Pyn Elite Fund has just announced the completion of selling 500,000 CMG shares of CMC Technology Group (CMC Corp) on May 30, thereby reducing ownership to 10.96 million units (ratio 5.77%).

Pyn Elite Fund is one of the largest foreign funds in the Vietnamese stock market with assets under management at the end of April reaching 742 million EUR (~20,000 billion VND). Mr. Petri Deryng, head of this foreign fund, recently made a shocking comment when he said that VN-Index could reach 1,700 points by the end of 2024.

Since mid-May, this foreign fund has been taking profits from its investment in this technology corporation. In just about half a month, Pyn Elite Fund has net sold 2.5 million CMG shares.

Pyn Elite Fund's move comes as CMG shares have slowed down after a strong increase a month ago. It is estimated that based on CMG's market price during the transaction, the foreign fund from Finland could "pocket" about VND150 billion.

After Pyn Elite Fund sold off, CMG shares continued to rise sharply to a new peak before turning around and correcting in the last session. Currently, CMG's market price is at 67,200 VND/share, up more than 54% compared to the beginning of 2024. CMC Corp's market capitalization is approximately 12,800 billion VND (~500 million USD).

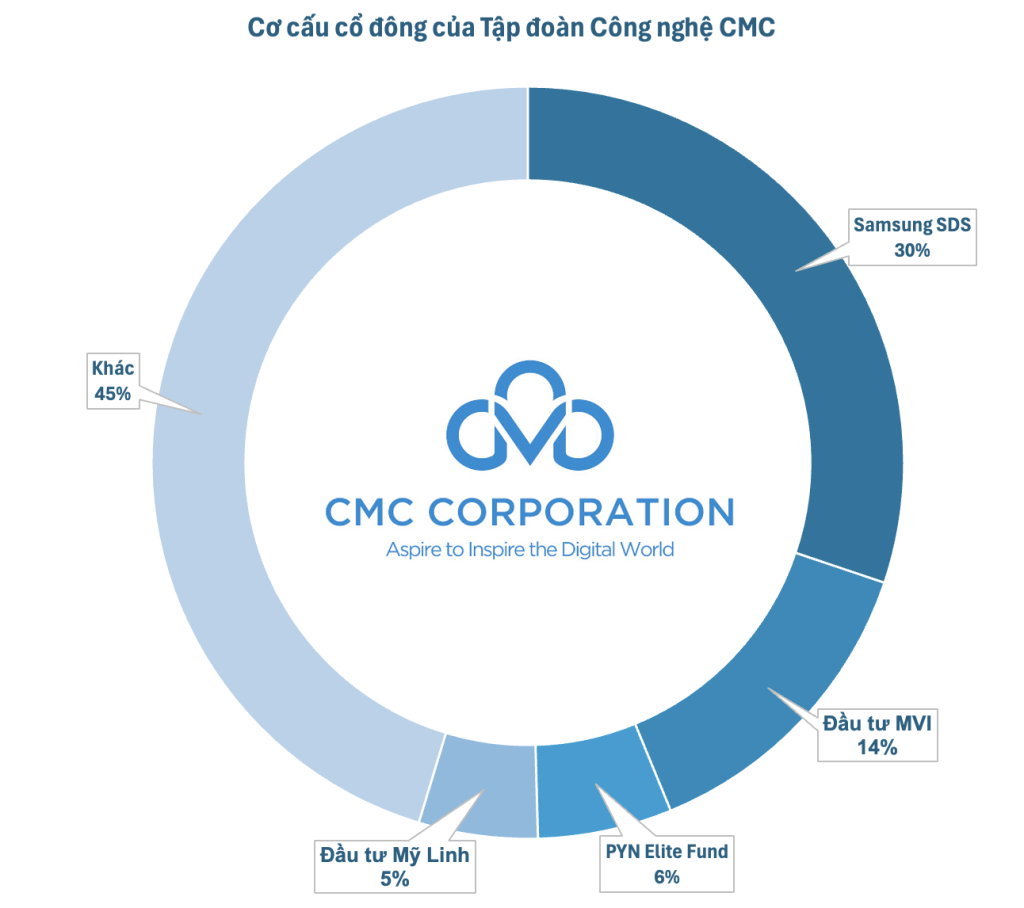

In the shareholder structure, in addition to Pyn Elite Fund, CMC Corp has 3 other major shareholders, the most notable of which is Samsung SDS. By mid-2019, Samsung's IT and Logistics solutions member officially became a strategic shareholder of CMC Corp from mid-2019, and is still the largest shareholder with an ownership ratio of about 30%.

