VN-Index ended the last trading week with an explosive session, conquering the 1,250 point zone. Many forecasts said that the short-term downtrend had been broken. However, the market still lacked support from cash flow.

VN-INDEX may face short-term profit-taking pressure

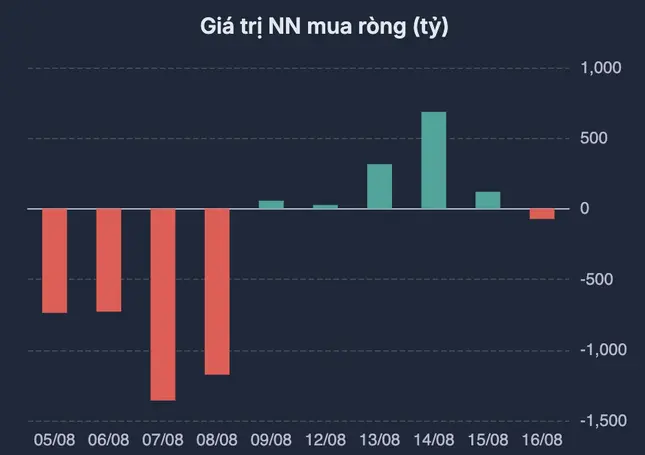

The main index ended the week up 28.59 points (2,34%) to 1,252.23 points. Foreign investors actively bought net VND1,072 billion at HoSE this week, focusing on HDB, KDC, FPT, VNM and MWG. However, HoSE liquidity still decreased by more than 14% compared to last week, because the remaining 4 sessions were gloomy, and cash flow "disappeared".

Data from Saigon - Hanoi Securities (SHS) shows that the most active industry group contributing to the market's increase is real estate (VHM, TCB, DIG, NVL...).

The group of stocks benefiting from public investment traded in green after the Prime Minister's direction: "Unlock all resources, lead with public investment, activate private investment". Securities stocks also had impressive developments, typically BSI, FTS, VIX, SHS, SSI.

According to SHS, the main index is regaining the strong psychological support zone of 1,250 points, and in the short term, it has also broken the current short-term downtrend line.

VN-INDEX may face short-term profit-taking pressure in the early sessions of next week before returning to conquer the resistance of 1,250 points once again. Similarly, VN30 may need to adjust before retesting the resistance zone around 1,290 points.

In the medium term, VN-Index has been fluctuating within a wide range of 1,180 - 1,300 points since the beginning of the year. If the index can overcome the resistance around 1,250 points, the medium-term trend is expected to return to the accumulation channel of 1,250 - 1,300 points.

However, the 1,250 point area is a very thick resistance, not easy to overcome with the previous backlog, unless there is a very strong positive macro supporting factor.

VN-Index is likely to continue to expand its recovery momentum.

According to experts from KB Securities (KBSV), the positive increase of VN-Index last week with strong liquidity increase can be considered a momentum explosion session.

This development, along with the breakthrough and successful conquest of the resistance zone around 1,235 points, is enough to confirm the short-term uptrend for the index, after a decline since the peak of 1,300 points.

VN-Index is likely to continue to expand its recovery momentum before facing pressure to shake and adjust at the next resistance zone around 1,270 points.

Many securities companies also gave a cautious view on the market reaction around the 1,250 - 1,260 point range. Vietcap Securities believes that profit-taking pressure around 1,260 points is inevitable and the current support level for the index is at 1,230 points.

The possibility of the index moving towards the 1,300 point zone

In the short term, VN-Index needs a sideways period around the resistance to absorb profit-taking pressure and accumulate new buying power.

Currently, the possibility of the index moving towards the 1,300 point zone is still higher than the scenario of a decline to 1,220 points. Adjustments are opportunities to increase the proportion of stocks.

The macro context also recorded many supportive signals for the market in the coming time. The analysis team of Yuanta Vietnam Securities commented that the exchange rate risk decreased when the USD index continued to fall sharply along with the cooling of USD bond yields, creating expectations for the return of foreign capital flows.

The long-term trend of the general market remains bullish, so investors can maintain buy-and-hold positions with a high proportion of stocks in their portfolios.

Source: CafeF