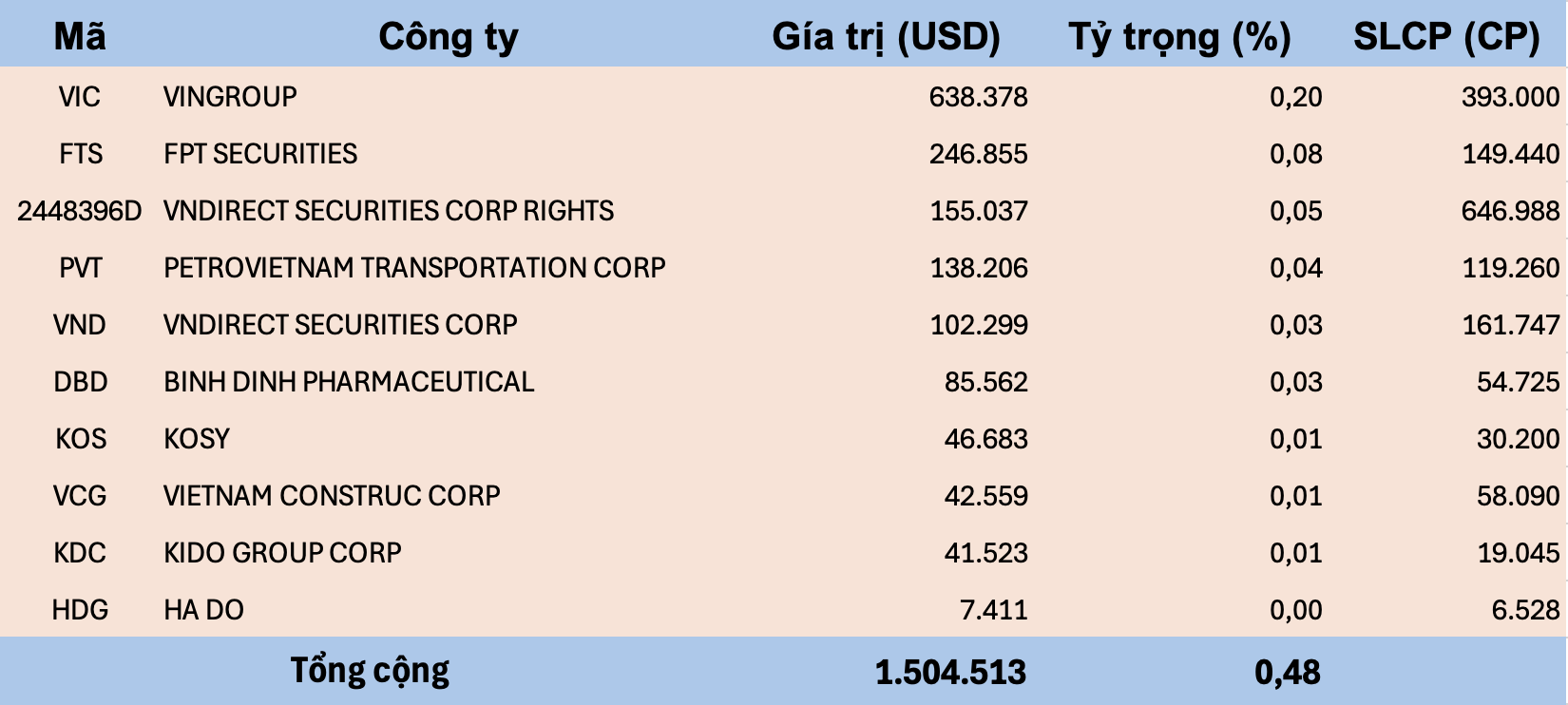

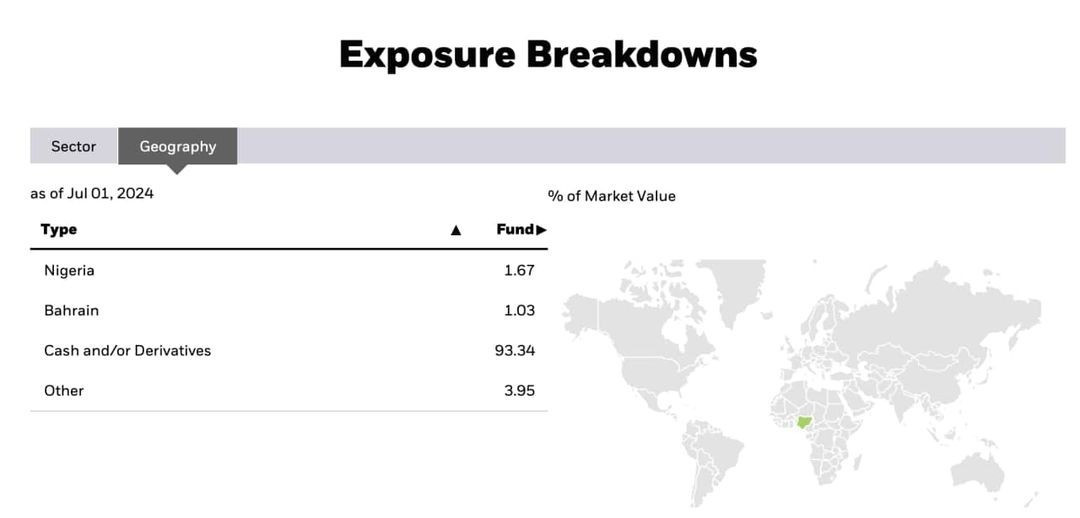

As of July 1, 2024, the total net asset value (NAV) of iShares MSCI Frontier and Select EM ETF is approximately 314 million USD, of which cash accounts for 93.4%. The proportion of Vietnamese stocks accounts for only 0.48%, equivalent to a total value of approximately 1.5 million USD (38 billion VND). The fund portfolio has only 9 Vietnamese stocks left, including VIC, FTS, PVT, VND, DBD, VCG, KDC, KOS) and the right to buy VND stocks (code 2448396D).

iShares MSCI Frontier and Select EM ETF is an ETF that specializes in investing in frontier and emerging markets, formerly known as Ishare MSCI Frontier Markets 100 ETF with the reference index being MSCI FM 100 Index. In March 2021, the fund changed its name to iShares MSCI Frontier and Select EM ETF as it is now and uses the MSCI Frontier & Emerging Markets Select Index as a reference.

In early June 2024, BlackRock unexpectedly announced the liquidation of the iShares MSCI Frontier and Select EM ETF after 12 years of operation. According to the plan, BlackRock expected this ETF to cease trading and no longer accept creation and redemption orders after the market closes on March 31, 2025. However, the announcement also emphasized that this date is subject to change.

During the extended liquidation period, the iShares MSCI Frontier and Select EM ETF will no longer be managed in accordance with its investment objective and policies as the fund will sell off its assets, BlackRock said. Proceeds from the liquidation are expected to be distributed to shareholders approximately three days after the last trading day, according to BlackRock.

