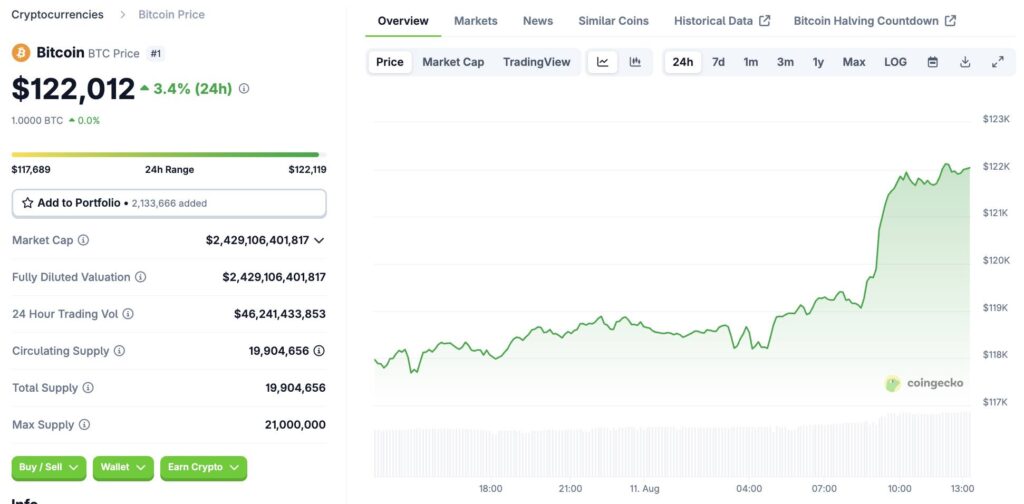

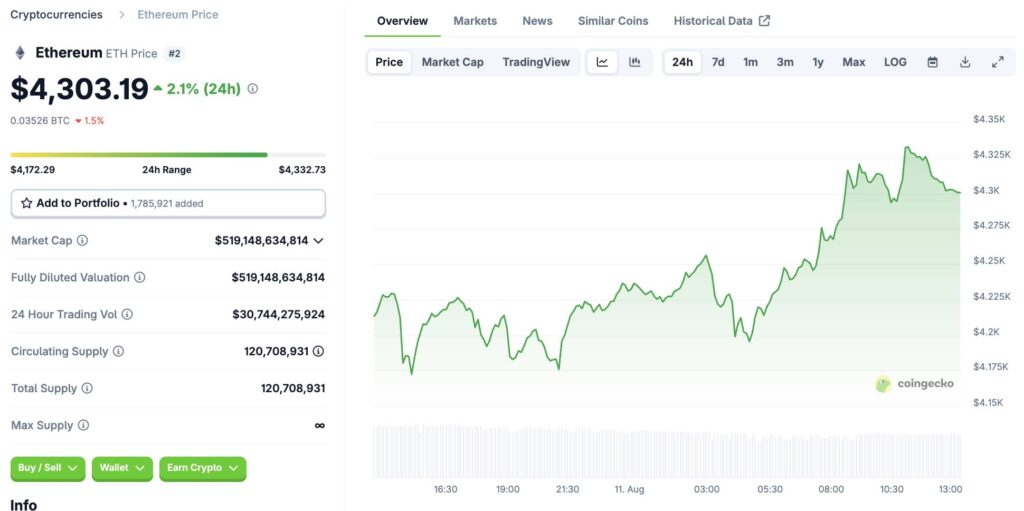

The cryptocurrency market is witnessing a strong boom as Bitcoin (BTC) and Ethereum (ETH) both broke historical milestones. On August 11, BTC price jumped sharply to $122,012, recording a gain of 3.3% in just 24 hours. Meanwhile, ETH also peaked at $4,300, its highest level since December 2021.

Catalyst from President Trump's Executive Order

As has been hotly discussed by the international cryptocurrency community, President Donald Trump has just signed a landmark executive order, allowing 401(k) retirement funds in the US to invest in crypto.

Under the order, the US Department of Labor will be directed to research and implement regulations that would allow cryptocurrencies, private equity (private equity) and other alternative assets join the portfolios of 401(k) funds.

Analysts say this is a huge source of demand from long-term investors, creating sustainable buying pressure for the market. Augustine Fan – Director of SignalPlus Research – said that this move is equivalent to the impact of the US approving the first spot ETF, and will open up an unprecedented wave of new capital.

BTC and ETH both broke out

In just 10 days, BTC has recovered from $112,000 (August 2) and is approaching its recent peak of $122,780 (July 14). Green spread across the market, as most large-cap altcoins increased from 5% to 15%.

ETH is not far behind, increasing by more than 2%, surpassing the $4,300 mark for the first time in 4 years. This rebound was driven not only by policy factors, but also by large organizations such as BitMine and SharpLink Gaming, who aggressively collected nearly $1 billion in ETH in the past week.

Spot ETFs and institutional capital flows fuel

On August 8, Bitcoin ETFs recorded $403.8 million in inflows, while Ethereum ETFs outperformed them with $461 million. This inflow shows that large crypto treasuries are increasing their holdings, likely continuing to play a leading role in the market.

However, investors are still closely monitoring economic data, especially July CPI and PPI, which will be released this week, to assess the possibility of the Federal Reserve changing its interest rate policy. Fed Chairman Jerome Powell emphasized that the possibility of a rate cut in September is still lower than expected, and will depend entirely on economic data.

Conclude

The event of BTC price surpassing 122,000 USD and ETH reaching a 4-year peak is a testament to the strength of policy factors and institutional capital flows for the crypto market. In this context, HVA Group is affirming its leading position in Vietnam, contributing to bringing domestic investors up to speed with global trends.