The massive selling of foreign stocks is becoming the focus of the Vietnamese stock market. Most recently, foreign investors had the strongest net selling session (July 8) since the beginning of the year with a net selling value of nearly VND2,500 billion.

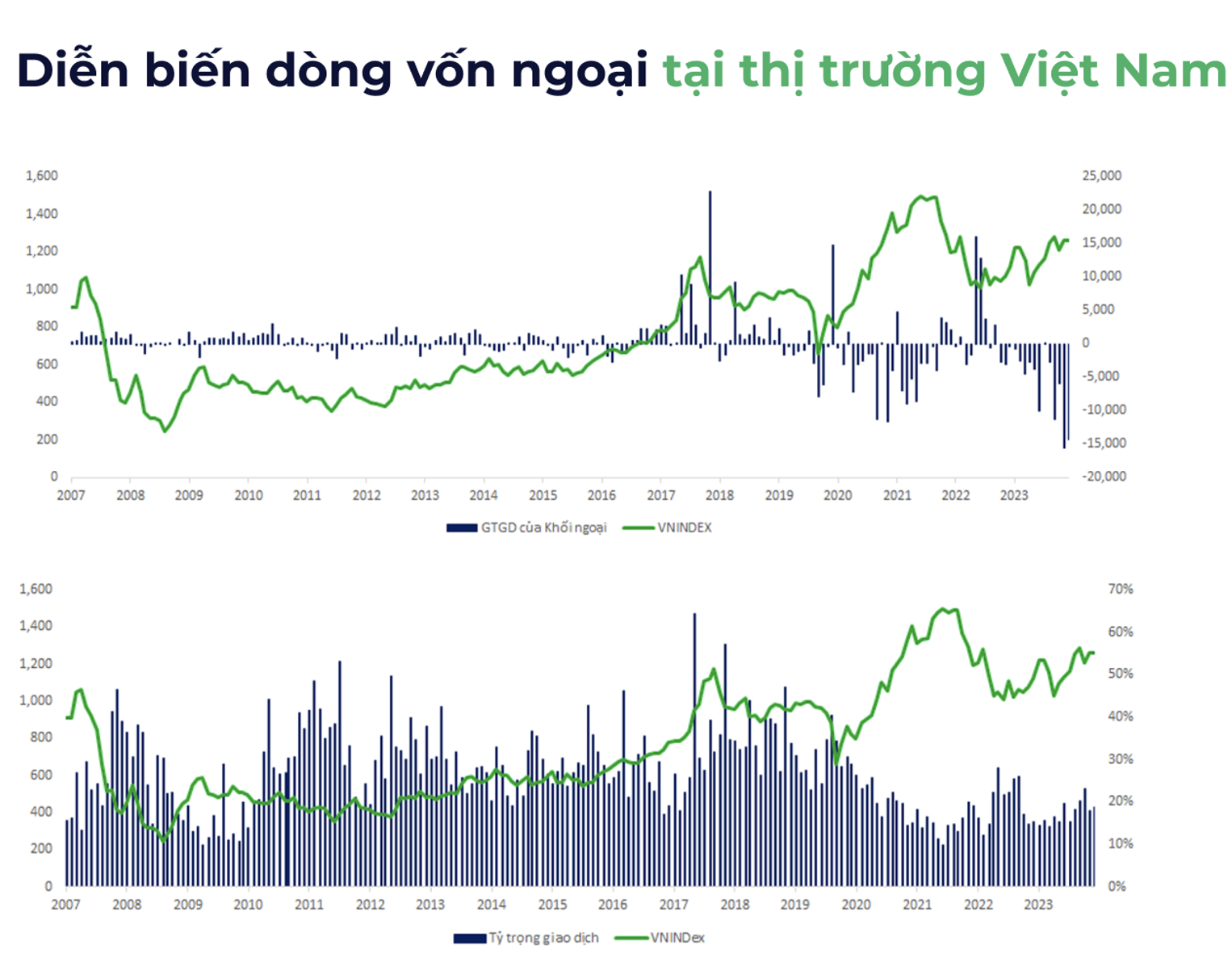

Statistics from the beginning of the year show that the net selling value of foreign investors in the market has exceeded VND54,000 billion on the HoSE, 2.2 times higher than the net selling level for the whole year of 2023. This figure is also close to the record net selling threshold in history in 2021 with over VND58,000 billion. After a period of continuous net selling, will foreign capital flow ever reverse?

At the investment seminar with the theme "Anticipating the recovery cycle in the second half of 2024" recently organized by DSC Securities, Mr. Bui Van Huy - CEO of Southern Branch of DSC Securities JSC said that foreign investors have net sold more than 50,000 billion VND since the beginning of the year, but the impact on the Vietnamese market is not too great.

The proof is that despite foreign investors' net selling, the market still did not fall but remained above the 1,280 point area. Foreign investors' trading volume only accounted for around 18-20% of the total trading volume of the entire market, much lower than the period before 2020, reaching 30-50% of the total market volume.

Some of the reasons leading to the net selling pressure of foreign investors in recent times are the interest rate difference between economies; Foreign funds evaluate the correlation of valuation and expected profits between investment areas; Some ETF funds have withdrawn net and dissolved; Vietnam's stock market lacks diversity in products and investment areas (industry groups).

However, Mr. Huy saw that the net selling pressure from foreign investors has also decreased significantly recently. This expert expects the net selling pressure from foreign investors to gradually cool down, or even return, when the story of upgrading the Vietnamese market is approaching.

Analyzing this issue further, Mr. Nguyen Tu Anh, Director of the Center for Economic Information, Analysis and Forecast (Central Economic Committee) said that the continuing interest rate gap causes domestic and foreign money to continuously withdraw from Vietnam. To solve this problem, it is necessary to balance interest rates and exchange rates.

The recent actions of the State Bank of Vietnam show that on the one hand, the central bank is selling foreign exchange reserves, on the other hand, it is raising interest rates on the interbank market to stabilize the exchange rate. Although there is a cautious view on the exchange rate in the last months of the year, experts expect that the Fed's interest rate cut will somewhat reduce the pressure on the exchange rate.

According to the expert, the correlation between exchange rates and stocks is not large, interest rates are the most important factor affecting the stock market. Foreign capital flows will return when other investment environments are no longer attractive. In an environment of low interest rates and a recovering economy with the world's top growth rate, Vietnam is expected to attract capital flows into the stock market.

However, foreign investors are more afraid of exchange rate fluctuations than high or low exchange rates, so stabilizing the exchange rate is an important goal to attract capital flows into Vietnam.

Sharing the same view, Mr. Nguyen Trung Hieu - General Director of NTP-AM Fund Management JSC said that foreign money has returned to some countries in Southeast Asia such as Indonesia and Malaysia. Accordingly, the expert expects foreign money to reduce net selling in the third quarter and may return in the fourth quarter.

Source: CafeF