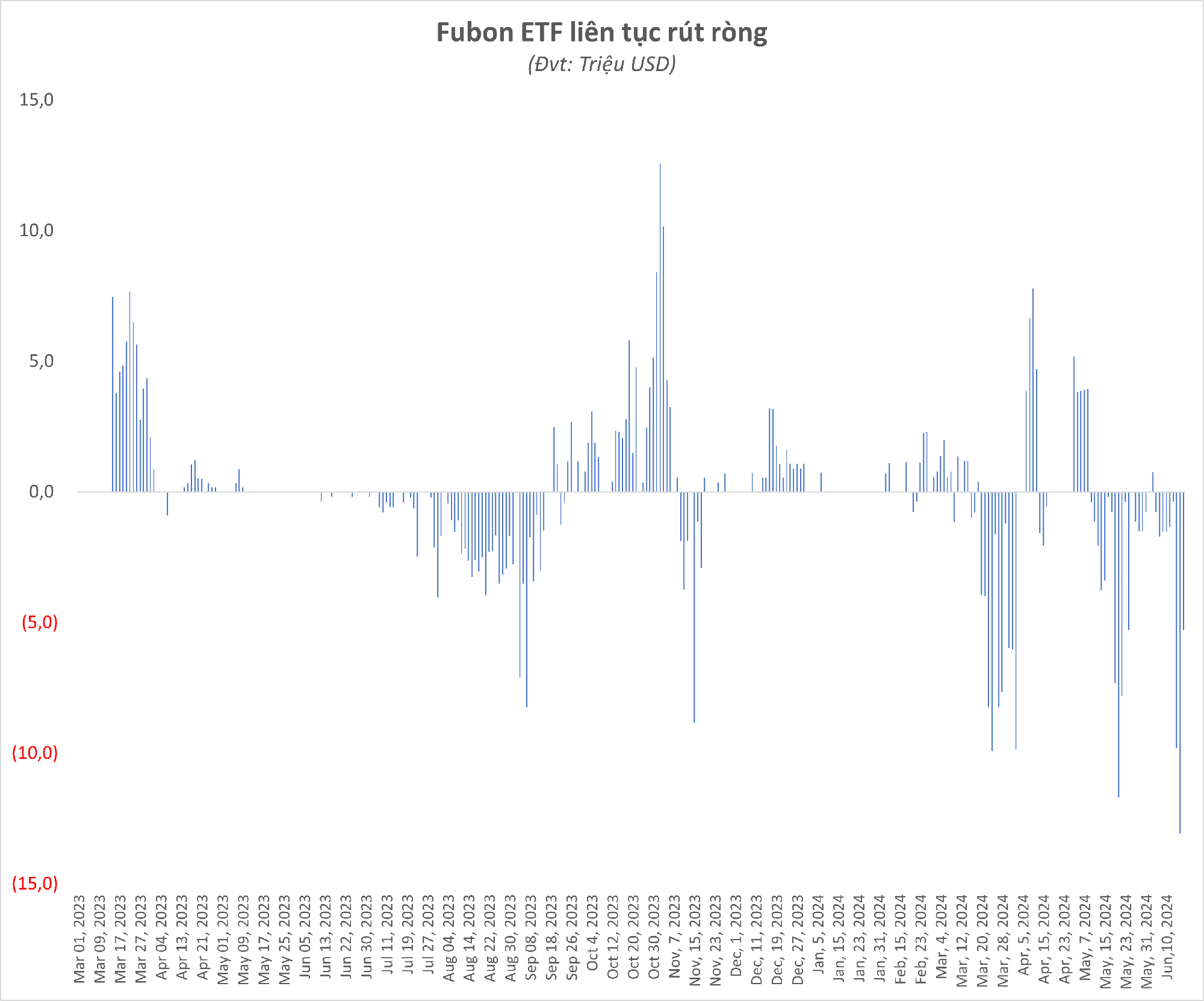

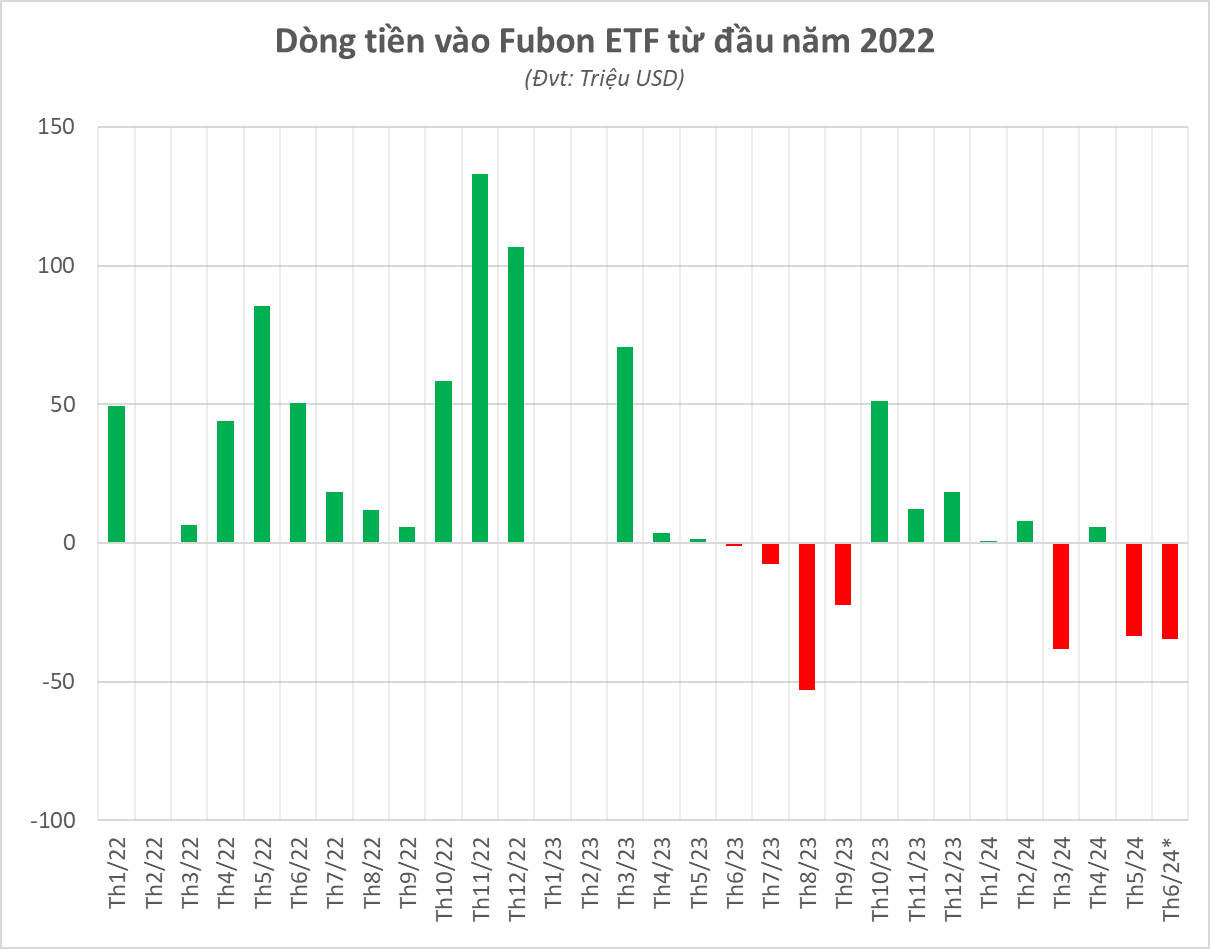

Cash flow into this ETF since the beginning of 2024 has recorded a net withdrawal of 95 million USD, equivalent to about 2,400 billion VND. Foreign fund Fubon FTSE Vietnam ETF has maintained a net selling trend of Vietnamese stocks for over a month. In some sessions, capital flows reversed to net buying, but the value was negligible due to strong selling momentum. Statistics in the last 9 sessions show that this foreign fund has been continuously withdrawn, with a value of up to 35 million USD, equivalent to nearly 900 billion VND of Vietnamese stocks that have been net sold.

