Ethereum (ETH) is witnessing a strong growth wave as record inflows from spot ETFs push ETH prices to their highest levels since early 2025. This development has not only attracted the attention of individual investors but also received special attention from financial institutions and large businesses globally.

ETH makes a spectacular breakout after a difficult period

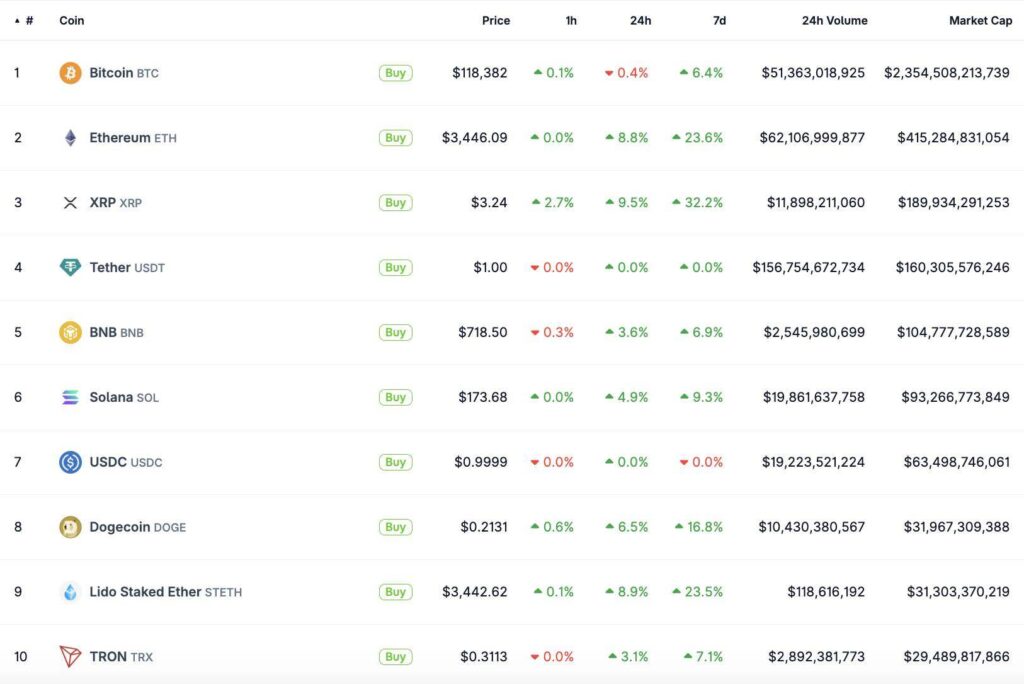

In the past 24 hours alone, ETH has surged 8,6%, currently oscillating around 3,432 USD, the highest level since mid-January 2025. Compared to April 2025, ETH price has increased by more than 118%, marking an impressive recovery period after a deep drop of 45% in Q1/2025 – Ethereum’s worst quarter since the crypto winter of 2018.

The main driver of this rally is institutional inflows through Ethereum ETFs. According to data from SoSoValue, on July 16, inflow ETF ETH set a new record 726 million USD, the highest level since these funds launched in July 2024.

Ethereum ETF Sets Record Inflow, Institutions Pour Money Into ETH

Among the ETFs, the fund BlackRock's ETHA leading with buying inflows 499 million USD, accounting for nearly 70% of total inflow for the day. Followed by Fidelity with 113.31 million USD and Grayscale with 54.18 million USDSince the beginning of July, the total net inflow into Ethereum ETFs has reached 2.27 billion USD, far exceeding previous months.

Grandma Rachael Lucas“Ethereum is increasingly being viewed as a long-term institutional investment asset,” said Markus S., an analyst at BTC Markets. “The fact that ETFs hold 41.3 trillion of the total ETH market cap is a clear indication that institutional money is pouring in at a rapid pace.”

