Foreign investors left a sad mark on the Vietnamese stock market with a record net selling scale. Statistics show that many unexpected records of foreign investors on the Vietnamese stock market in the first months of 2024.

MANY UNEXPECTED RECORDS

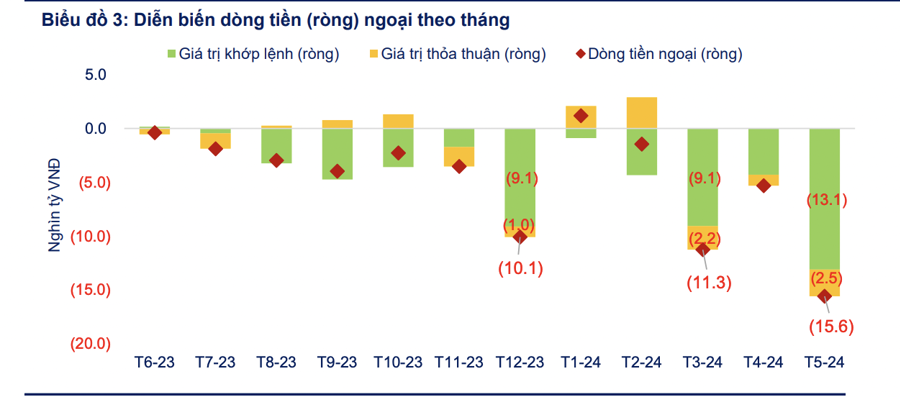

Accordingly, the net selling value of foreign investors increased sharply in May 2024, reaching a record high: The net selling value of foreign investors on the 3 floors (HOSE, HNX and UPCOM) reached more than 15.6 trillion VND in May 2024. This is the month with the highest net selling value ever, surpassing the record net selling value in March 2024 (11.3 trillion VND). More than 84% of the net selling value of foreign investors in May 2024 was executed through order matching.

Accumulated in the first 5 months of 2024, foreign investors' net selling value exceeded the total net selling value of the whole year of 2023 by 32.4 trillion VND, 1.42 times the net selling value in 2023 (more than 22.8 trillion VND).

Looking at the 1-year time frame, foreign net selling (on HOSE alone) continued to increase. In the 12-month period, foreign investors net sold a total of VND61 trillion, focusing on strong selling in May 2024 and March 2024.

Domestic individuals are the net buyers corresponding to the net selling force of foreign countries from May 2023 to present. Accumulated in 12 months, the total net buying value of Domestic individuals reached 62 trillion VND.

The net selling scale of foreign organizations increased sharply in May 2024, mostly coming from the Active group: The total net selling value of foreign organizations recorded 14.9 trillion, a sharp increase of 157% compared to April 2024. Specifically, the active group accounted for 94.1% of net selling value in the month and the rest came from ETF funds.

In the first 5 months of 2024, the net selling value of foreign organizations exceeded the whole year of 2023. The total net selling value of foreign organizations reached nearly 34 trillion VND in the first 5 months of the year. This is the largest net selling level ever, 1.36 times higher than the total net selling value in 2023 (25 trillion VND). Of which, the Active group net sold 14.1 trillion VND and ETF funds accounted for the rest (869 billion VND).

Looking at the 1-year time frame, the net selling trend continued to increase in both the ETF and Active groups. The strong net selling force in the Active group was mainly concentrated in December and May. In the 12 months, the Active group net sold a total of VND 41 trillion while the ETF group reached VND 16.3 trillion.

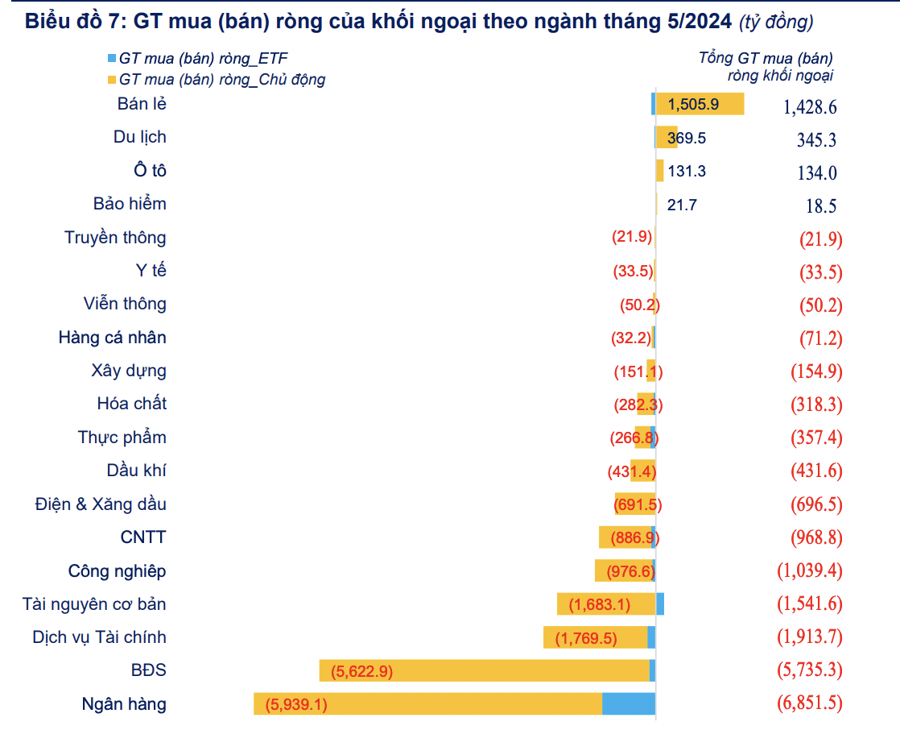

Banking, Real Estate, Securities are the Top net sellers of the Active group in May 2024: Specifically, the Banking stocks that were strongly net sold included CTG, ABB, VPB, HDB; in which, ABB was divested by the strategic shareholder, the International Finance Corporation (IFC), and the net selling force of foreign investors in CTG and HDB partly came from the PYN Elite fund.

