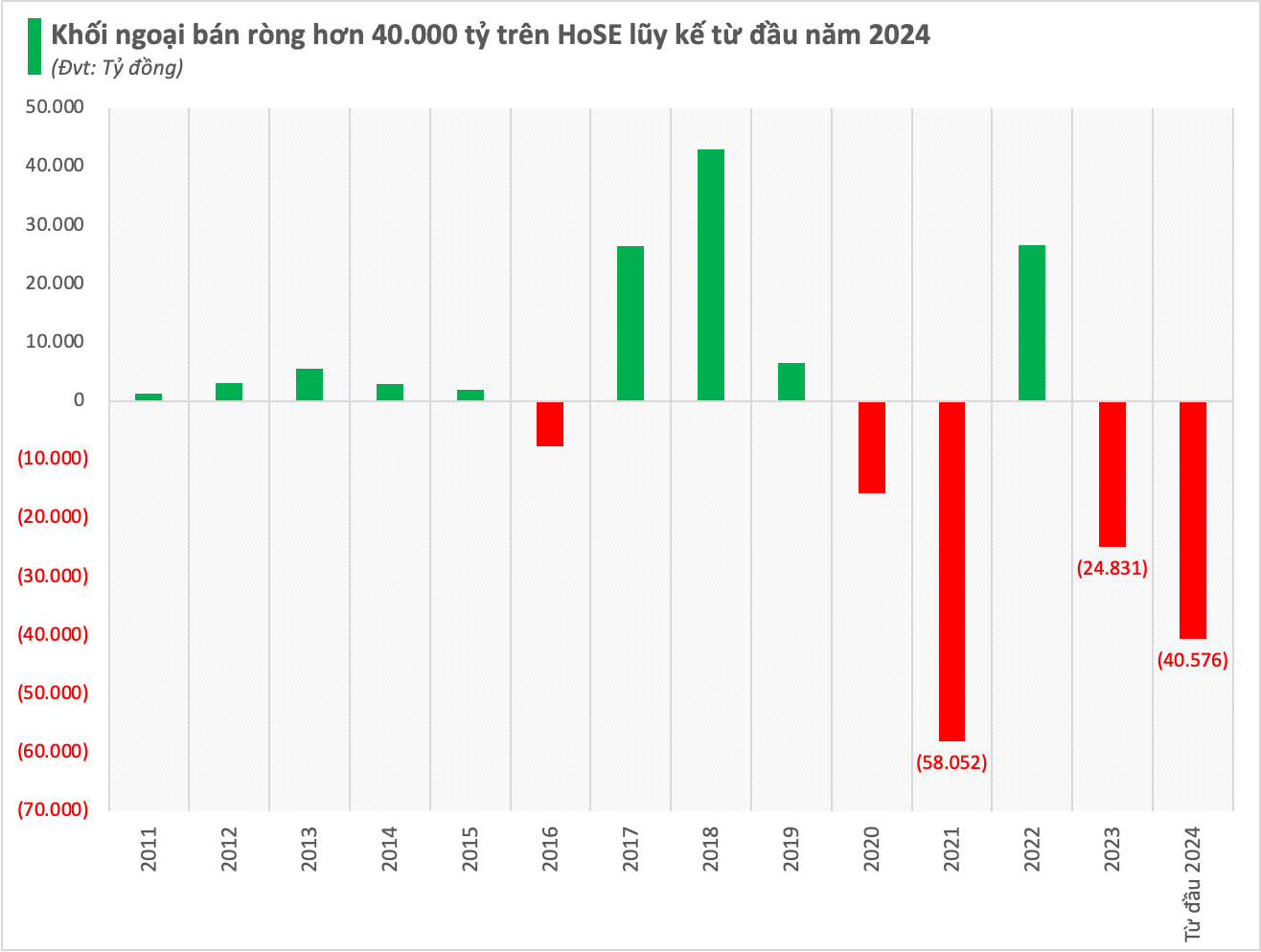

It is not impossible that a "sad" record milestone in foreign net selling will be set on the Vietnamese stock market, with VND40,000 billion, equivalent to USD1.6 billion, being the net selling value of foreign investors on HoSE since the beginning of 2024.