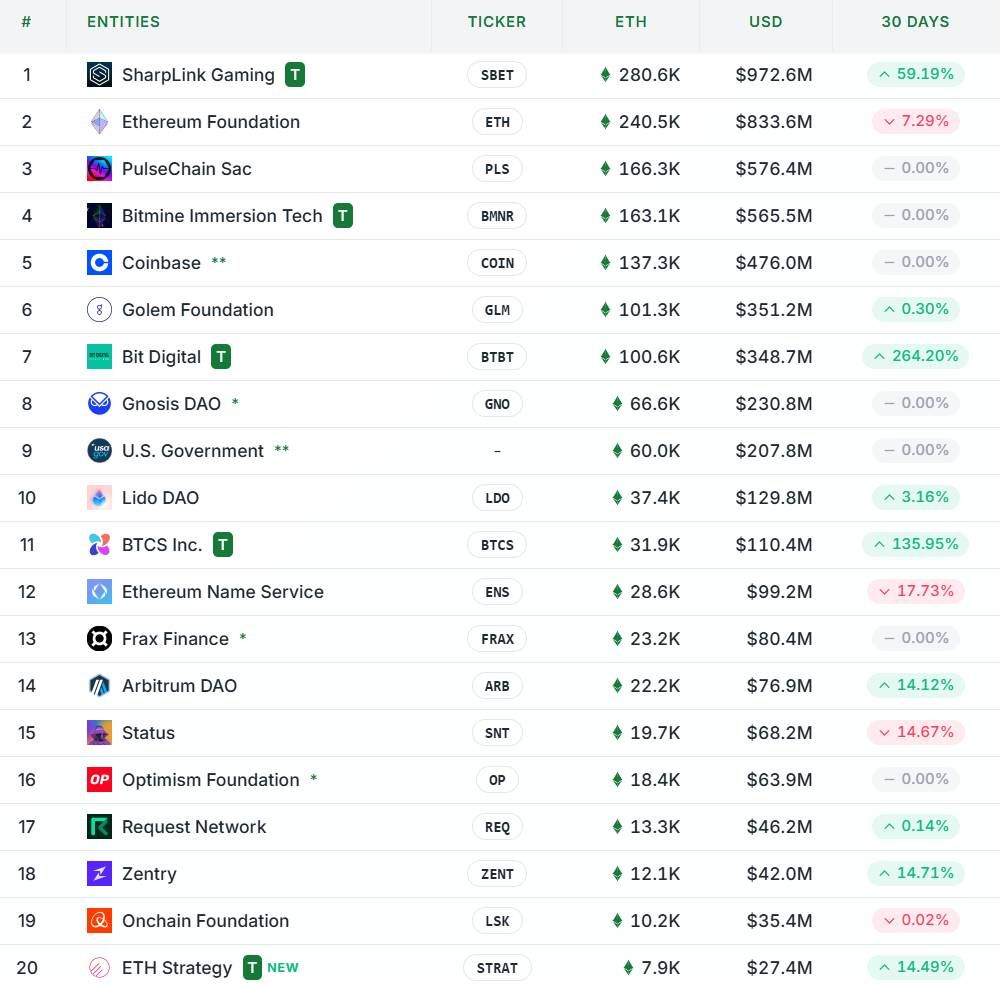

Not only ETFs, many listed companies have also started accumulating ETH as a reserve asset, similar to what businesses did with Bitcoin. Notably, SharpLink Gaming, backed by Consensys, has become the world's largest ETH holder with 280,706 ETH, surpassing even the Ethereum Foundation.

Altcoin market is booming, signaling a new cycle

Along with ETH's rise, major altcoins also rose simultaneously: XRP up 5% to $3.05, Solana (SOL) up 5.16% to $170.96 and BNB up 3,44% to $710. Meanwhile, Bitcoin (BTC) is trading around 118,395 USD, slightly reduced market share (Bitcoin Dominance) still 63,09%, the lowest in nearly three months.

“The decline in Bitcoin Dominance is often an early sign of a new altcoin cycle. When combined with institutional buying, ETH locked in staking, and positive macro signals, the market is forming the foundation for an upcoming altcoin season,” Lucas said.

Conclude

With impressive growth momentum, Ethereum is proving to be an attractive digital asset for institutional investors. The growing participation of ETFs and large enterprises such as SharpLink Gaming shows confidence in the long-term value of ETH.