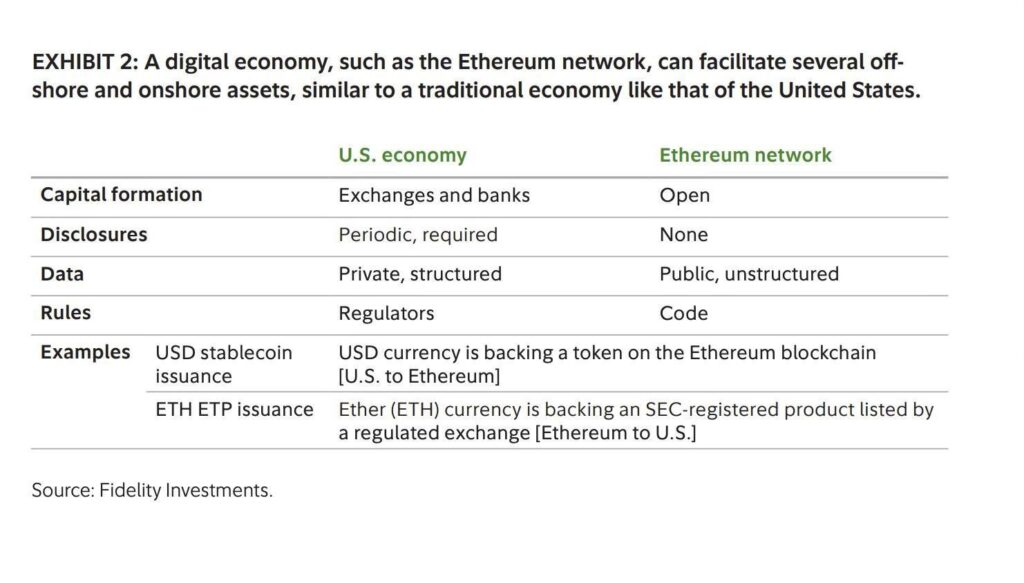

In a recent report, Fidelity Investments – one of the world's largest investment organizations with assets under management of up to 4.9 trillion USD – has presented a unique perspective: evaluating Ethereum as a digital nation, possessing full economic structures similar to a real economy.

This perspective marks an important step forward in better understanding the nature of blockchain operations, as well as opening up many opportunities for technology and financial institutions to participate more deeply in the Web3 ecosystem.

Digital Economic Architecture on Ethereum

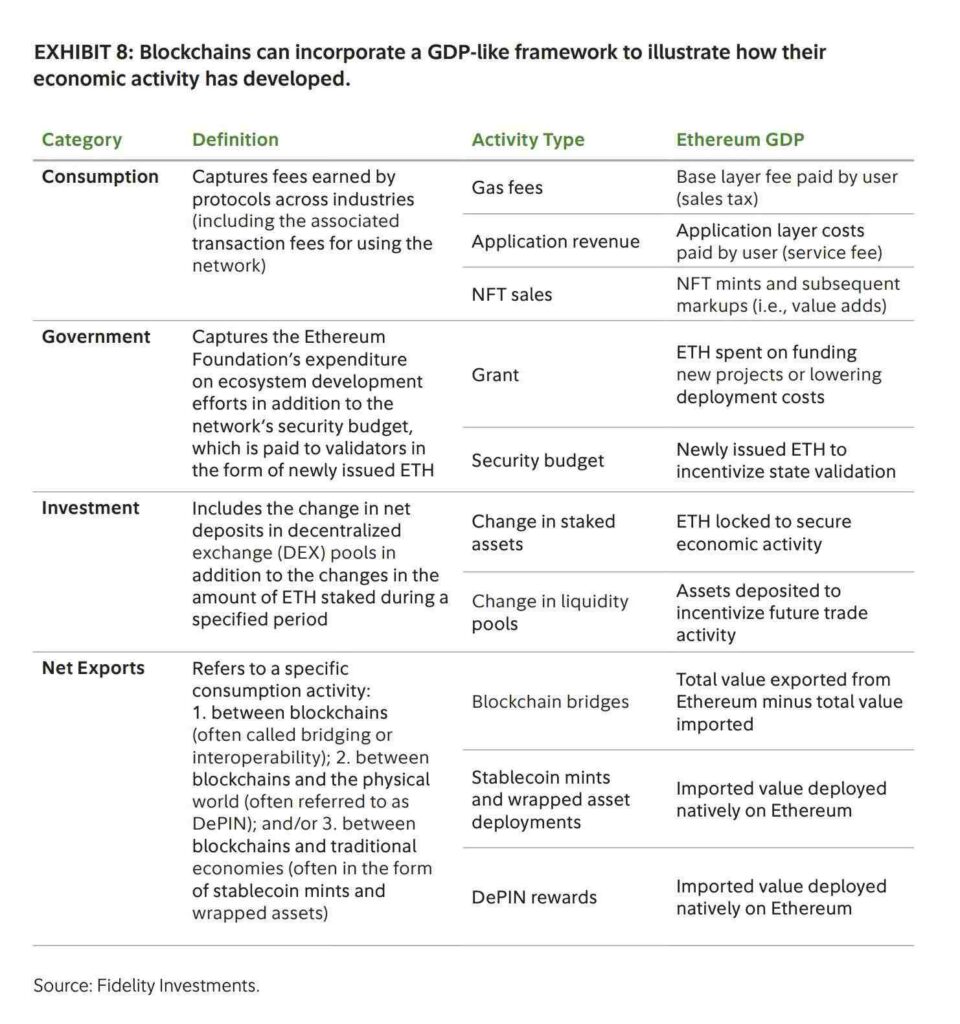

According to Fidelity's analysis, Ethereum can be broken down into four main sectors similar to those in a national economy:

Consumption

- Gas fees act as a kind of consumption tax in the traditional economy.

