According to Agriseco, the second half of this year will be the hinge for a new growth cycle in 2025 with the prospect of upgrading the market, an important factor in attracting foreign investment flows.

The stock market is an attractive investment channel with an increase of about 13% since the beginning of the year, much higher than the traditional savings channel. The good increase in stock prices goes hand in hand with the recovery of business results and the economy.

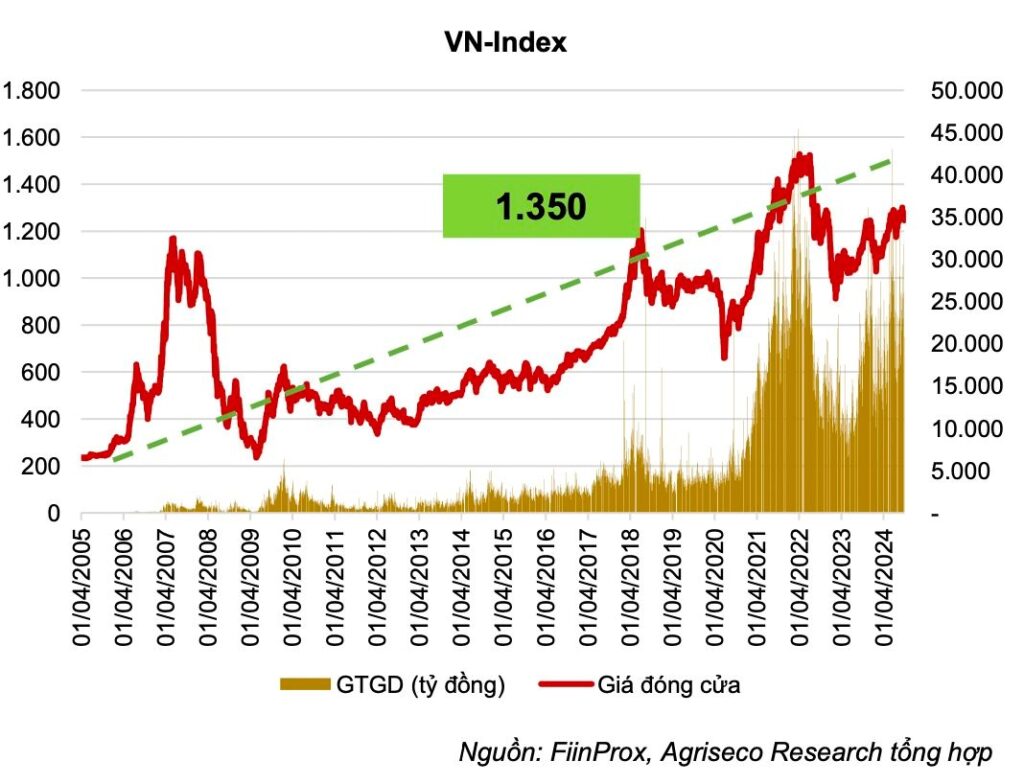

Accordingly, the profits of enterprises in the second quarter of 2024 increased by 26% compared to the same period last year and higher than the increase in the first quarter of 2024 (+21.5%). Although there has been a fairly good recovery since the beginning of the year, the index has encountered difficulties when approaching the resistance zone of 1,300 points and has recently experienced corrections.

Stocks are entering a new growth phase.