The last time the market witnessed a massive foreign sell-off was in 2021, with the cumulative net selling value exceeding VND58,000 billion - setting a record for the strongest year of foreign investors' selling on the Vietnamese stock market. It is possible that new record milestones will soon be set as foreign investors have yet to show signs of stopping selling, continuously selling thousands of billions of VND each session.

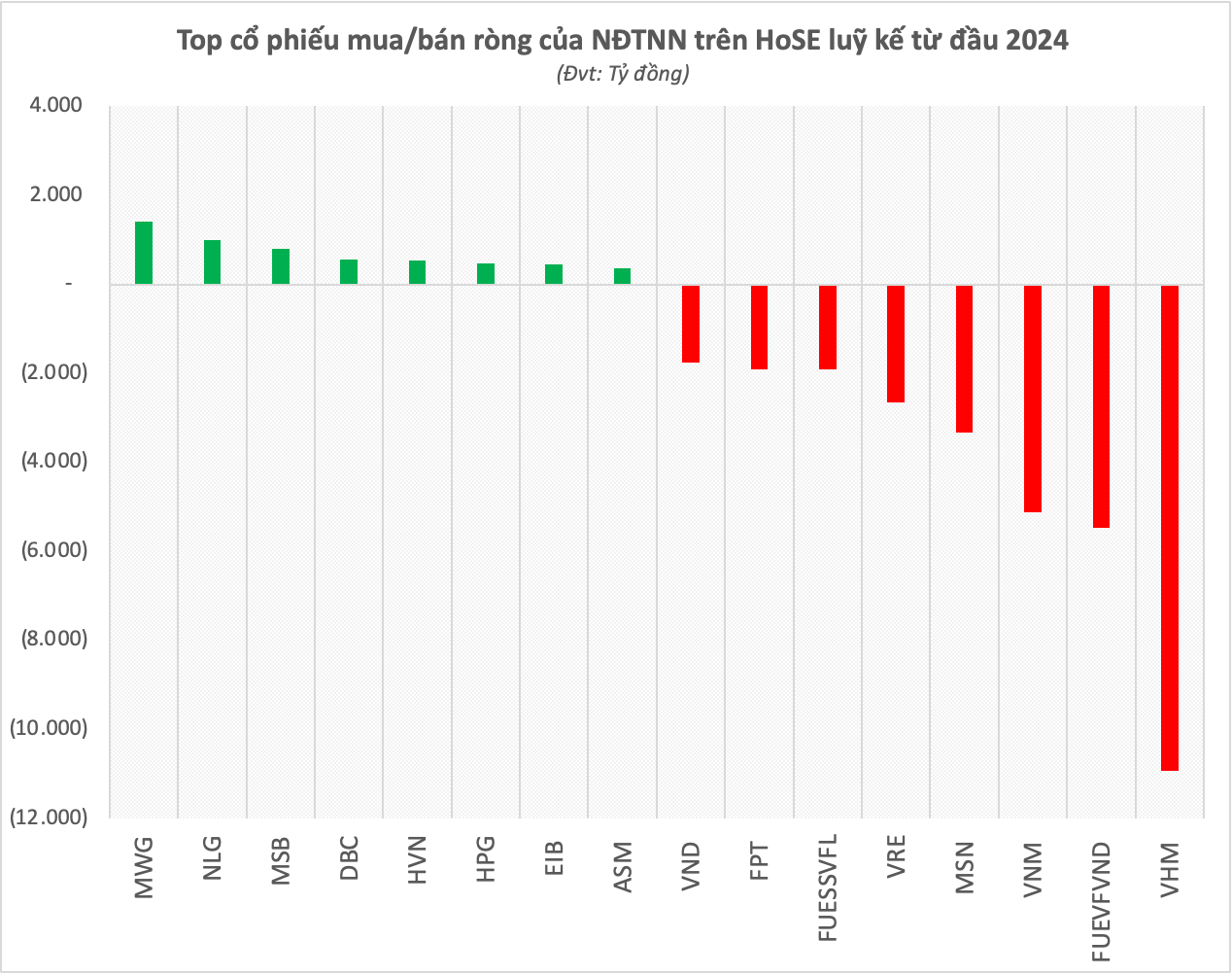

The strongest net selling volume since the beginning of the year was recorded at Vinhomes real estate stock - VHM with a value of approximately VND 11,000 billion, of which more than VND 8,000 billion worth of shares were net sold in matching orders. Under strong selling pressure, VHM's market price has dropped more than VND 11% since the beginning of the year, even setting the lowest price in its listing history at VND 37,700/share (session 11/6).

Next on the list of foreign net sales is FUEVFVND fund certificate with a net selling value of nearly VND5,500 billion. Two other bluechip stocks, VNM and MSN, were also net sold for more than VND5,100 billion and more than VND3,300 billion, respectively.

Similarly, strong net selling value of foreign investors was also recorded in a series of other stocks such as VRE (~2,700 billion), FUESSVFL (~1,900 billion), FPT (~1,900 billion), VND (1,800 billion).

Among these, the hot technology stock FPT unexpectedly appeared on the net selling list, in the context of a strong price increase, continuously setting new peaks. Therefore, it is not excluded that this is a profit-taking move by foreign investors because the selling momentum only started in the past month.

On the other hand, foreign investors are aggressively buying Mobile World – MWG. This leading retail stock was net bought for nearly VND2,400 billion in the first half of 2024. In addition, NLG and MSB were also net bought well with values of approximately VND1,000 billion and VND800 billion, respectively.

The difference in interest rate environment, monetary policy, high exchange rate… has significantly impacted the actions of foreign investors. This has caused capital restructuring activities globally, weaker growth markets, depreciated currencies or frontier markets will be strongly withdrawn to allocate capital to more efficient markets. Not only Vietnam, but also regional markets such as Thailand and China are clearly affected.