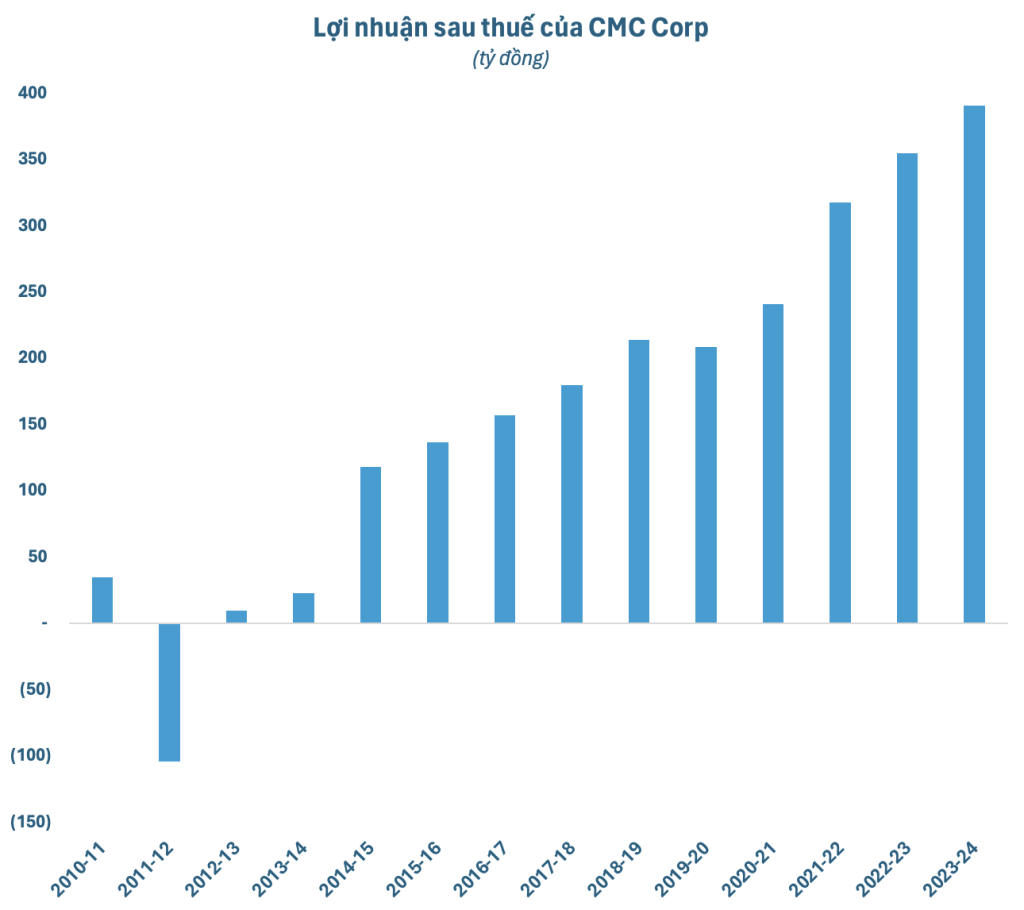

After Samsung SDS invested capital, CMC Corp's business situation has improved significantly. Profit after tax has continuously increased every year since 2019 and reached 391 billion VND in the 2023-24 fiscal year (from April 1, 2023 to March 31, 2024), an increase of nearly 10% compared to the previous fiscal year. This is the highest profit level that CMC Corp has achieved since its operation.

In the period of 2023-2025, CMC Corp aims to become a global enterprise with a revenue of billions of USD. The Group pursues the orientation of being the leading consultant and provider of digital transformation services in Vietnam, contributing to shaping the market of cloud computing and SaaS services and being in the top of the Cyber Security market. In the international market, CMC Corp aims to become the leading provider of information technology services in Asia and further expand to other countries in the US and Europe.

On July 25, CMC Corp will hold its 2024 Annual General Meeting of Shareholders in Hanoi. Up to now, this technology group has not announced detailed meeting documents.

Source: CafeF