Construction and installation enterprises have recorded billion-dollar contracts as the industry maintains growth momentum with many projects disbursed.

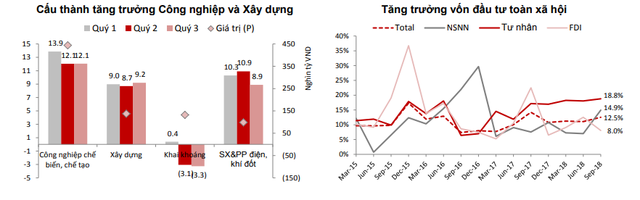

The construction industry is an unexpected factor contributing to the improvement of the country's GDP with an increase of 9.2% in the third quarter, the highest since the beginning of the year. According to a report by the Analysis Department of Saigon Securities Inc. (HOSE: SSI) - SSI Research, this increase may come from changes in the disbursement of social investment capital, especially public investment disbursement.

In the third quarter alone, total social investment reached 507,000 billion, an increase of 12.51 billion VND over the same period, the highest in the past year, of which state budget capital increased by nearly 151 billion VND, double the growth rate of the previous two quarters. Private investment capital, the source of capital with the largest proportion (42.51 billion VND), improved slightly and reached the highest level in many years, increasing by nearly 191 billion VND.

These figures are in line with the early year forecasts of securities companies and experts on the growth of the construction sector in 2018 thanks to the focus on infrastructure investment and a "warmer" real estate market.

According to VPBS report, The FitchGroup Company has given a positive view on Vietnam's construction and infrastructure industry with an expected average annual growth of 7.2% in the period 2017-2026. According to The FitchGroup Company, high population growth in major cities such as Hanoi and Ho Chi Minh City will boost the demand for infrastructure development such as transportation, energy, utilities and civil works. Meanwhile, the Government is making efforts to divest state-owned enterprises to supplement capital for urgent infrastructure projects.

In addition, in the first 10 months of the year, more than 5.7 billion USD of FDI capital flowed into the real estate market. Currently, 45 PPP projects have been planned for implementation with a total investment of up to 127 billion USD, most of which are transportation and energy projects.

In Ho Chi Minh City, many key infrastructure projects have been deployed to solve traffic congestion such as: the parallel road project of Ho Chi Minh City - Long Thanh - Dau Giay Expressway, Ring Road 2; Binh Tien Bridge and Road project, closing Ring Road 2, section from An Lac to Nguyen Van Linh, upgrading and expanding Nguyen Huu Tho Street, 4 steel bridges on Le Van Luong Street, North - South axis...

Some major projects in other provinces are also planned for implementation: Long Thanh Airport, high-speed railway, Hanoi Metro, Yen Xa Wastewater Plant... Or projects of private enterprises such as Hoa Phat Dung Quat Steel Plant (Quang Ngai), Vinfast Automobile Manufacturing Plant (Hai Phong)...

Billion-dollar contracts of construction enterprises

In October, the "big guy" Coteccons Construction Joint Stock Company (HOSE: CTD) announced the signing of a construction contract for the Timberland Manwah Binh Duong factory project worth VND1,500 billion and the Viettel Military Telecommunications Group Headquarters project. Previously, in the past 3 quarters, CTD had signed many contracts with a value equivalent to VND20,000 billion. The value of signed but unimplemented contracts (backlog) at the end of September reached VND22,065 billion, of which civil housing projects accounted for 50% in value. This figure does not include Vincity projects that will be implemented in the near future. For the 3 Vincity projects including 195 towers implemented by Vingroup (HSX: VIC) in the near future, CTD expects to undertake 30% of work volume.

In the first 9 months, CTD's revenue increased by 141% to VND 20,737 billion. Profit after tax increased slightly to VND 1,192 billion. EPS for the first 9 months was recorded at VND 14,469. In 2018, CTD set a business plan with revenue of VND 28,000 billion and profit after tax of VND 1,500 billion. With the results of the first 9 months, the company has achieved 791% of the annual profit target.

Hoa Binh Construction Group Corporation (HOSE: HBC) also consecutively announced winning bids for 3 new projects worth nearly VND2,000 billion, including The Peak - Mid Town project in Phu My Hung Urban Area, Swan City - East Saigon phase 1 project and part of the Four Seasons luxury hotel project. Most recently, Hoa Binh and HOT Engineering and Construction Company entered into a joint venture to bid for the Kuwait University of Architecture project worth KD100 million (equivalent to USD330 million). After 9 months, HBC achieved net revenue and net profit of VND12,768 billion and VND508 billion, respectively.

Another construction unit, specializing in underground construction foundations, Fecon Joint Stock Company (HOSE: FCN) has just announced the signing of an additional contract worth VND1,000 billion, including the bidding package at the Long Son Petrochemical Complex and Nghi Son 2 Thermal Power Plant projects, VinCity Gia Lam and VinCity Dai Mo projects.

The Long Son Petrochemical Complex project has an investment of 5.4 billion USD, and is the largest petrochemical complex in Vietnam with a capacity of up to 1.6 million tons/year. Meanwhile, the Nghi Son 2 Thermal Power Project (Thanh Hoa) has a capacity of 1,200 MW, with a total investment of 2.793 billion USD, will be commercially operated in 2022, with an annual electricity output of 8.1 billion kWh, contributing about 3% to the national power system.

Fecon is recording 9-month net revenue of nearly VND1,709 billion, an increase of VND311 billion over the same period and net profit of VND123.2 billion.