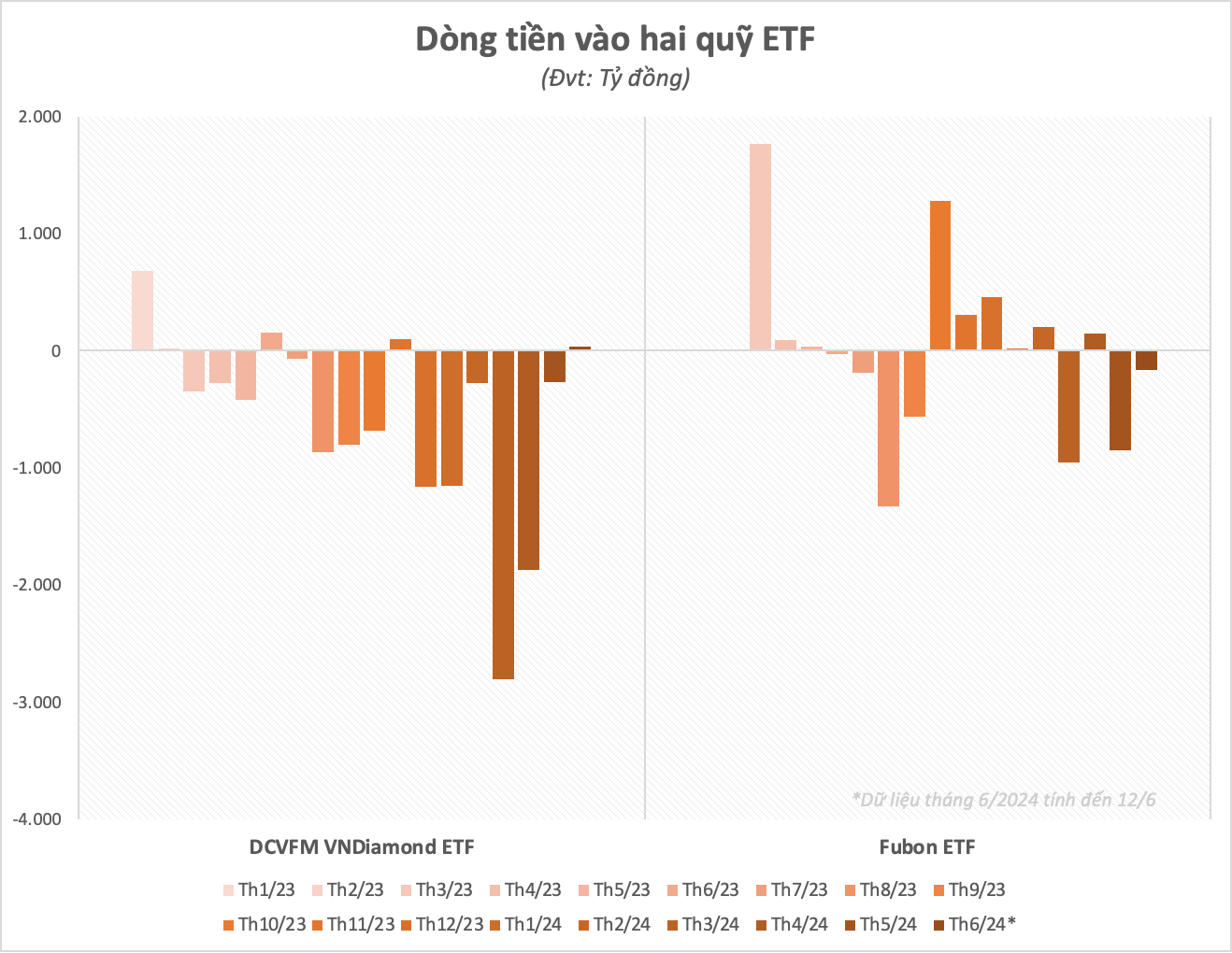

In addition, the net selling pressure also partly comes from the capital withdrawal trend taking place in some large ETF funds. Typically, the DCVFM VNDiamond ETF (FUEVFVND) of Dragon Capital, the capital flow into this ETF fund recorded a net withdrawal of more than 6,300 billion since the beginning of 2024. Similarly, Fubon ETF - the largest ETF fund in the market is also pushing up the net sale of hundreds of billions of Vietnamese stocks in the past few sessions. The cash flow into this ETF since the beginning of 2024 recorded a net withdrawal of nearly 1,600 billion VND.

Some specific stories in the Vietnamese stock market can also have a negative impact on foreign investors, such as the transition to the new KRX system that cannot be implemented yet, or the difference in proportion between industry groups on the floor, and the lack of "good" products such as manufacturing, industry, technology, medical, health care, etc.

Regarding foreign capital flows in the market, SSI Research in a recent report stated that, unlike the previous period when large foreign selling intensity often put pressure on market indexes, capital flows from individual investors are the main driving force in the current period. With a low interest rate environment, domestic individual investors are still actively participating in the stock market and responding well to foreign net selling pressure. This is also showing a positive impact on the VN-Index's performance. The index has surpassed the 1,300 point threshold for the first time in 2 years, and has increased by more than 15% since the beginning of 2024.

SSI Research believes that risks related to interest rates and exchange rates are the biggest factors affecting foreign capital flows into Vietnam at the present stage. However, the report points out a positive point, which is the expectation that the second draft of the circular allowing securities companies to implement payment support for institutional investors will be announced soon.

The analysis team maintains a cautious view on capital flows into Vietnam's ETFs, but assesses that the intensity of net withdrawals will be more limited. Positive signals may begin to appear when the macro environment (exchange rates and interest rates) is more stable.

Source: CafeF