Real estate continued to face net selling pressure from foreign investors in May, mainly in Vinhomes (VHM) and Vincom Retail (VRE). In Financial Services (Securities), most of the net selling pressure came from VND and SSI stocks.

On the contrary, Retail and Tourism were net bought by Foreigners: Retail was actively bought by the Active group, mainly MWG bought by the fund group related to Dragon Capital. In the Tourism & Entertainment group, foreign investors net bought HVN. In addition, Dabaco (DBC) was strongly bought by the Elite PYN fund and Nam Long Group (NLG) with the participation of the group related to Dragon Capital (VEIL, Amersham Industries, ...).

A Glimpse of Light from ETFs

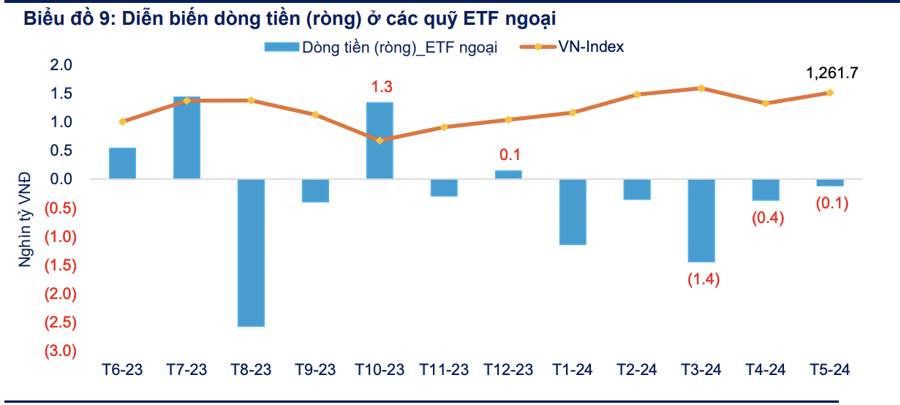

The only positive signal is that ETFs recorded a decrease in net withdrawals. ETFs continued to record a net withdrawal of more than VND 1.3 trillion in May 2024, however, the scale of net withdrawals decreased significantly compared to April 2024. Of which, the net withdrawal value of foreign ETFs was more than VND 112 billion and domestic ETFs was VND 1.2 trillion.

The total net withdrawal value in the first 5 months of 2024 reached VND12.5 trillion, 7.9 times higher than the total net withdrawal value for the whole year of 2023 and equivalent to VND38.61 trillion of net selling value by foreign investors in the same period. Of which, foreign ETFs were under net withdrawal pressure of more than VND3.4 trillion and domestic ETFs were VND9.1 trillion.

Net withdrawals decreased sharply in VFMVN Diamond ETF (-270 billion VND) but increased significantly in VFM VN30 ETF (-564 billion VND), SSIAM VNFIN LEAD (-676 billion VND). Meanwhile, cash flow reversed to net withdrawal in May 2024 in Fubon FTSE fund (-786 billion VND).

On the other hand, the Xtracker FTSE fund unexpectedly had a net inflow of VND 182 billion in May 2024 after 3 months of net withdrawals before that. Net inflows for the second consecutive month were recorded in the VanEck Vietnam ETF fund (+ VND 130 billion) and in the group of Korean funds, including the KIM ACE Vietnam VN30 fund (+ VND 373 billion), KIM Growth VN30 (+ VND 310 billion).

Capital inflows from Korea continued to be strong compared to the first 4 months of 2024, specifically KIM GROWTH VN30 and KIM ACE Vietnam VN30 funds. The purchase portfolios of these funds were mainly Steel (HPG), Banking (TCB, ACB), and Information Technology (FPT).

On the contrary, capital flows from Taiwan (Fubon FTSE Vietnam) and through domestic ETFs (ETF DCVFMVN Diamond, ETF SSIAM VNFIN LEAD) were strongly withdrawn. The net selling portfolio was concentrated in the Banking sector (TCB, MBB, VCB, VPB).

Foreign Active Group boosted stock sales in May 2024: The net selling value of the Foreign Active Group in May 2024 was VND 14.1 trillion, exceeding the net selling level recorded in December 2023 (VND 8.3 trillion). This is the 4th consecutive month that the Active Group has been net sellers, increasing sharply in May 2024. Accumulated in the first 5 months of 2024, the Active Group net sold VND 22.9 trillion, equivalent to VND 55.41 trillion of the total net selling value in 2023 (VND 41.3 trillion).

Cash flow update at 2 active funds (VEIL and PYN Elite Fund): Net withdrawal continued to be recorded at VEIL fund in May 2024. with a net withdrawal value of more than VND 166 billion. Meanwhile, PYN Elite Fund net withdrew nearly VND 68 billion in the same month.

In May 2024, PYN Elite fund strongly net sold HDB, CTG and actively net bought MBB, STB, and MBB: Top net sellers were HDB (9 million shares equivalent to VND 211 billion), CTG (8.1 million shares, VND 259 billion), and SHS (521 thousand shares, VND 9 billion). On the contrary, top net buyers were MBB (9.8 million shares, VND 213 billion), ACV (4.2 million shares, VND 348 billion), STB (3.4 million shares, VND 94 billion).

Source: VnEconomy