In the context of a global financial market facing numerous unpredictable variables, gold and silver continue to be seen as important assets in value preservation and risk diversification strategies. However, in reality, many investors still equate the two. possessing physical gold and silver and Trading fluctuating gold and silver prices through financial or forex applications..

The differences between these two forms lie not only in the transaction methods, but also in the nature of the assets, operating models, risk management mechanisms, and the sustainability of the system.

The nature of ownership: real assets and financial position

HanaGold is built around trading and accumulating gold linked to real assets. Users own physical gold and silver, clearly recorded and linked to a transparent custody mechanism. The balance displayed on the system reflects the corresponding gold value, not a symbolic financial commitment.

Owning physical gold allows users to maintain property rights even during periods of significant market volatility. While its value may fluctuate according to market developments, its underlying value remains based on the real asset owned by the buyer.

Conversely, on financial or forex applications, investors do not hold physical gold or silver. What is traded are financial positions based on price fluctuations. When the trade is completed, no physical assets are transferred, and all risk is associated with the platform's solvency and operational mechanisms.

Operating model and conflicts of interest

A key difference of HanaGold lies in the fact that the platform does not operate on a hedging or price-betting model. HanaGold does not benefit from user losses and does not bear the opposite risk when gold prices rise. Users bear the risk of market price fluctuations themselves, but always hold real assets as the underlying value.

Meanwhile, many financial or forex trading platforms operate on a hedging model, where the platform's interests may directly conflict with the user's trading results. This increases systemic risk, especially during periods of high market volatility.

Financial leverage and liquidation risk

HanaGold does not use financial leverage. The price of gold may rise or fall, but users' assets are not forcibly sold. Investors retain full discretion to decide when to continue holding, receive physical gold, or conduct other transactions according to the platform's mechanisms.

Conversely, forex trading applications often use high leverage. When the market moves against expectations, accounts can be subject to margin calls or automatic liquidation in a very short time. The risk of losing all capital can occur even when price fluctuations are not too large, especially for investors who do not constantly monitor the market.

Separation of assets and systemic risk management

HanaGold approaches risk management based on the principle of clearly separating customer assets from the business's operating assets. Users' gold is stored independently and is not used for other financial purposes of the platform.

The system's liquidity is built on a foundation of gold custody and market mechanisms, rather than relying on new user inflows. This helps limit the risk of chain reactions and enhances the ability to preserve value during periods of high market volatility.

Meanwhile, many decentralized finance or forex models rely heavily on the flow of money within the system, making liquidity risk and systemic risk significant when the market reverses.

Transparency and legal aspects

HanaGold operates within a clear legal framework, adhering to regulations related to transactions and asset custody. Accounting principles, internal controls, and asset segregation are considered fundamental to its operations.

Users can verify assets, delivery partners, and gold prices according to standard market rates. The product structure is designed to be simple and easy to understand, minimizing the risk of information asymmetry between the platform and the user.

Conversely, many forex platforms operate across borders, without underlying assets in Vietnam. When disputes arise, users often face difficulties in protecting their rights due to differences in legal frameworks and regulatory jurisdictions.

Applying NFC and Blockchain identification technology.

Besides linking transactions to physical assets, HanaGold focuses on applying technology to enhance verification and protect the rights of owners. One of the key solutions is NFC identification technology, which is directly integrated into gold products.

Each gold product issued by HanaGold is equipped with a unique NFC identification chip, allowing access to information about its origin, identification data, and management process within the system. Authentication is performed quickly through a simple touch of the device, providing users with intuitive and convenient access to information.

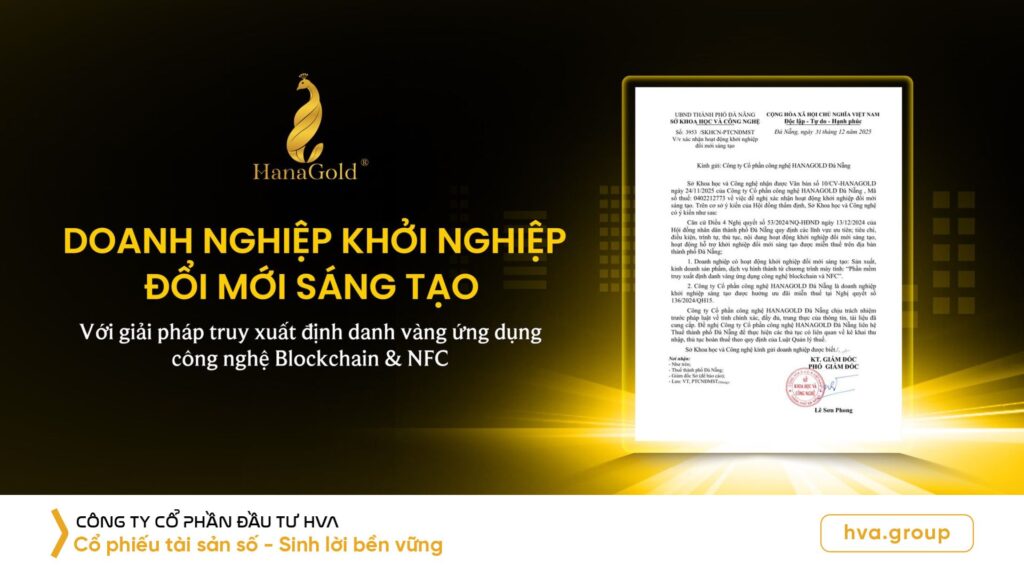

HanaGold's gold identification and traceability solution, utilizing Blockchain and NFC technology, has been recognized by relevant authorities, thereby contributing to minimizing fraud risks and information asymmetry, long-standing problems in the gold market.

HanaGold and its long-term development strategy.

HanaGold has been recognized by the Da Nang Department of Science and Technology as an innovative startup in the technology sector. This recognition is not only a prestigious title but also a crucial reference point for investors and partners when evaluating the platform's technology model and development direction.

HanaGold's focus is not on creating complex financial products, but on applying technology to increase data transparency, enhance verifiability, and build long-term trust based on real assets.

Conclude

Buying physical gold and silver on HanaGold and investing through financial apps and forex are two completely different approaches to asset and risk management.

HanaGold is suitable for investors who prioritize owning real assets, accumulating and preserving value, while desiring a transparent model that minimizes conflicts of interest and systemic risks. Financial and forex platforms are more suitable for investors pursuing short-term trading, seeking quick profits, and willing to accept high volatility. In its long-term development strategy, HanaGold is currently collaborating with... HVA as a strategic partner, aiming to build asset accumulation and management solutions based on transparency, technology, and sustainable value.