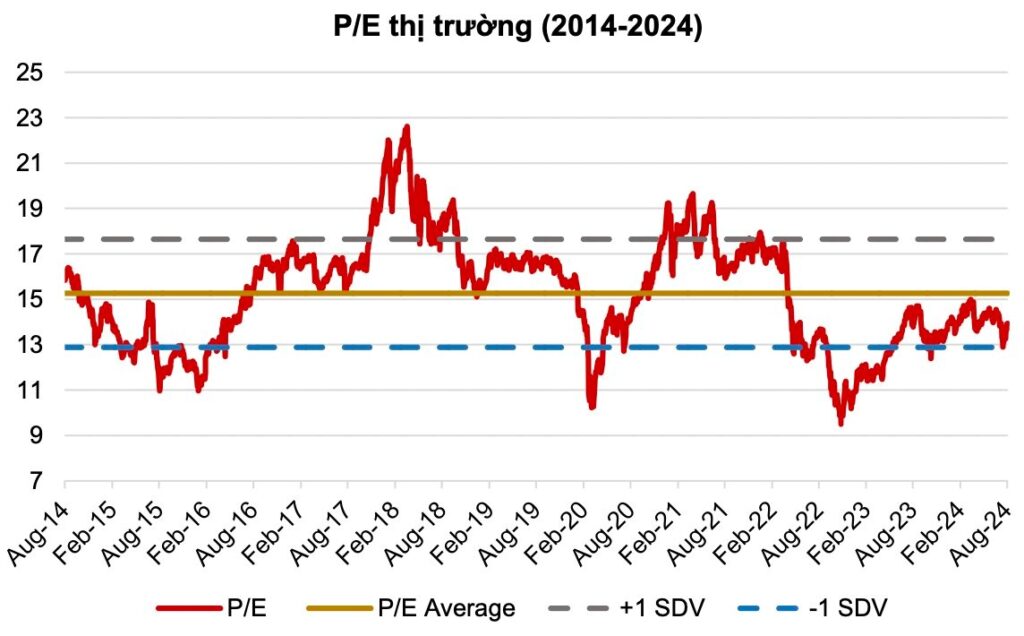

In a recent report, Agriseco Securities stated that in terms of valuation, the market is at an attractive valuation level compared to history. Specifically, the VN-Index is trading at 13.9x times (lower than the average of 2014-2024 at 15.26 times) and P/B at 1.7x times (lower than the average of 2014-2024 at 2.16 times). Agriseco believes that the current valuation level is suitable for accumulating investment stocks in the medium and long term.

Agriseco believes that business activities have almost completely recovered and entered a new growth phase, continuing to open up many opportunities for the stock market. Risk factors such as exchange rates, interest rates, and inflation are still potential, but are still under control and creating a favorable environment for the market to continue to grow.

“The second half of this year will also be the hinge for a new growth cycle in 2025 with the prospect of upgrading the market, an important factor in attracting foreign investment flows,” the report stated.

VN-Index will reach 1,350 points by the end of the year

According to Agriseco, the main driving force for the market's growth will come from both domestic and foreign factors. In terms of the international context, the bright spot is the gradual recovery of global economic growth and continued cooling of inflation in the last months of 2024. In addition, the gradual loosening of monetary policy - interest rates tending to decrease are also important driving forces for the market.

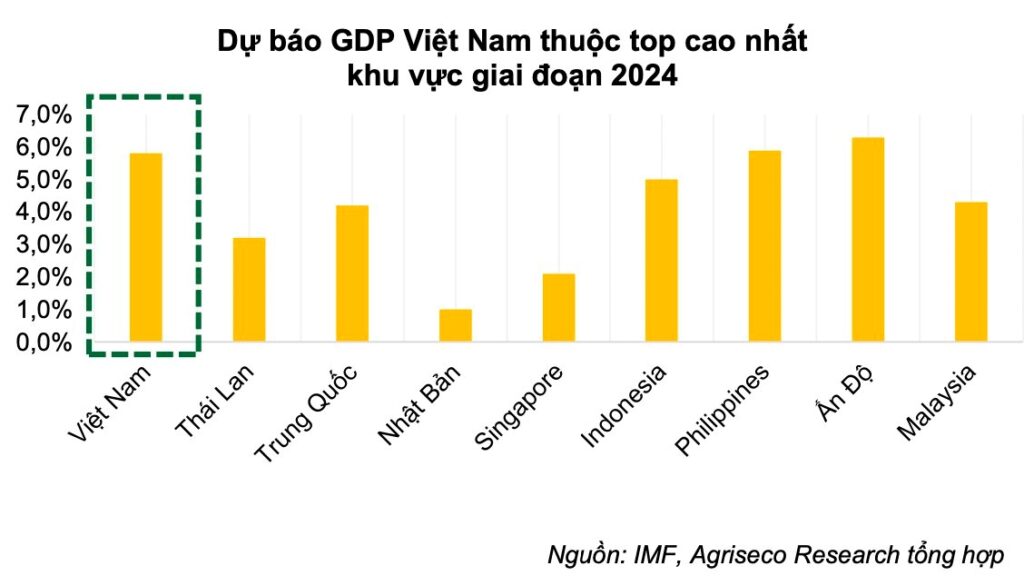

Domestically, Agirseco expects economic growth to continue to recover positively in the second half of the year. Despite facing many challenges as global demand has not fully recovered, GDP in the second half of the year is forecast to reach about 6.6%, higher than the growth rate in the first half of the year.