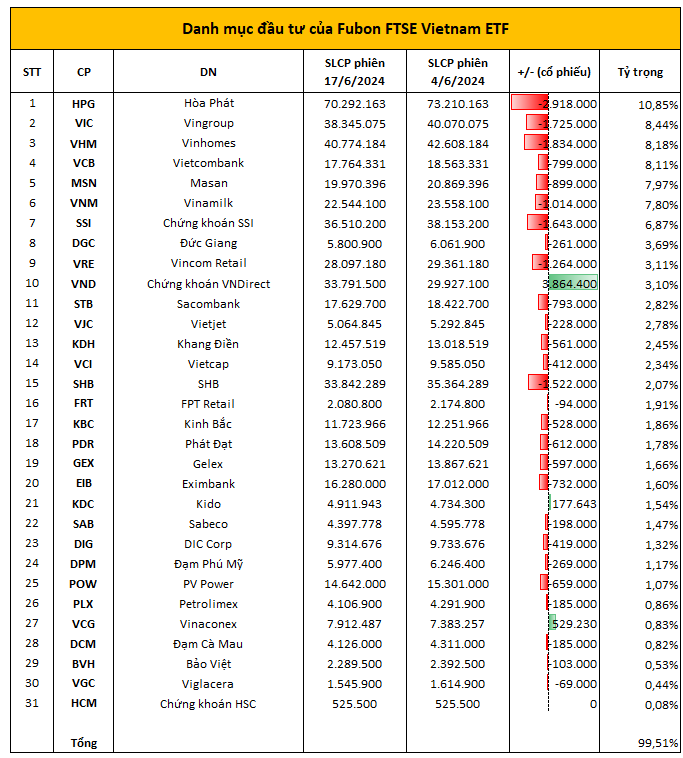

Regarding the selling volume during this period, Fubon ETF sold most of the stocks in the portfolio, specifically net selling more than 2.9 million HPG shares, 1.6 million SSI shares, 1.8 million VHM shares, 1.7 million VIC shares, 1.3 million VRE shares.

On the contrary, only VND of VNDirect, VCG of Vinaconex and KDC of Kido were the three stocks that were bought more, in which Fubon ETF bought the most net in VND with nearly 4 million shares. At the same time, the fund also bought net more than 529 thousand shares of VCG and nearly 178 thousand shares of KDC.

At the end of June 17, the scale of Fubon FTSE Vietnam ETF reached 24.2 billion NTD (about 749 million USD, equivalent to 19,100 billion VND), continuing to be the largest ETF fund on the Vietnamese stock market.

In the portfolio structure, HPG is still the stock with the largest proportion with 10.85% (holding 70.3 million shares), followed by VIC (38 million shares, proportion of 8.44%), VHM (41 million shares, proportion of 8.18%), VCB (17.8 million shares, proportion of 8.11%), MSN (20 million shares, proportion of 7.97%)...

With strong net selling momentum, cash flow into this ETF since the beginning of 2024 recorded a net withdrawal of 95 million USD, equivalent to about 2,400 billion VND.

The net withdrawal of Fubon ETF is in line with the general foreign investors' movements on the Vietnamese stock market. From the beginning of 2024 to the end of the session on June 17, foreign investors' net selling exceeded VND43,400 billion on HoSE.

The latest information is that the Financial Supervision and Administration Commission has officially approved the additional capital mobilization amount of the 6th round of Fubon FTSE Vietnam ETF at 5 billion TWD (~154 million USD). Thus, Fubon ETF may pour in about 4,000 billion VND more to buy Vietnamese stocks in the near future. This is expected to reverse the continuous net withdrawal trend of this foreign fund on the Vietnamese stock market.

Source: CafeF