The crypto market is witnessing a major turning point as traditional financial institutions start to bet heavily on staking – one of the core pieces of the decentralized economy. The two names leading this trend are BlackRock and Canary Capital with the latest moves regarding funds ETF staking.

BlackRock Bets Big on ETH Staking

BlackRock, a giant in the asset management industry, has just filed an adjustment application to the SEC under Rule 19b-4 (Securities Act of 1934) to allow the fund to iShares Ethereum Trust (ETHA) – the largest Ethereum ETF on the market – executed staking ETH.

This profile clarifies several key points:

- The fund's ETH will not be pooled with assets from other entities, avoiding complex staking pool structures.

- ETHA will not bear the risk of slashing or forking, ensuring safety for investors.

- Staking rewards are considered fund income., legalizing staking activities within the ETF legal framework.

Coinbase – the primary custodian and execution unit – is almost certain to be a strategic partner in the proposal.

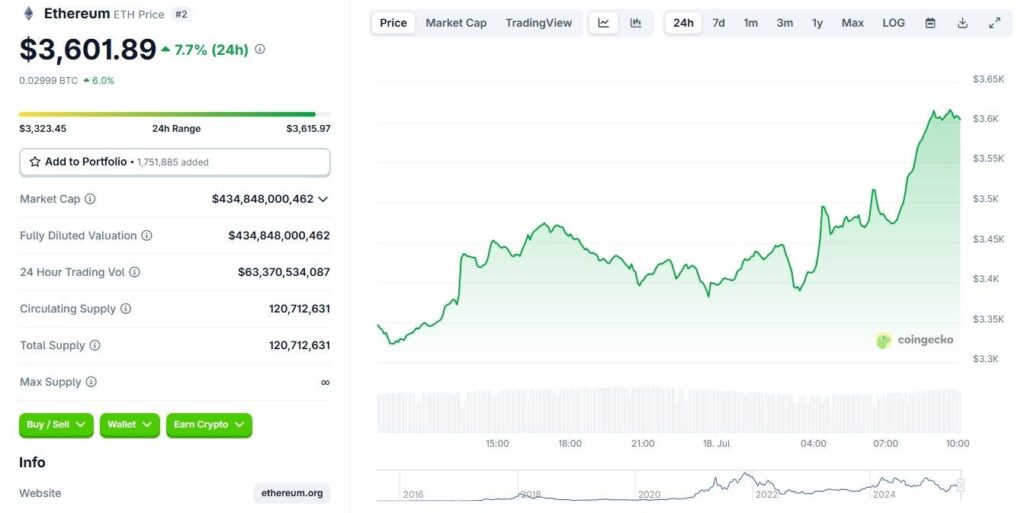

Notably, the funds Ethereum ETF just recorded record capital inflows 726 million USD in just one day, in there 499 million USD flows into ETHA. Since the beginning of July, the total inflow has reached 2.27 billion USD, contributing to pushing up prices ETH up around 3,601 USD, the highest level this year.

Canary Capital Expands Portfolio with Injective Staking ETF

Not just BlackRock, Canary Capital are also making great strides with their filings. Canary Staked Injective ETF go up SEC. This is the first staking ETF in the US that tracks assets INJ – native token of Injective.

Under the proposal, the fund would:

- Direct holding INJ and partial staking through authorized validators.

- Expected staking reward level 10-12%/year, far surpassing many major crypto assets like ETH.

- Canary has been set up Delaware Trust, an important legal standardization step.

In addition to INJ, Canary is also pursuing staking funds for TRX, CRO, SEI, SUI, HBAR, LTC and even Pudgy Penguins (PENGU).

Positive signals from SEC and ETF staking prospects

Although no staking ETF has been approved under the 1934 Act, SEC is sending a positive signal by admitting the majority of crypto staking activity not a securityAt the same time, the agency is said to be drafting new guidelines to simplify the approval process.

Bloomberg expert James Seyffart predicts a high probability that BlackRock's ETH staking application will be approved before Q4/2025 – much earlier than the April 2026 deadline.

Conclude

Strong participation of leading financial institutions in Staking ETF is ushering in a new era for the digital finance industry. This is not only a positive signal for the value of crypto assets such as ETH good INJ, but also an affirmation that DeFi and TradFi is gradually integrating.