Thereby, the forecast of GDP for the whole year of 2024 can complete the target of 6-6.5% set by the Government with the driving forces coming from: (1) Recovery momentum of production and export activities; (2) More active disbursement of FDI capital and public investment; (3) Retail consumption activities maintain growth momentum.

The Fed Is About to Lower Interest Rates and Exchange Rates Are Cooling Down

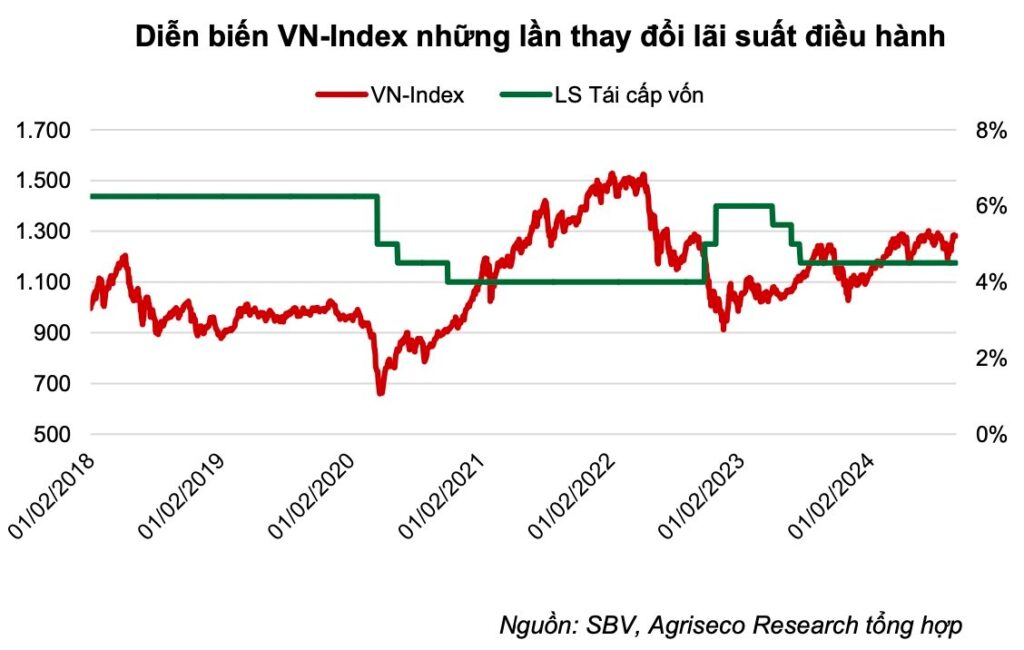

On the other hand, in the context of the FED about to lower interest rates and the exchange rate cooling down, the interest rate level can be maintained at a low level to promote credit growth to help the economy recover. For the policy interest rate, it is forecasted to remain at the current level of 4.5%, lending interest rates continue to decrease in the context of economic improvement, exchange rate pressure, and increasing inflation.

Low interest rates are still the driving force for the stock market to grow sustainably. Interest rates maintained at a reasonable level will help production and business activities recover and improve profits, thereby increasing the attractiveness of the stock market. According to statistics from Agriseco Research, during periods of falling interest rates, the stock market often increases positively in the medium and long term.

Agriseco Research forecasts that the total market profit in 2024 will grow by 15% compared to 2023. In particular, profits will continue to improve gradually each quarter.

VN-Index will recover to 1,350 points by the end of 2024 on the basis of (1) Total market profit regaining positive growth momentum in 2024 with a growth rate of about 15%; (2) Reasonable P/E of 14 times.