- Revenue from decentralized applications (DApps) is similar to service revenue.

- Sales from NFT transactions represent demand for valuable digital goods.

Government Spending

- Ethereum subsidies (like airdrops, grants) are like government spending programs that encourage innovation and ecosystem growth.

- Issuing new ETH to reward network validators can be seen as a defense budget to protect network security.

Investment

- Staking ETH to protect the network is both profitable and similar to a form of savings or long-term capital investment.

- Liquidity pools act as financial infrastructure, supporting trading and borrowing activities in the decentralized ecosystem.

Net Exports

- Blockchain bridges allow assets to move between different networks, similar to the import and export of goods between countries.

- Assets like stablecoins and DePIN systems built on Ethereum are domestic products exported across the ecosystem.

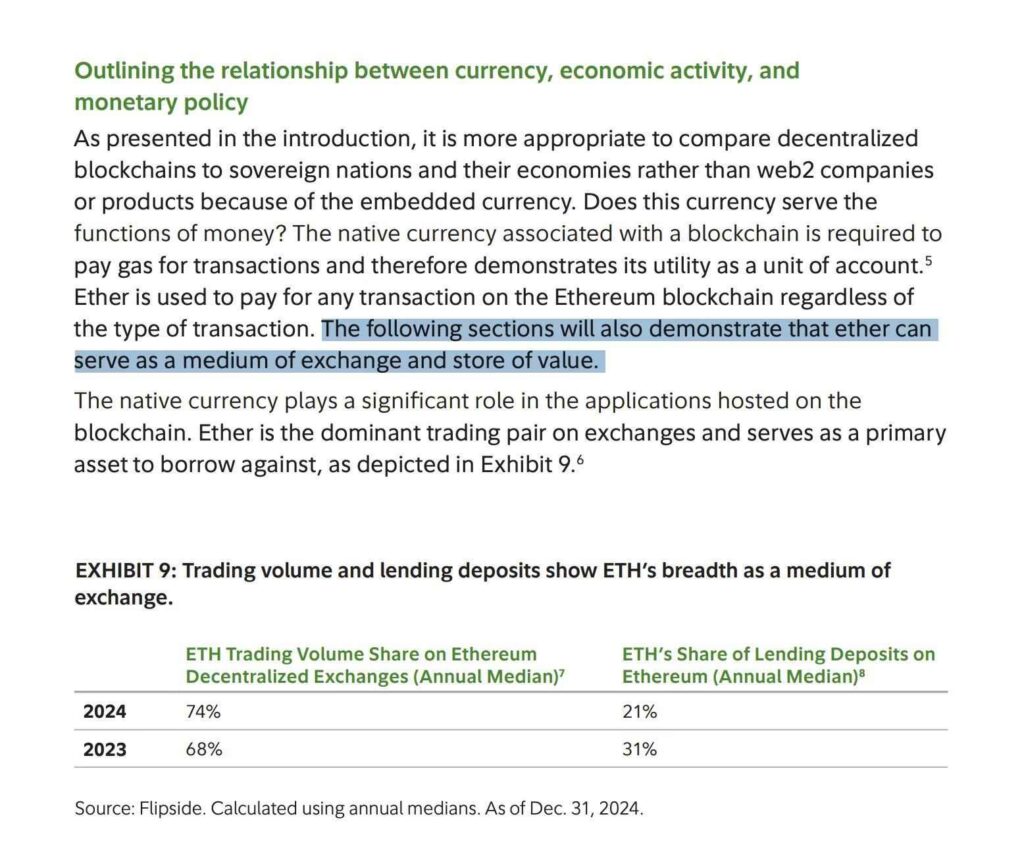

ETH – The Central Digital Currency

ETH is no longer just a digital token, but acts as the sovereign currency in the Ethereum ecosystem. ETH's role is clearly demonstrated through three main functions:

- Is the unit of accounting for determining value and calculating transaction fees.

- As a medium of exchange in decentralized financial activities.

- As a store of value, similar to gold in the traditional economy.

Data from Fidelity shows that in 2023, ETH accounted for 68% of total trading volume on DEX exchanges and 31% of total deposits in lending protocols. In 2024, the share of DEX transactions increased to 74% while the share of lending participation decreased to 21%. These figures show the increasingly central role of ETH in the decentralized finance ecosystem.

Conclude

Fidelity’s analysis shows that Ethereum is moving closer to the role of a digital nation, with clear economic structures, cash flows, and operating mechanisms. ETH is both a transaction tool and a store of value – as core as gold in the traditional financial system.