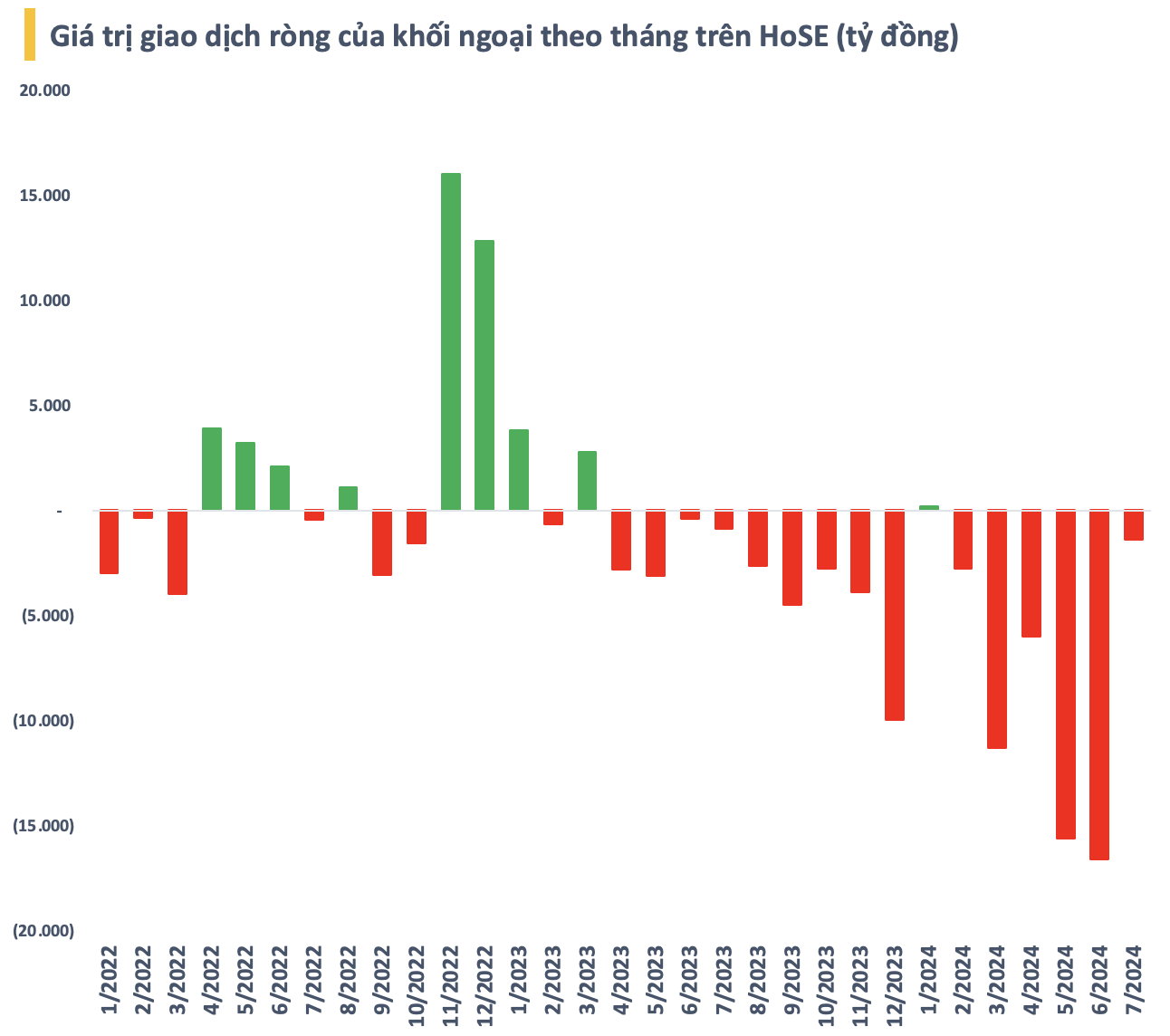

Prior to the surprise decision, Vietnam had always been the market with the highest proportion in the portfolio of the iShares MSCI Frontier and Select EM ETF. At the end of the first quarter of 2024, the proportion of Vietnamese stocks accounted for 28.5% of the fund's NAV. However, this number has continuously decreased in recent times when the fund decided to stop operating.

With the few remaining shares, it is possible that iShares MSCI Frontier and Select EM ETF sold out in the past 2 sessions of July 2-3. The fact that this foreign ETF fund “ran out of stock” to sell can be considered a good sign for millions of domestic investors. Because the strong net selling pressure from foreign investors over the past time has somewhat negatively impacted market developments.

Last June, foreign investors continued to break records when they net sold nearly VND16,600 billion on HoSE alone. This trend continued in early July but with a slightly lighter intensity. Since the beginning of the year, foreign investors have net sold a total of more than VND53,000 billion (USD2 billion) on HoSE.

According to some comments, foreign capital flows will reverse when the prospect of upgrading becomes clearer. In a recent report, VDSC forecasts that if upgraded by MSCI, the capitalization of Vietnamese stocks will account for 0.44% in the MSCI Emerging Market Index basket. This implies that there will be a capital flow of about 4 billion USD from foreign investment funds referring to this index pouring into the Vietnamese stock market.

However, according to the periodic market classification results announced on the morning of June 21, MSCI has not yet added Vietnam to the list of countries to be considered for upgrading from a frontier market to an emerging market. The positive point is that Vietnam has improved another important criterion according to MSCI's assessment.

Specifically, in the previous Global Market Accessibility Report, MSCI assessed that Vietnam's "Transferability" criterion had been changed from "Needs Improvement" to "No Major Issues" +. Vietnam has improved in transferability thanks to the increase in off-exchange trading and physical transfers that can be made without prior approval from the regulatory authority.

Source: CafeF